Question: What multivariate method is best suitable for tracking a sample of 100 small start-up businesses regularly each year to see how differences in access to

What multivariate method is best suitable for tracking a sample of 100 small start-up businesses regularly each year to see how differences

in access to financing impacts their survival over time?

Types of Multivariate Methods (you can select from this list)

Path Analysis

Factor Analysis

Components Analysis

Multiple Regression Analysis Structural Equation Modeling (SEM) Multilevel Models

Time Series and Forecasting multivariate method is best suited for tracking a sample of 100 small start-up businesses each year to see how differences in access to financing impact their survival over time? Types of Multivariate Methods (you can select from this list) Path Analysis Factor Analysis Components Analysis Multiple Regression Analysis Structural Equation Modeling (SEM) Multilevel Models Time Series and Forecasting

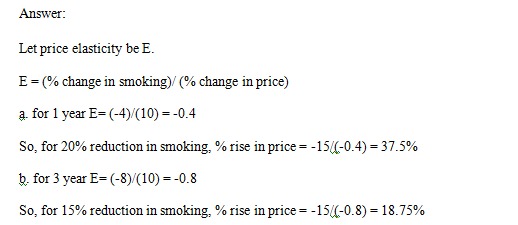

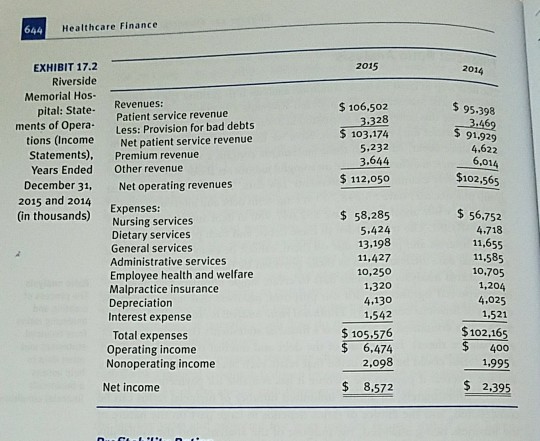

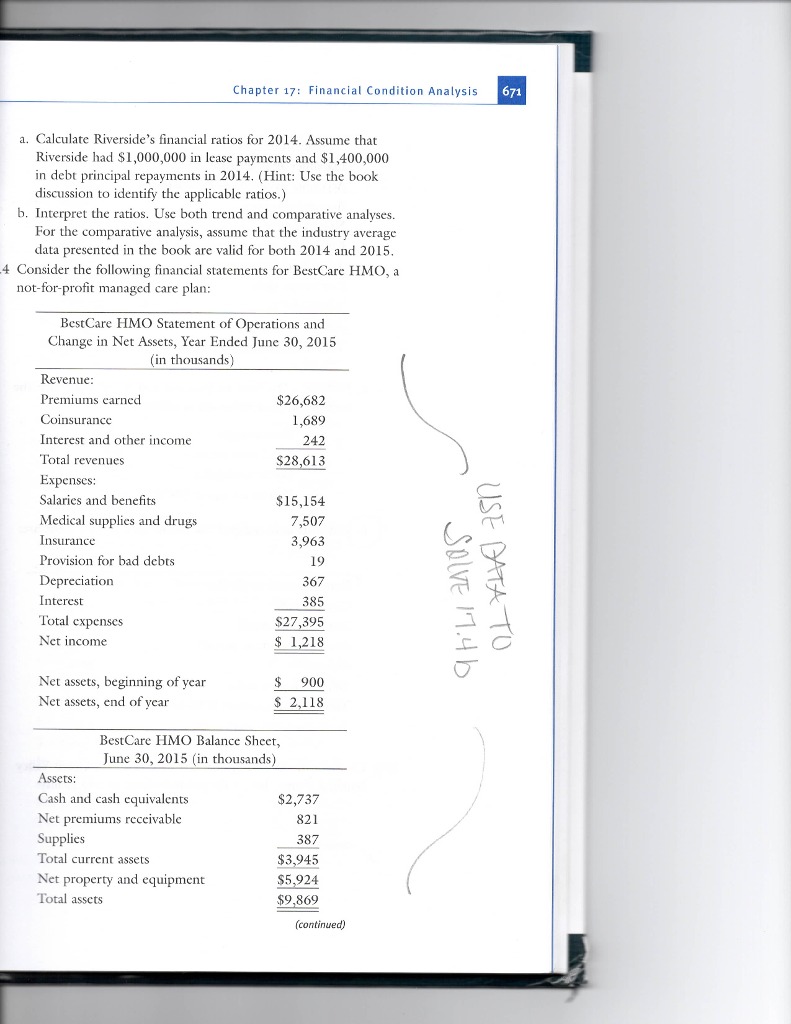

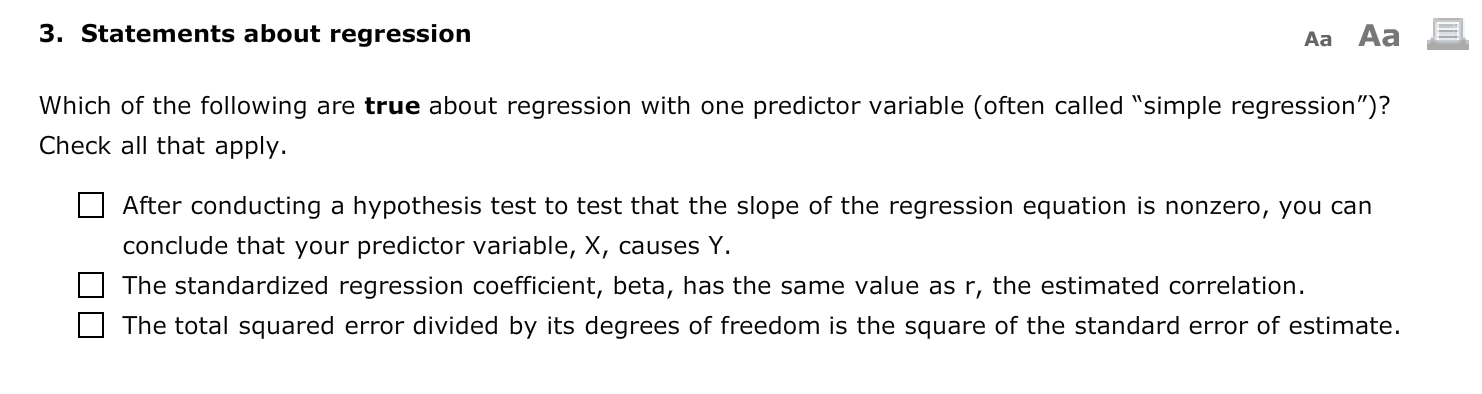

Answer: Let price elasticity be E. E = (% change in smoking)/(% change in price) a. for 1 year E= (-4)/(10) =-0.4 So, for 20% reduction in smoking, % rise in price = -15/(-0.4) =37.5% b. for 3 year E= (-8)/(10) = -0.8 So, for 15% reduction in smoking, % rise in price = -15/(-0.8) =18.75%644 Healthcare Finance EXHIBIT 17.2 2015 2014 Riverside Memorial Hos- pital: State- Revenues: $ 106,502 Patient service revenue $ 95.398 ments of Opera- Less: Provision for bad debts 3.328 3.469 tions (Income Net patient service revenue $ 103.174 $ 91,929 Statements). 5.232 Premium revenue 4,622 3.644 Years Ended Other revenue 6,014 December 31, Net operating revenues $ 112,050 $102.565 2015 and 2014 (in thousands) Expenses: Nursing services $ 58,285 $ 56.752 Dietary services 5.424 4,718 General services 13.198 11,655 Administrative services 11,427 11.585 Employee health and welfare 10,250 10.705 Malpractice insurance 1,320 1,204 Depreciation 4,130 4.025 Interest expense 1,542 1,521 Total expenses $ 105.576 $ 102.165 Operating income $ 6,474 $ 400 Nonoperating income 2,098 1,995 Net income $ 8.572 $ 2.395Chapter 17: Financial Condition Analysis 671 a. Calculate Riverside's financial ratios for 2014. Assume that Riverside had $1,000,000 in lease payments and $1,400,000 in debt principal repayments in 2014. (Hint: Use the book discussion to identify the applicable ratios.) b. Interpret the ratios. Use both trend and comparative analyses. For the comparative analysis, assume that the industry average data presented in the book are valid for both 2014 and 2015. Consider the following financial statements for BestCare HMO, a not-for-profit managed care plan: BestCare HMO Statement of Operations and Change in Net Assets, Year Ended June 30, 2015 (in thousands) Revenue: Premiums earned $26,682 Coinsurance 1,689 Interest and other income 242 Total revenues $28,613 Expenses: Salaries and benefits $15,154 Medical supplies and drugs 7,507 Insurance 3,963 Provision for bad debts 19 USE DATA TO Depreciation 367 Interest 385 SOLVE 17.4 b Total expenses $27,395 Net income $ 1,218 Net assets, beginning of year $ 900 Net assets, end of year $ 2,118 BestCare HMO Balance Sheet, June 30, 2015 (in thousands) Assets: Cash and cash equivalents $2,737 Net premiums receivable 821 Supplies 387 Total current assets $3,945 Net property and equipment $5,924 Total assets $9,869 (continued)3. Statements about regression Aa Aa '5 Which of the following are true about regression with one predictor variable (often called \"simple regression")? Check all that apply. |:| After conducting a hypothesis test to test that the slope of the regression equation is nonzero, you can conclude that your predictor variable, X, causes Y. |:| The standardized regression coefficient, beta, has the same value as r, the estimated correlation. I:I The total squared error divided by its degrees of freedom is the square of the standard error of estimate