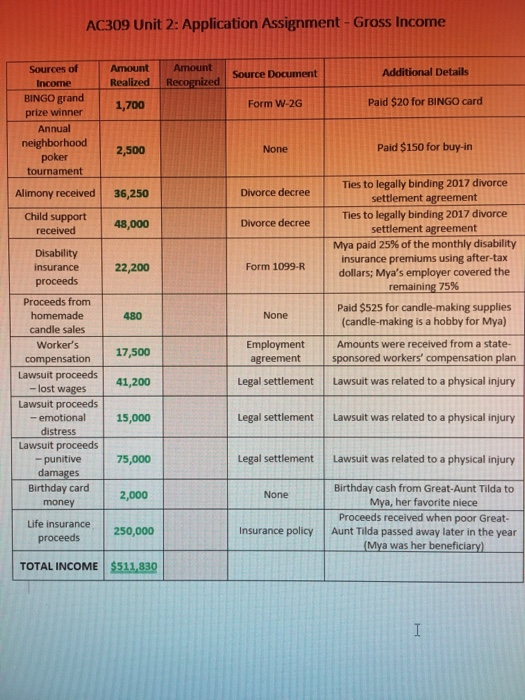

Question: what must be recognized? AC309 Unit 2: Application Assignment - Gross Income Amount Amount Sources of Additional Details Realized Recoenized Source Document Income BINGO grand

AC309 Unit 2: Application Assignment - Gross Income Amount Amount Sources of Additional Details Realized Recoenized Source Document Income BINGO grand prize winner Paid $20 for BINGO card Form W-2G 1,700 Annual neighborhood poker Paid $150 for buy-in None 2,500 tournament Ties to legally binding 2017 divorce settlement agreement Divorce decree Alimony received 36,250 Ties to legally binding 2017 divorce settlement agreement Mya paid 25 % of the monthly disability insurance premiums using after-tax dollars; Mya's employer covered the remaining 75 % Child support Divorce decree 48,000 received Disability insurance 22,200 Form 1099-R proceeds Proceeds from Paid $525 for candle-making supplies (candle-making is a hobby for Mya) homemade 480 None candle sales Employment Amounts were received from a state- Worker's 17,500 sponsored workers' compensation plan compensation Lawsuit proceeds -lost wages Lawsuit proceeds -emotional agreement Legal settlement Lawsuit was related to a physical injury 41,200 Lawsuit was related to a physical injury Legal settlement 15,000 distress Lawsuit proceeds -punitive damages Birthday card Lawsuit was related to a physical injury Legal settlement 75,000 Birthday cash from Great-Aunt Tilda to Mya, her favorite niece Proceeds received when poor Great- Aunt Tilda passed away later in the year (Mya was her beneficiary) 2,000 None money Life insurance Insurance policy 250,000 proceeds TOTAL INCOME $511,830 I this individual was unable to work in 2018 due to workplace injury sustained last year. They still amassed a material gross income in 2018 from various sources and has asked for your assistance in determining how much of the $511,830 gross income she realized in 2018 must also be recognized as taxable income on her 2018 individual income tax return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts