Question: What numbers must I use and what do I do mathematically to compute and get the values on beginning Cash Balance for August, September, and

What numbers must I use and what do I do mathematically to compute and get the values on beginning Cash Balance for August, September, and Quarter? If you don't mind, could you help me figure out what to do to get the values on the other cells on the Cash Budget too, please? I have uploaded most of the information that one would only need for this last part of this assignment.

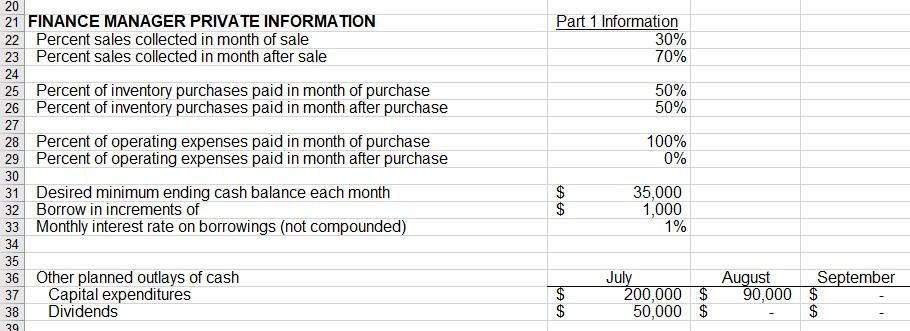

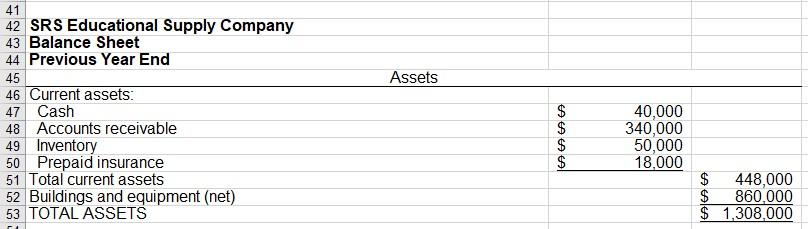

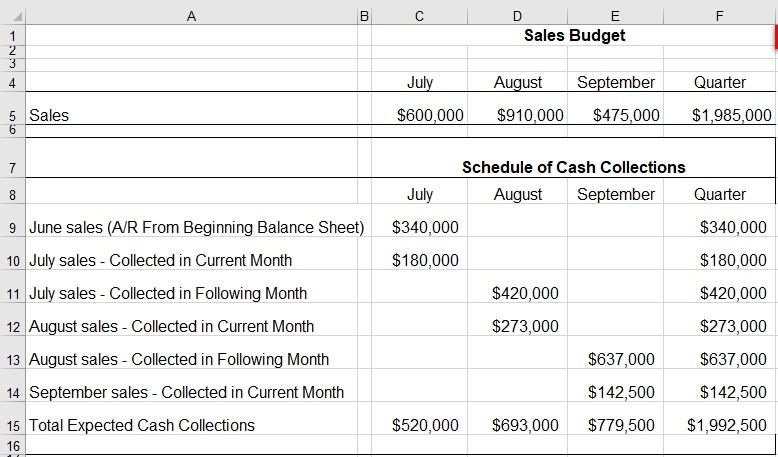

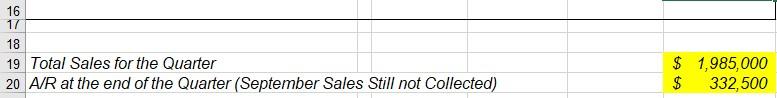

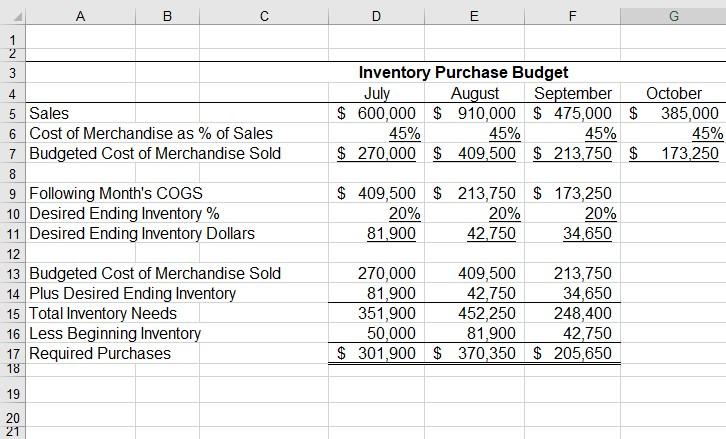

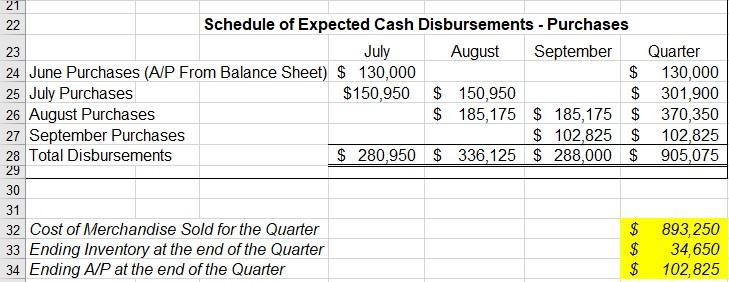

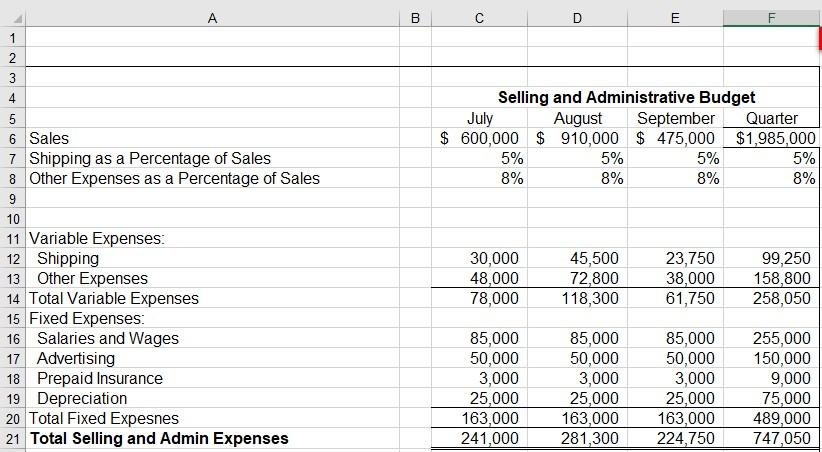

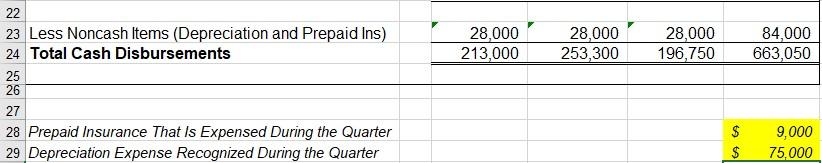

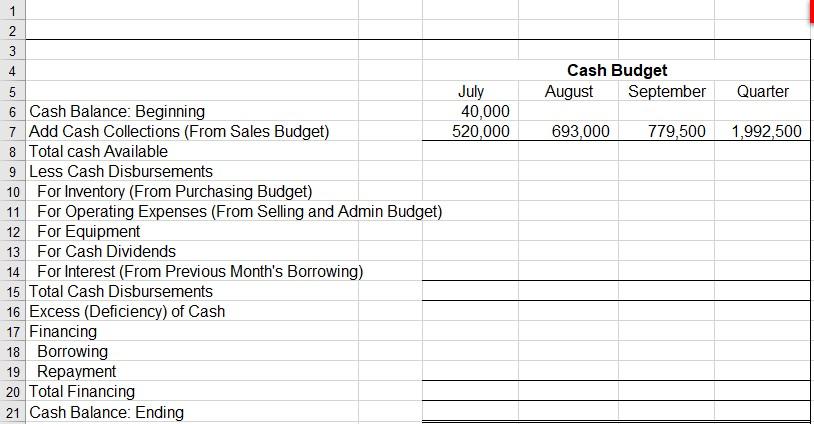

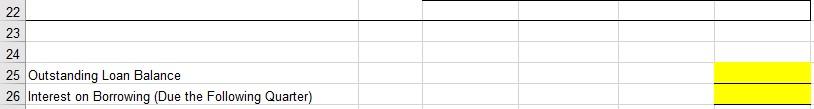

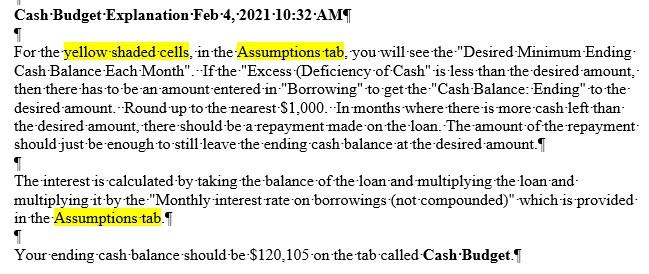

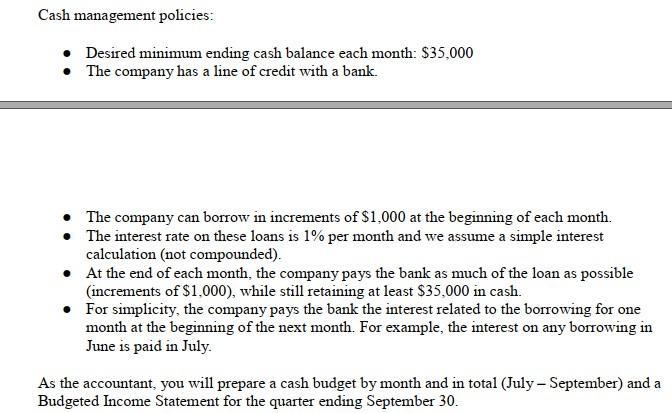

Part 1 Information 30% 70% 50% 50% 20 21 FINANCE MANAGER PRIVATE INFORMATION 22 Percent sales collected in month of sale 23 Percent sales collected in month after sale 24 25 Percent of inventory purchases paid in month of purchase 26 Percent of inventory purchases paid in month after purchase 27 28 Percent of operating expenses paid in month of purchase 29 Percent of operating expenses paid in month after purchase 30 Desired minimum ending cash balance each month 32 Borrow in increments of 33 Monthly interest rate on borrowings (not compounded) 34 35 36 Other planned outlays of cash 37 Capital expenditures 38 Dividends 100% 0% 31 $ $ 35,000 1,000 1% $ $ July August September 200,000 $ 90,000 $ 50,000 $ $ 39 41 Assets 42 SRS Educational Supply Company 43 Balance Sheet 44 Previous Year End 45 46 Current assets: 47 Cash 48 Accounts receivable 49 Inventory 50 Prepaid insurance 51 Total current assets 52 Buildings and equipment (net) 53 TOTAL ASSETS $ $ $ $ 40,000 340,000 50,000 18,000 $ 448,000 $ 860.000 $ 1,308,000 A B E 71 D Sales Budget 1 2 3 st July Quarter August September $910,000 $475,000 5 Sales 6 $600,000 $1,985,000 7 8 8 Schedule of Cash Collections July August September $340,000 Quarter $340,000 $180,000 $180,000 $420,000 9 June sales (A/R From Beginning Balance Sheet) 10 July sales - Collected in Current Month 11 July sales - Collected in Following Month 12 August sales - Collected in Current Month 13 August sales - Collected in Following Month 14 September sales - Collected in Current Month 15 Total Expected Cash Collections 16 $420,000 $273,000 $273,000 $637,000 $637,000 $142,500 $142,500 $1,992,500 $520,000 $693,000 $779,500 16 17 18 19 Total Sales for the Quarter 20 A/R at the end of the Quarter (September Sales Still not Collected) $ 1,985,000 $ 332,500 A B D E F F 1 N Inventory Purchase Budget July August September $ 600,000 $ 910,000 $ 475,000 $ 45% 45% 45% $ 270,000 $ 409,500 $ 213,750 $ October 385,000 45% 173,250 3 4 5 Sales 6 Cost of Merchandise as % of Sales 7 Budgeted Cost of Merchandise Sold 8 9 Following Month's COGS 10 Desired Ending Inventory % 11 Desired Ending Inventory Dollars 12 13 Budgeted Cost of Merchandise Sold 14 Plus Desired Ending Inventory 15 Total Inventory Needs 16 Less Beginning Inventory 17 Required Purchases $ 409,500 $ 213,750 $ 173,250 20% 20% 20% 81,900 42,750 34,650 270,000 409,500 213,750 81,900 42,750 34,650 351,900 452,250 248,400 50,000 81,900 42,750 $ 301,900 $ 370,350 $ 205,650 18 19 20 21 21 22 Schedule of Expected Cash Disbursements - Purchases 23 July August September Quarter 24 June Purchases (A/P From Balance Sheet) $ 130,000 $ 130,000 25 July Purchases $150,950 $ 150,950 $ 301,900 26 August Purchases $ 185,175 $ 185,175 $ 370,350 27 September Purchases $ 102,825 $ 102,825 28 Total Disbursements $ 280,950 $ 336,125 $ 288,000 $ 905,075 29 30 31 32 Cost of Merchandise Sold for the Quarter $ 893,250 33 Ending Inventory at the end of the Quarter $ 34,650 34 Ending A/P at the end of the Quarter $ 102,825 A B C D E F 1 0 1 Selling and Administrative Budget July August September Quarter $ 600,000 $ 910,000 $ 475,000 $1,985,000 5% 5% 5% 5% 8% 8% 8% 8% 3 4 5 6 Sales 7 Shipping as a Percentage of Sales 8 Other Expenses as a Percentage of Sales 9 10 11 Variable Expenses 12 Shipping 13 Other Expenses 14 Total Variable Expenses 15 Fixed Expenses: 16 Salaries and Wages 17 Advertising 18 Prepaid Insurance 19 Depreciation 20 Total Fixed Expesnes 21 Total Selling and Admin Expenses 30,000 48,000 78,000 45,500 72,800 118,300 23,750 38,000 61,750 99,250 158,800 258,050 85,000 50,000 3,000 25,000 163,000 241,000 85,000 50,000 3,000 25,000 163,000 281,300 85,000 50,000 3,000 25,000 163,000 224,750 255,000 150,000 9,000 75,000 489,000 747,050 28,000 213,000 28,000 253,300 28,000 196,750 84,000 663,050 22 23 Less Noncash Items (Depreciation and Prepaid Ins) 24 Total Cash Disbursements 25 26 27 28 Prepaid Insurance That Is Expensed During the Quarter 29 Depreciation Expense Recognized During the Quarter $ $ 9,000 75,000 N- Cash Budget August September Quarter 693,000 779,500 1,992,500 1 2 3 4 5 July 6 Cash Balance: Beginning 40,000 7 Add Cash Collections (From Sales Budget) 520,000 8 Total cash Available 9 Less Cash Disbursements 10 For Inventory (From Purchasing Budget) 11 For Operating Expenses (From Selling and Admin Budget) 12 For Equipment 13 For Cash Dividends 14 For Interest (From Previous Month's Borrowing) 15 Total Cash Disbursements 16 Excess (Deficiency) of Cash 17 Financing 18 Borrowing 19 Repayment 20 Total Financing 21 Cash Balance: Ending 22 23 24 25 Outstanding Loan Balance 26 Interest on Borrowing (Due the Following Quarter) Cash-Budget-Explanation-Feb-4,-2021:10:32 AM For the yellow shaded cells in the Assumptions tab, you will see the "Desired-Minimum Ending Cash Balance Each-Month".--If the "Excess (Deficiency-of-Cash" is less than the desired amount. then there has to be an amount-entered in-"Borrowing" to get the-"Cash-Balance: Ending" to the desired-amount. -Round up to the nearest-$1,000.--In months where there is more cash-left than the desired-amount, there should be a repayment made on the loan. The amount of the repayment- should just be enough to-still-leave the ending-cash-balance at the desired amount. The interest is calculated by taking the balance of the loan and multiplying the loan-and- multiplying it by the-"Monthly interest rate on borrowings (not-compounded)" which is provided in the Assumptions tab. Your ending cash balance should be $120.105 on the tab-called Cash-Budget. Cash management policies: Desired minimum ending cash balance each month: $35,000 The company has a line of credit with a bank. The company can borrow in increments of $1,000 at the beginning of each month. The interest rate on these loans is 1% per month and we assume a simple interest calculation (not compounded). At the end of each month, the company pays the bank as much of the loan as possible (increments of $1,000), while still retaining at least $35,000 in cash. For simplicity, the company pays the bank the interest related to the borrowing for one month at the beginning of the next month. For example, the interest on any borrowing in June is paid in July. As the accountant, you will prepare a cash budget by month and in total (July-September) and a Budgeted Income Statement for the quarter ending September 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts