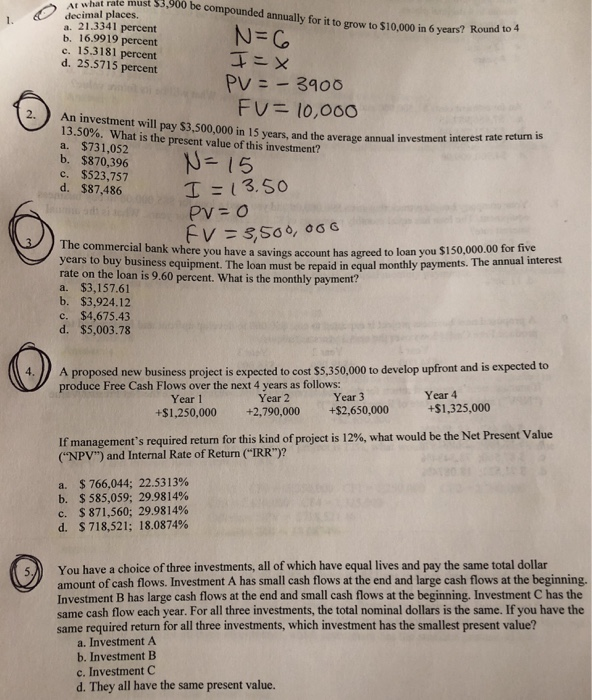

Question: what rate must $3,900 be compounded annually for it to grow to $10,000 in 6 years? Rou decimal places. a. 21.3341 percent b. 16.9919 percent

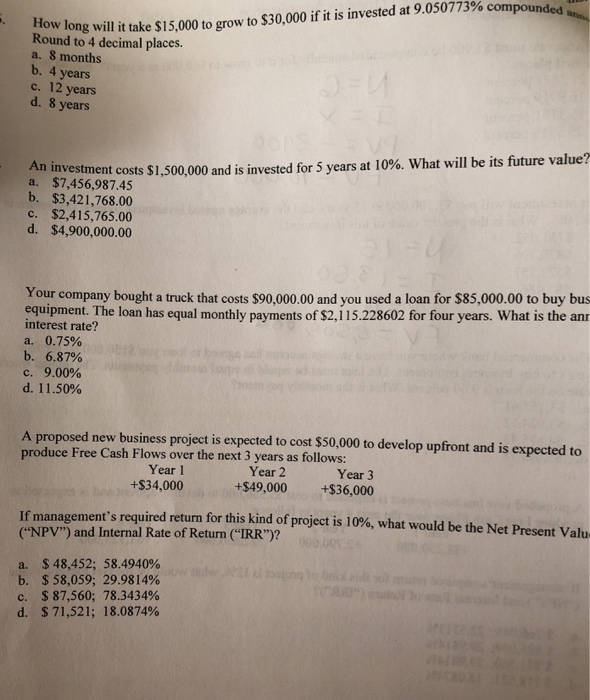

what rate must $3,900 be compounded annually for it to grow to $10,000 in 6 years? Rou decimal places. a. 21.3341 percent b. 16.9919 percent c. 15.3181 percent d. 25.5715 percent PV300 13.50% what is the present value of this investment? a. $731,052 b. $870,396 c. $523,757 d. $87,486 in 15 years, and the average annual investment interest rate return is The commercial bank where you have a savings account has agreed to l oan you $150,000.00 for five years to buy business equipment. The loan must be repaid in equal monthly payments. The annual interest rate on the loan is 9.60 percent. What is the monthly payment? a. $3,157.61 b. $3,924.12 c. $4,675.43 d. $5,003.78 4.)A proposed new business project is expected to cost $5,350,000 to develop upfront and is expected to produce Free Cash Flows over the next 4 years as follows: Year +$1,325,000 Year 3 Year 2 +$1,250,000 +2,790,000 +$2,650,000 Year 1 If management's required return for this kind of project is 12%, what would be the Net Present Value ("NPV") and Internal Rate of Return ("IRR")? a. b. c, d. $766,044; 22.5313% $585,059, 29.9814% $871,560; 29.9814% $ 718,521; 18.0874% 5You have a choice of three investments,all of which have equal lives and pay the same total dollar amount of cash flows. Investment A has small cash flows at the end and large cash flows at the beginning. Investment B has large cash flows at the end and small cash flows at the beginning. Investment C has the same cash flow each year. For all three investments, the total nominal dollars is the same. If you have the same required return for all three investments, which investment has the smallest present value? a. Investment A b. Investment B c. Investment C d. They all have the same present value. compounded Round to 4 dll it take $15,000 to grow to $30,000 if it is invested at 9.050773% How Rou nd to 4 decimal places. a. 8 months b. 4 years c. 12 years d. 8 years An investm a. $7,456,987.45 b. $3,421,768.00 c. $2,415,765.00 d. $4,900,000.00 ent costs $1,500,000 and is invested for 5 years at 10%. What will be its future value? Your company bought a truck that costs $90,000.00 and you used a loan for $85,000.00 to buy bus equipment. The loan has equal monthly payments of $2,115.228602 for four years. What is the an interest rate? a. 0.75% b. 6.87% . 9.00% d. 11.50% A proposed new business project is expected to cost $50,000 to develop upfront and is expected to produce Free Cash Flows over the next 3 years as follows: Year 1 +$34,000 Year 3 +$49,000 +$36,000 Year 2 If management's required return for this kind of project is 10%, what would be the Net Present Valu ("NPV") and Internal Rate of Return ("IRR")? a. $48,452; 58.4940% b. $58,05% 2998 14% d, $87,560; 78.3434% S 71,521; 18.0874%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts