Question: What sheet do I record this on the tax return? 14. Because of her busy work schedule, Paige was unable to provide her accountant with

What sheet do I record this on the tax return?

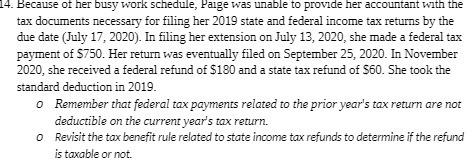

14. Because of her busy work schedule, Paige was unable to provide her accountant with the tax documents necessary for filing her 2019 state and federal income tax returns by the due date (July 17, 2020). In filing her extension on July 13, 2020, she made a federal tax payment of $750. Her return was eventually filed on September 25, 2020. In November 2020, she received a federal refund of $180 and a state tax refund of $60. She took the standard deduction in 2019. o Remember that federal tax payments related to the prior year's tax return are not deductible on the current year's tax return. o Revisit the tax benefit rule related to state income tax refunds to determine if the refund is taxable or not.

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Paiges payment of 750 made on July 13 2020 would be recorded on Form 1040 Schedu... View full answer

Get step-by-step solutions from verified subject matter experts