Question: what shoukd I do for McKesson 1. Explain the methods used to come up with cash flow or dividend estimates. 2. Explain how you estimated

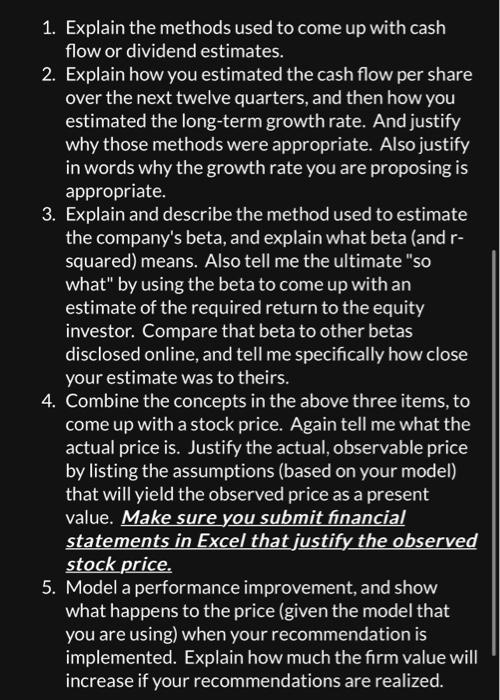

1. Explain the methods used to come up with cash flow or dividend estimates. 2. Explain how you estimated the cash flow per share over the next twelve quarters, and then how you estimated the long-term growth rate. And justify why those methods were appropriate. Also justify in words why the growth rate you are proposing is appropriate. 3. Explain and describe the method used to estimate the company's beta, and explain what beta (and r squared) means. Also tell me the ultimate "so what" by using the beta to come up with an estimate of the required return to the equity investor. Compare that beta to other betas disclosed online, and tell me specifically how close your estimate was to theirs. 4. Combine the concepts in the above three items, to come up with a stock price. Again tell me what the actual price is. Justify the actual, observable price by listing the assumptions (based on your model) that will yield the observed price as a present value. Make sure you submit financial statements in Excel that justify the observed stock price. 5. Model a performance improvement, and show what happens to the price (given the model that you are using) when your recommendation is implemented. Explain how much the firm value will increase if your recommendations are realized. 1. Explain the methods used to come up with cash flow or dividend estimates. 2. Explain how you estimated the cash flow per share over the next twelve quarters, and then how you estimated the long-term growth rate. And justify why those methods were appropriate. Also justify in words why the growth rate you are proposing is appropriate. 3. Explain and describe the method used to estimate the company's beta, and explain what beta (and r squared) means. Also tell me the ultimate "so what" by using the beta to come up with an estimate of the required return to the equity investor. Compare that beta to other betas disclosed online, and tell me specifically how close your estimate was to theirs. 4. Combine the concepts in the above three items, to come up with a stock price. Again tell me what the actual price is. Justify the actual, observable price by listing the assumptions (based on your model) that will yield the observed price as a present value. Make sure you submit financial statements in Excel that justify the observed stock price. 5. Model a performance improvement, and show what happens to the price (given the model that you are using) when your recommendation is implemented. Explain how much the firm value will increase if your recommendations are realized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts