Question: what should be placed in the field based on the following options - Accounts payable Accounts receivable Accumulated depreciationBuilding Accumulated depreciationEquipment Building Cash Common dividend

what should be placed in the field based on the following options -

- Accounts payable

- Accounts receivable

- Accumulated depreciationBuilding

- Accumulated depreciationEquipment

- Building

- Cash

- Common dividend payable

- Common stock dividend distributable

- Common stock$10 par value

- Common stock$3.33 par value

- Common stock, $0.50 par value

- Common stock, $1 par value

- Common stock, $1 stated value

- Common stock, $2 par value

- Common stock, $2 stated value

- Common stock, $20 par value

- Common stock, $5 par value

- Common stock, $8 stated value

- Common stock, no-par value

- Cost of goods sold

- Depreciation expenseBuilding

- Depreciation expenseEquipment

- Equipment

- Income summary

- Interest expense

- Interest revenue

- Inventory

- Land

- Note payable

- Organization expenses

- Paid-in capital in excess of par value, common stock

- Paid-in capital in excess of par value, preferred stock

- Paid-in capital in excess of stated value, common stock

- Paid-in capital, treasury stock

- Preferred stock

- Preferred stock, $100 par value

- Preferred stock, $50 par value

- Rent expense

- Retained earnings

- Salaries expense

- Sales

- Sales discounts

- Sales returns and allowances

- Supplies

- Supplies expense

- Treasury stock

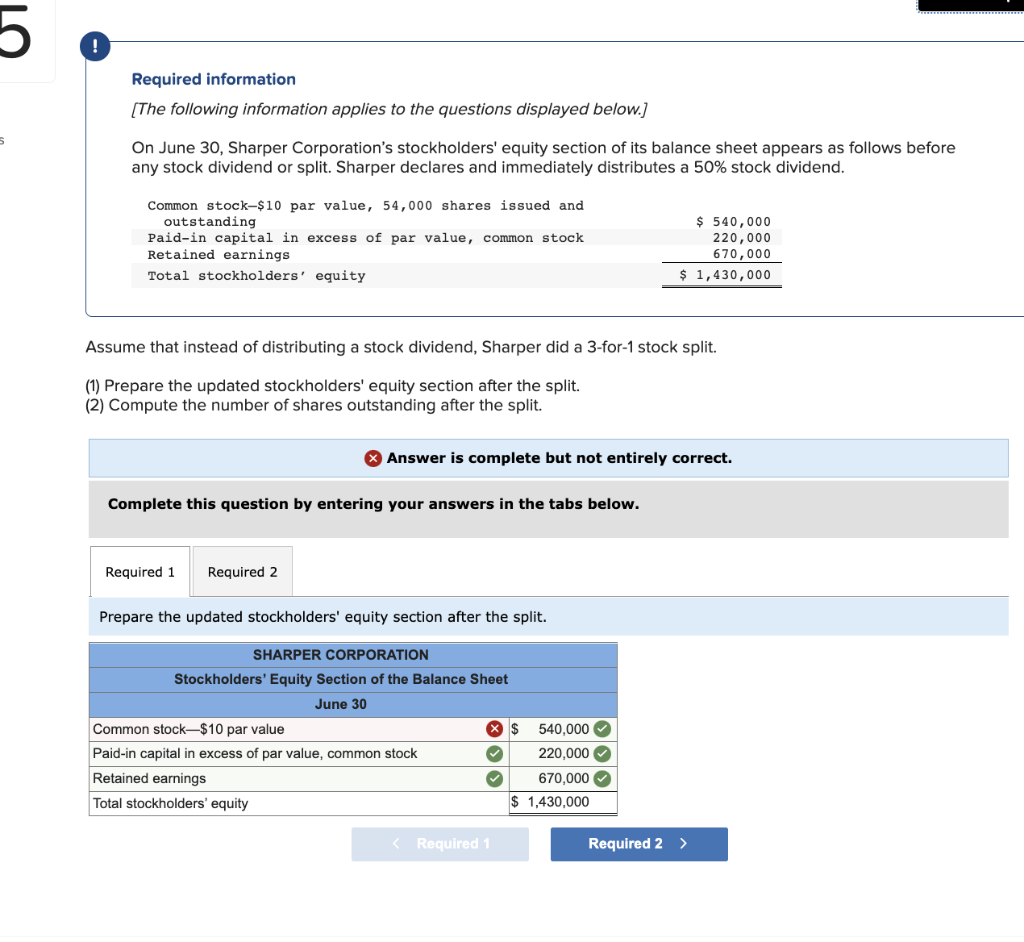

5 5 Required information [The following information applies to the questions displayed below.] On June 30, Sharper Corporation's stockholders' equity section of its balance sheet appears as follows before any stock dividend or split. Sharper declares and immediately distributes a 50% stock dividend. Common stock-$10 par value, 54,000 shares issued and outstanding $ 540,000 Paid-in capital in excess of par value, common stock Retained earnings 220,000 670,000 Total stockholders' equity $ 1,430,000 Assume that instead of distributing a stock dividend, Sharper did a 3-for-1 stock split. (1) Prepare the updated stockholders' equity section after the split. (2) Compute the number of shares outstanding after the split. > Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the updated stockholders' equity section after the split. SHARPER CORPORATION Stockholders' Equity Section of the Balance Sheet June 30 Common stock-$10 par value X $ Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts