Question: what the correct answer? question 1 question 2 question 3 Cash Accounts Receivable Inventory Prepaid Insurance Long-term Assets Accounts Payable Notes Payable due in 10

what the correct answer? question 1

question 2

question 3

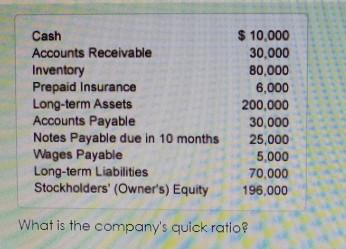

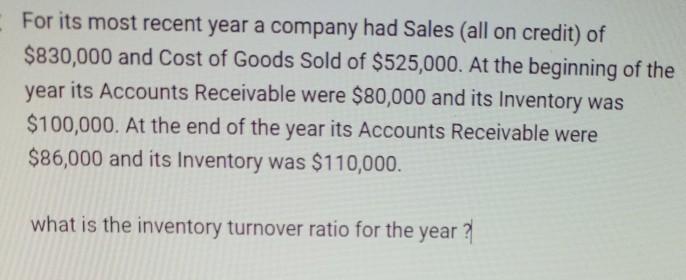

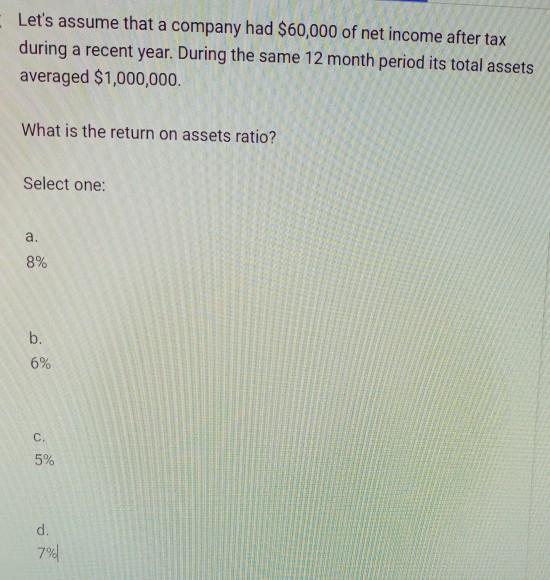

Cash Accounts Receivable Inventory Prepaid Insurance Long-term Assets Accounts Payable Notes Payable due in 10 months Wages Payable Long-term Liabilities Stockholders' (Owner's) Equity $ 10,000 30,000 80,000 6,000 200,000 30,000 25,000 5,000 70,000 196,000 What is the company's quick ratio For its most recent year a company had Sales (all on credit) of $830,000 and Cost of Goods Sold of $525,000. At the beginning of the year its Accounts Receivable were $80,000 and its Inventory was $100,000. At the end of the year its Accounts Receivable were $86,000 and its Inventory was $110,000. what is the inventory turnover ratio for the year? Let's assume that a company had $60,000 of net income after tax during a recent year. During the same 12 month period its total assets averaged $1,000,000. What is the return on assets ratio? Select one: a. 8% b. 6% C. 5% d. 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts