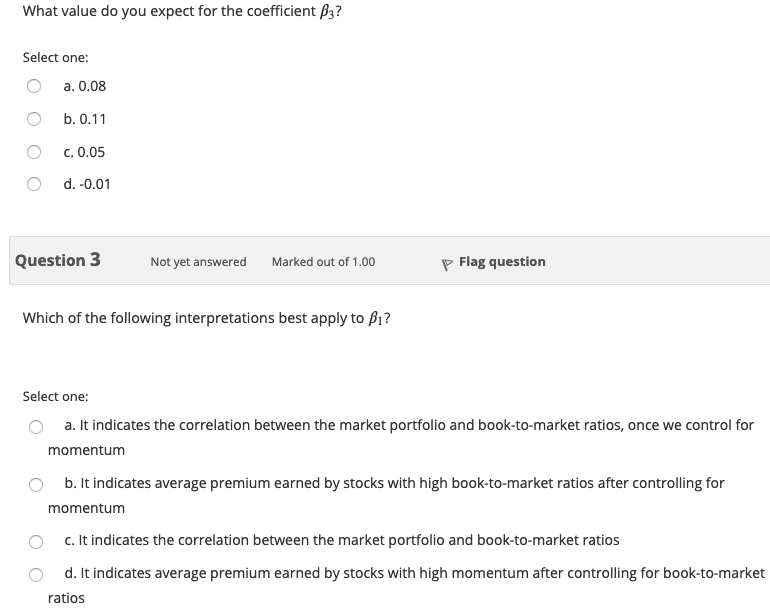

Question: What value do you expect for the coefficient B3? Select one: a. 0.08 b. 0.11 c. 0.05 d. -0.01 Question 3 Not yet answered Marked

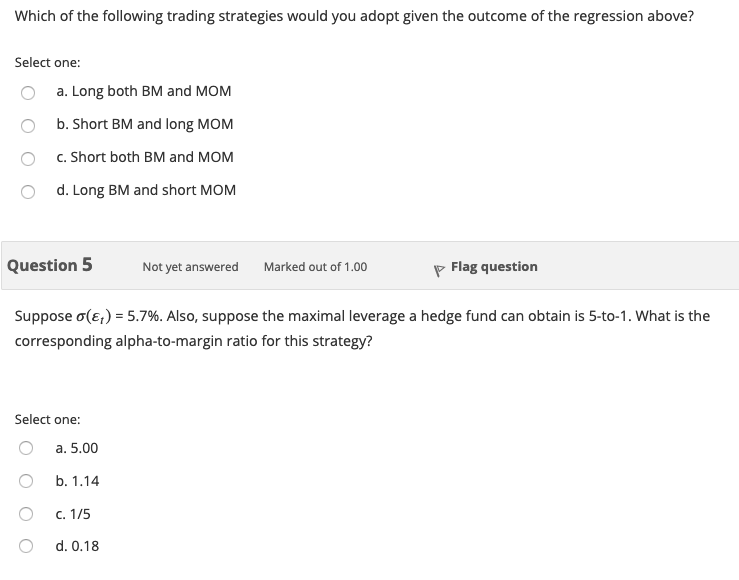

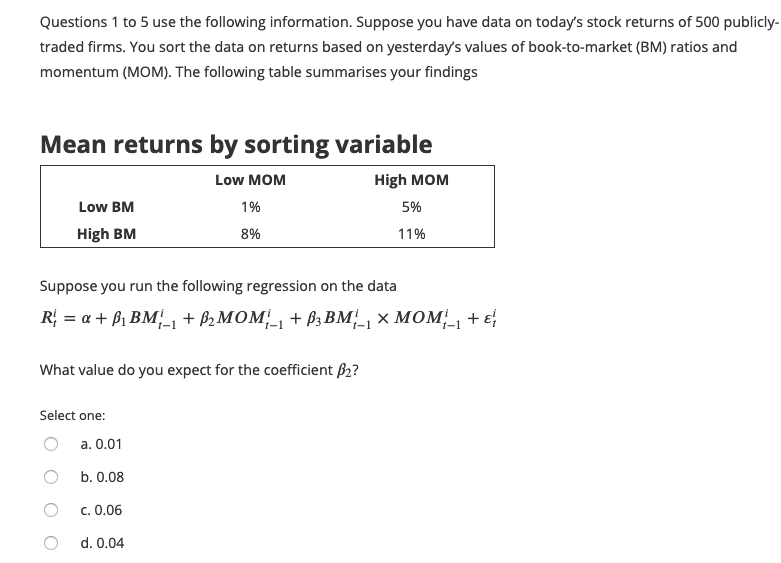

What value do you expect for the coefficient B3? Select one: a. 0.08 b. 0.11 c. 0.05 d. -0.01 Question 3 Not yet answered Marked out of 1.00 p Flag question Which of the following interpretations best apply to B? Select one: a. It indicates the correlation between the market portfolio and book-to-market ratios, once we control for momentum b. It indicates average premium earned by stocks with high book-to-market ratios after controlling for momentum C. It indicates the correlation between the market portfolio and book-to-market ratios d. It indicates average premium earned by stocks with high momentum after controlling for book-to-market ratios Which of the following trading strategies would you adopt given the outcome of the regression above? Select one: a. Long both BM and MOM b. Short BM and long MOM C. Short both BM and MOM d. Long BM and short MOM Question 5 Not yet answered Marked out of 1.00 p Flag question Suppose o( ) = 5.7%. Also, suppose the maximal leverage a hedge fund can obtain is 5-to-1. What is the corresponding alpha-to-margin ratio for this strategy? Select one: a. 5.00 b. 1.14 C. 1/5 d. 0.18 Questions 1 to 5 use the following information. Suppose you have data on today's stock returns of 500 publicly- traded firms. You sort the data on returns based on yesterday's values of book-to-market (BM) ratios and momentum (MOM). The following table summarises your findings Mean returns by sorting variable Low MOM High MOM Low BM 1% 5% High BM 8% 11% Suppose you run the following regression on the data R = a + B, BM-1 + B2MOM-1 + B2 BM-1 X MOM-1 + ; What value do you expect for the coefficient B2? Select one: a. 0.01 b. 0.08 C. 0.06 d. 0.04 What value do you expect for the coefficient B3? Select one: a. 0.08 b. 0.11 c. 0.05 d. -0.01 Question 3 Not yet answered Marked out of 1.00 p Flag question Which of the following interpretations best apply to B? Select one: a. It indicates the correlation between the market portfolio and book-to-market ratios, once we control for momentum b. It indicates average premium earned by stocks with high book-to-market ratios after controlling for momentum C. It indicates the correlation between the market portfolio and book-to-market ratios d. It indicates average premium earned by stocks with high momentum after controlling for book-to-market ratios Which of the following trading strategies would you adopt given the outcome of the regression above? Select one: a. Long both BM and MOM b. Short BM and long MOM C. Short both BM and MOM d. Long BM and short MOM Question 5 Not yet answered Marked out of 1.00 p Flag question Suppose o( ) = 5.7%. Also, suppose the maximal leverage a hedge fund can obtain is 5-to-1. What is the corresponding alpha-to-margin ratio for this strategy? Select one: a. 5.00 b. 1.14 C. 1/5 d. 0.18 Questions 1 to 5 use the following information. Suppose you have data on today's stock returns of 500 publicly- traded firms. You sort the data on returns based on yesterday's values of book-to-market (BM) ratios and momentum (MOM). The following table summarises your findings Mean returns by sorting variable Low MOM High MOM Low BM 1% 5% High BM 8% 11% Suppose you run the following regression on the data R = a + B, BM-1 + B2MOM-1 + B2 BM-1 X MOM-1 + ; What value do you expect for the coefficient B2? Select one: a. 0.01 b. 0.08 C. 0.06 d. 0.04

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts