Question: What will be the net profits from the proceeds / payoffs to an investor who purchases Google puts with exercise price $80 if the stock

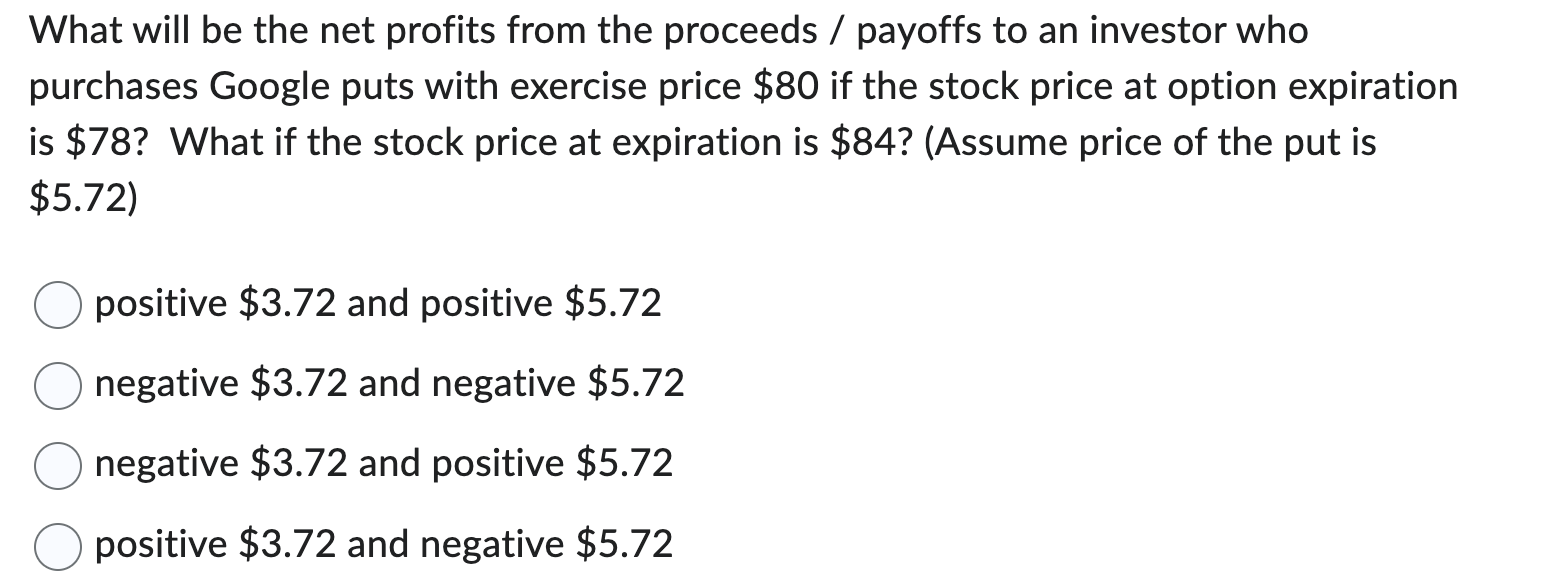

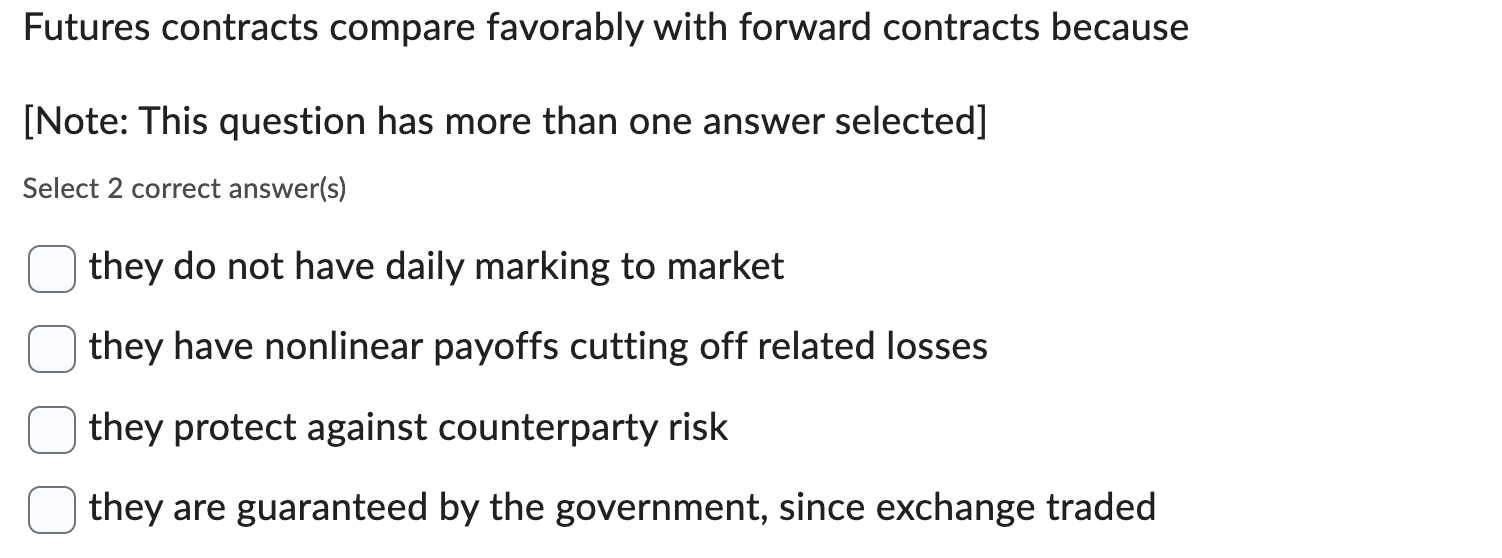

What will be the net profits from the proceeds / payoffs to an investor who purchases Google puts with exercise price $80 if the stock price at option expiration is $78 ? What if the stock price at expiration is $84 ? (Assume price of the put is $5.72) positive $3.72 and positive $5.72 negative $3.72 and negative $5.72 negative $3.72 and positive $5.72 positive $3.72 and negative $5.72 Futures contracts compare favorably with forward contracts because [Note: This question has more than one answer selected] Select 2 correct answer(s) they do not have daily marking to market they have nonlinear payoffs cutting off related losses they protect against counterparty risk they are guaranteed by the government, since exchange traded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts