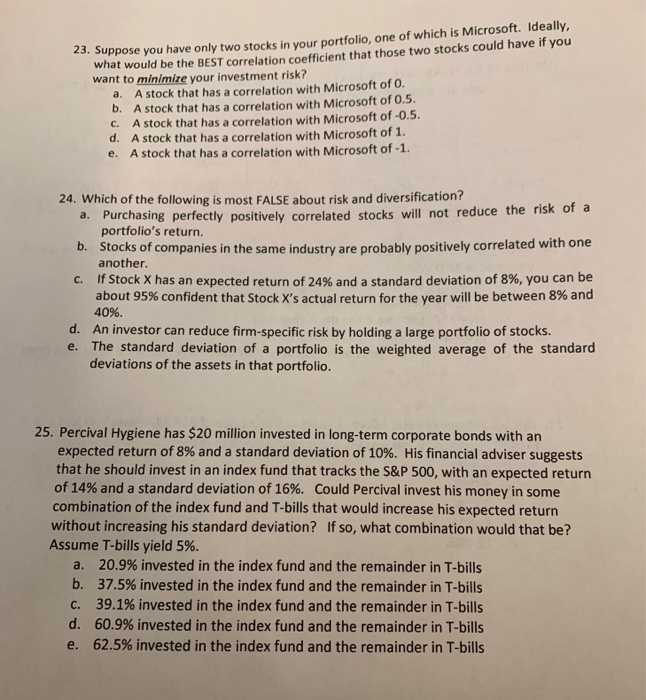

Question: what would be the BEST correlation coefficient that those two stocks could have if you want to minimize your investment risk? 23. Suppos have only

what would be the BEST correlation coefficient that those two stocks could have if you want to minimize your investment risk? 23. Suppos have only two stocks in your portfolio, one of which is Microsoft. Ideally a. A stock that has a correlation with Microsoft of O b. A stock that has a correlation with Microsoft of 0.5 C. A stock that has a correlation with Microsoft of -0.5 d. A stock that has a correlation with Microsoft of 1 e. A stock that has a correlation with Microsoft of -1 24. Which of the following is most FALSE about risk and diversification? a. Purchasing perfectly positively correlated stocks will not reduce the ris b. C. If Stock X has an expected return of 24% and a standard deviation of 8%, you can be portfolio's return. another about 95% confident that Stock X's actual return for the year will be between 8% and Stocks of companies in the same industry are probably positively correlated with one 40%. d. An investor can reduce firm-specific risk by holding a large portfolio of stocks. e. The standard deviation of a portfolio is the weighted average of the standard deviations of the assets in that portfolio. 25. Percival Hygiene has $20 million invested in long-term corporate bonds with an expected return of 8% and a standard deviation of 10%. His financial adviser suggests that he should invest in an index fund that tracks the S&P 500, with an expected return of 14% and a standard deviation of 16%. Could Percival invest his money in some combination of the index fund and T-bills that would increase his expected return without increasing his standard deviation? If so, what combination would that be? Assume T-bills yield 5%. a. 20.9% invested in the index fund and the remainder in T-bills b, 37.5% invested in the index fund and the remainder in T-bills c. 39.1% invested in the index fund and the remainder in T-bills d, 60.9% invested in the index fund and the remainder in T-bills e. 62.5% invested in the index fund and the remainder in T-bills

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts