Question: What would be the correct answers? Return to question Required information [The following information applies to the questions displayed below. Wells Technical Institute (WTI) provides

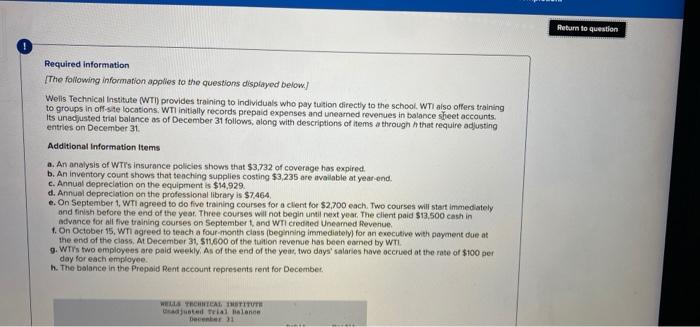

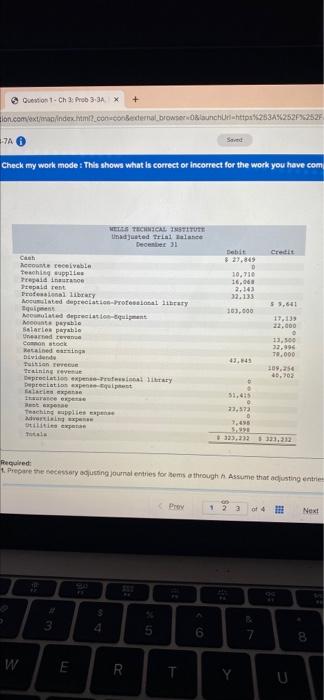

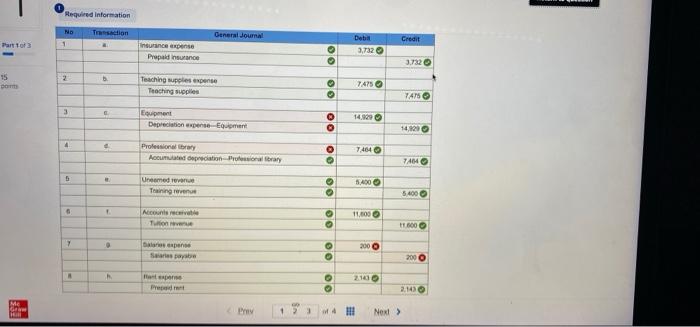

Return to question Required information [The following information applies to the questions displayed below. Wells Technical Institute (WTI) provides training to individuals who pay tuition directly to the school. WTI also offers training to groups in off-site locations. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Its un adjusted trial balance as of December 31 follows, along with descriptions of items through that require adjusting entries on December 31 Additional Information Items a. An analysis of WTI's Insurance policies shows that $3,732 of coverage has expired. b. An inventory count shows that teaching supplies costing $3,235 are available at year-end, c. Annual depreciation on the equipment is $14,929. d. Annual depreciation on the professional library is $7464 e. On September 1, WTI agreed to do five training courses for a client for $2,700 each. Two courses will start immediately and finish before the end of the year. Three courses will not begin until next year. The client paid $13,500 cash in advance for all five training courses on September and WTI credited Uneamed Revenue 1. On October 15, WTI agreed to teach a four-month class beginning immediately for an executive with payment due at the end of the class. At December 31, $11,600 of the tuition revenue has been earned by WTL 9. WTY's two employees are paid weekly As of the end of the year two days' salaries have accrued at the rate of $100 per day for each employee. h. The balance in the Prepaid Rent account represents rent for December WELLS TECHNICAL TOTTUR justed Trial Balance December + 3 QUOT- Ch 3 Prob 3-3A X lon.com/index.htm.coconbedernal browser Olaunchurahttp%253A%252F%252F -7A Sad Check my work mode : This shows what is correct or incorrect for the work you have com Credit Debit 8 27.04 0 10,710 16.00 2.143 59.661 103,600 WEES STORE unadjusted Trial talace December 31 C Account receivable teaching supplies Ted Large Prepaid rent Trolli Musted depreciation Professional library sont Med depreciation quien Mapable Salarios parable Und even Common stock cained in Dividende eve Trening eve Deprecately Depreciation expert pas It so Teaching piese we text 17,133 22.000 42.45 13,500 32.996 79.000 109.25 10.703 51,415 23,573 0 7.48 59 Required t. Prepare the necessary austing journal entries for tem a through Assume that adjusting entre Bry 12 of 4 Next 3 S 4 5 7 W E R . Y U Required information Tassedion General Journal ND 1 Credit Part to the expense Prepaid in Deba 3,732 3.732 15 2 b Teaching suples expense Teaching supplies 7475 7475 3 Equipment Depreciation expense Eart 14.909 00 1412 4 Professional ray Accurate depreciation - baty 7,464 OO 7414 5 med revne Training OO 400 5.400 1 concrete Tune . 11.00 0 1600 7 Spen Sebe 2000 200 ante Pret OO 2.14 Me GA 1 2 3 WHI Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts