Question: what would be the deduction for 2018 Michelle is a licensed paralegal and is employed on a part-time basis by several local attorneys. She works

what would be the deduction for 2018

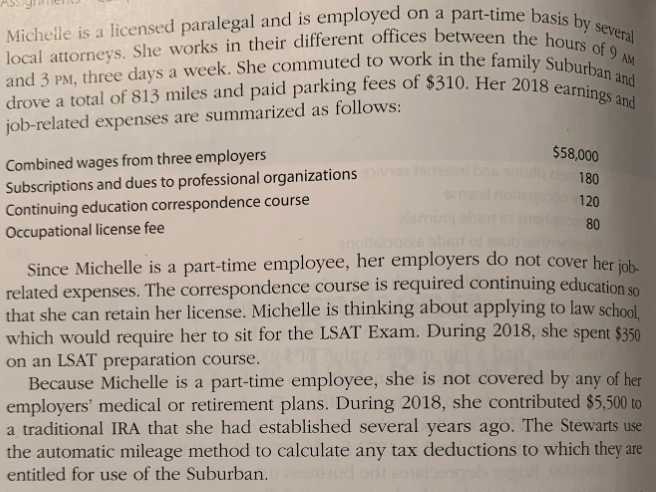

Michelle is a licensed paralegal and is employed on a part-time basis by several local attorneys. She works in their different offices between the hours of 9 AM and 3 PM, three days a week. She commuted to work in the family Suburban and drove a total of 813 miles and paid parking fees of $310. Her 2018 earnings and job-related expenses are summarized as follows: $58,000 bs snid z 1o0 Combined wages from three employers Subscriptions and dues to professional organizations ie Continuing education correspondence course Occupational license fee snlna 120 elamuoiab 80 Since Michelle is a part-time employee, her employers do not cover her ioh related expenses. The correspondence course is required continuing education so that she can retain her license. Michelle is thinking about applying to law school which would require her to sit for the LSAT Exam. During 2018, she spent $350 on an LSAT preparation course. Because Michelle is a part-time employee, she is not covered by any of her employers' medical or retirement plans. During 2018, she contributed $5,500 to a traditional IRA that she had established several years ago. The Stewarts use the automatic mileage method to calculate any tax deductions to which they entitled for use of the Suburban. 11 are uct orltas Michelle is a licensed paralegal and is employed on a part-time basis by several local attorneys. She works in their different offices between the hours of 9 AM and 3 PM, three days a week. She commuted to work in the family Suburban and drove a total of 813 miles and paid parking fees of $310. Her 2018 earnings and job-related expenses are summarized as follows: $58,000 bs snid z 1o0 Combined wages from three employers Subscriptions and dues to professional organizations ie Continuing education correspondence course Occupational license fee snlna 120 elamuoiab 80 Since Michelle is a part-time employee, her employers do not cover her ioh related expenses. The correspondence course is required continuing education so that she can retain her license. Michelle is thinking about applying to law school which would require her to sit for the LSAT Exam. During 2018, she spent $350 on an LSAT preparation course. Because Michelle is a part-time employee, she is not covered by any of her employers' medical or retirement plans. During 2018, she contributed $5,500 to a traditional IRA that she had established several years ago. The Stewarts use the automatic mileage method to calculate any tax deductions to which they entitled for use of the Suburban. 11 are uct orltas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts