Question: what would go these be recorded on a journal entry book ? it doesnt seem like it would fit the format of the book? 1.

what would go these be recorded on a journal entry book ?

it doesnt seem like it would fit the format of the book?

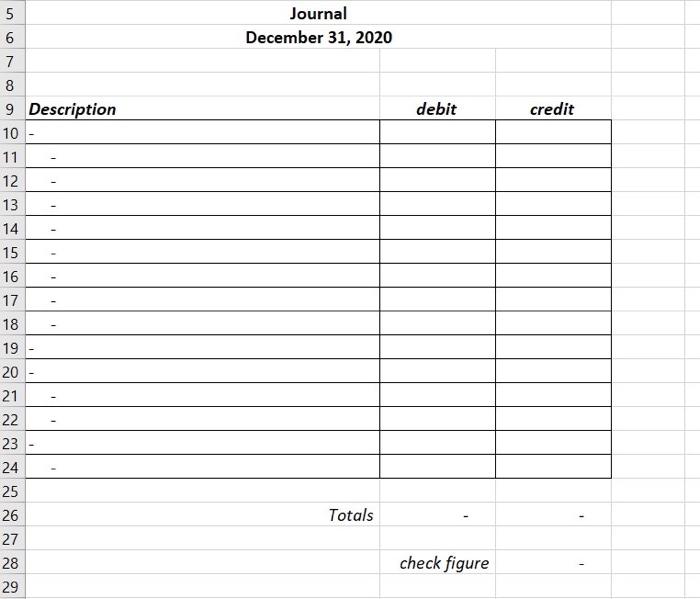

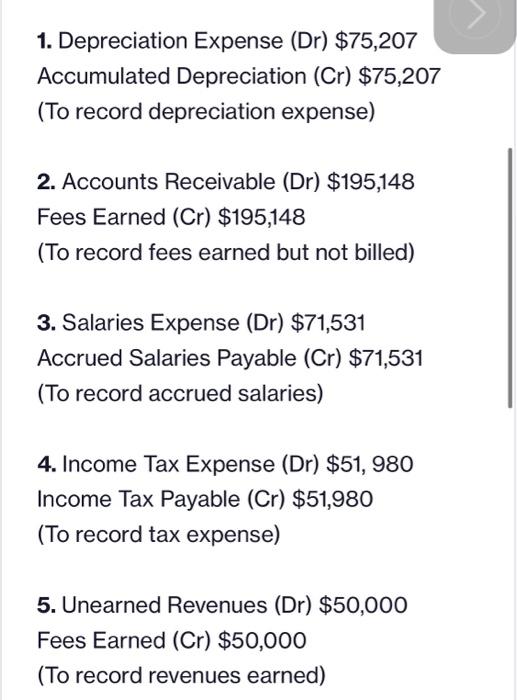

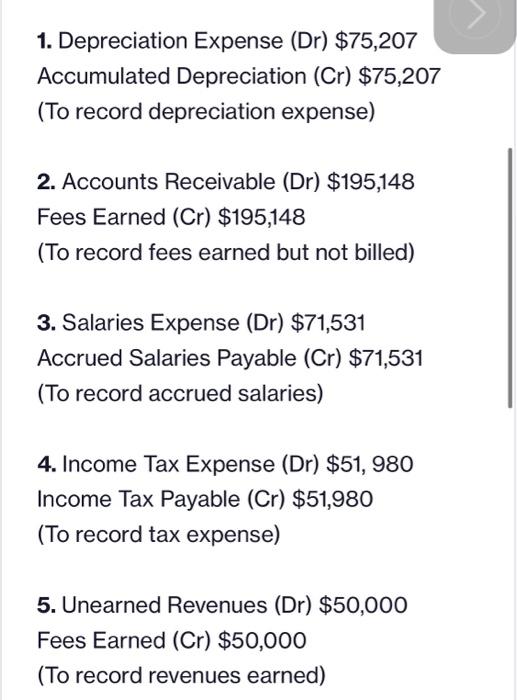

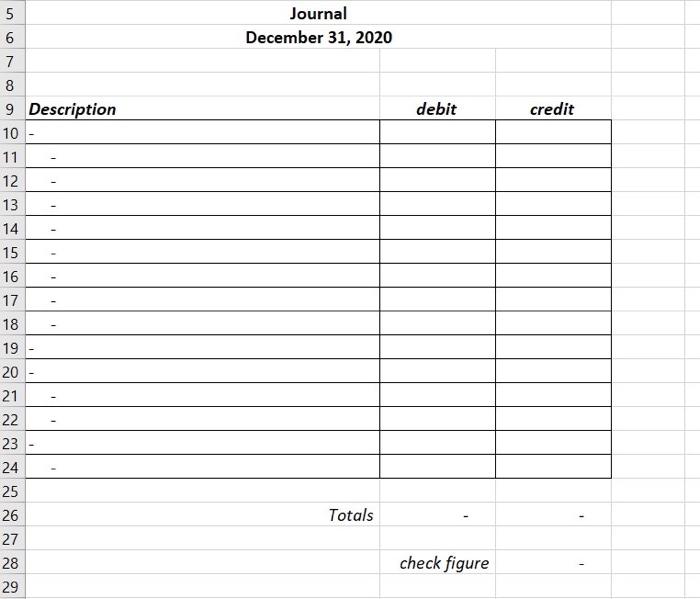

1. Depreciation Expense (Dr) $75,207 Accumulated Depreciation (Cr) $75,207 (To record depreciation expense) 2. Accounts Receivable (Dr) $195,148 Fees Earned (Cr) $195,148 (To record fees earned but not billed) 3. Salaries Expense (Dr) $71,531 Accrued Salaries Payable (Cr) $71,531 (To record accrued salaries) 4. Income Tax Expense (Dr) $51, 980 Income Tax Payable (Cr) $51,980 (To record tax expense) 5. Unearned Revenues (Dr) $50,000 Fees Earned (Cr) $50,000 (To record revenues earned) un Journal December 31, 2020 7 8 5 6 7 8 9 Description 10 11 12 13 debit credit 2. 14 15 16 17 18 19 20 21 22 23 24 25 26 Totals 27 28 29 check figure

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock