Question: What would i do to get C? Please help!!! Thank you Suppose Alcatel-Lucent has an equity cost of capital of 10%, market capitalization of $10.80

What would i do to get C? Please help!!! Thank you

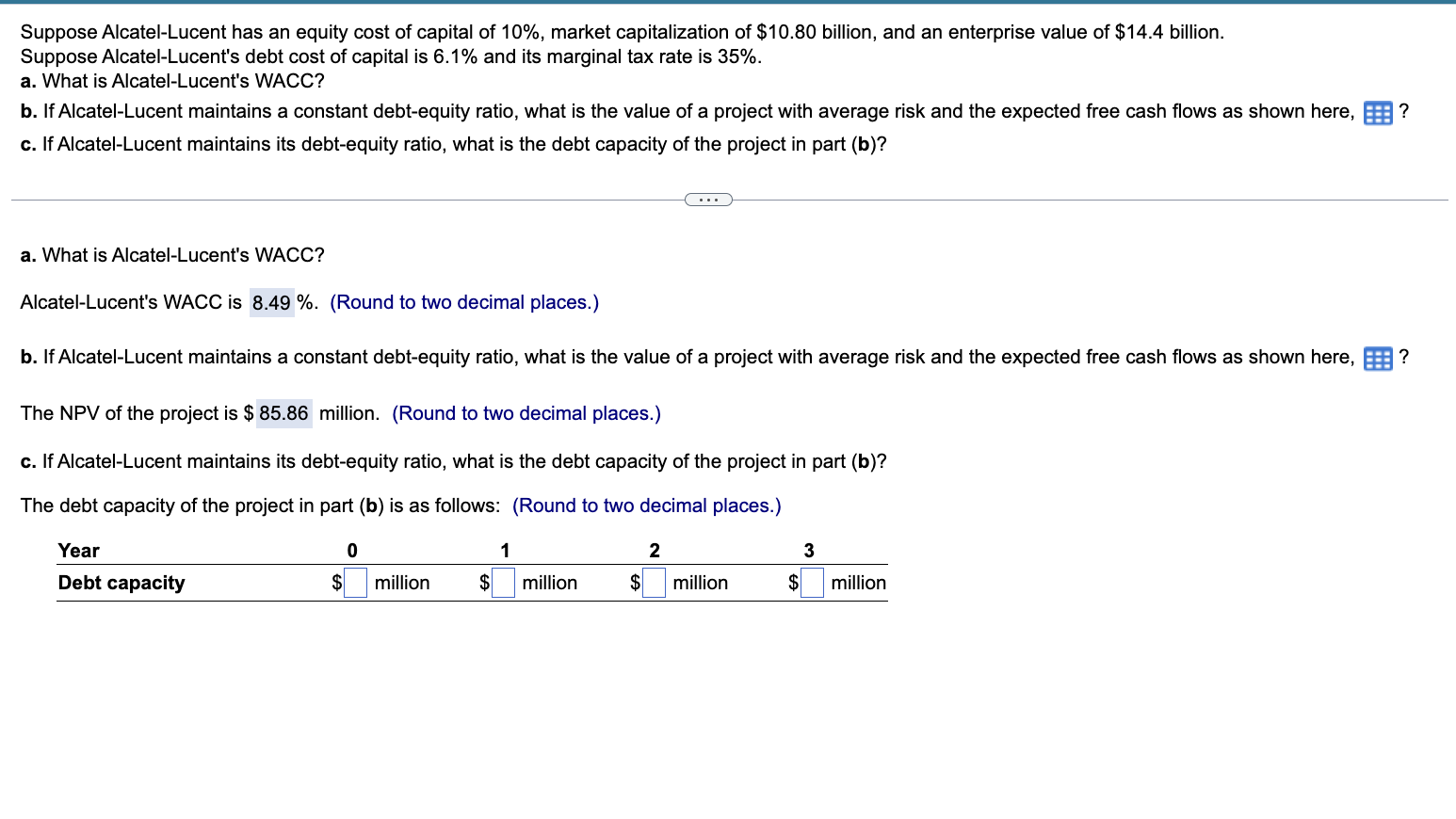

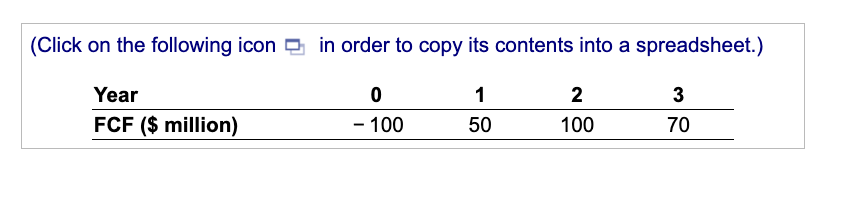

Suppose Alcatel-Lucent has an equity cost of capital of 10%, market capitalization of $10.80 billion, and an enterprise value of $14.4 billion. Suppose Alcatel-Lucent's debt cost of capital is 6.1% and its marginal tax rate is 35%. a. What is Alcatel-Lucent's WACC? b. If Alcatel-Lucent maintains a constant debt-equity ratio, what is the value of a project with average risk and the expected free cash flows as shown here, ? c. If Alcatel-Lucent maintains its debt-equity ratio, what is the debt capacity of the project in part (b)? a. What is Alcatel-Lucent's WACC? Alcatel-Lucent's WACC is 8.49%. (Round to two decimal places.) b. If Alcatel-Lucent maintains a constant debt-equity ratio, what is the value of a project with average risk and the expected free cash flows as shown here, ? The NPV of the project is $85.86 million. (Round to two decimal places.) c. If Alcatel-Lucent maintains its debt-equity ratio, what is the debt capacity of the project in part (b)? The debt capacity of the project in part (b) is as follows: (Round to two decimal places.) (Click on the following icon in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts