Question: What would question 5 look like on the correct tax form? Print Preview given asgift. possible, Courtney prefers to avoid depreciating capital expenditures over time.

What would question 5 look like on the correct tax form?

What would question 5 look like on the correct tax form?

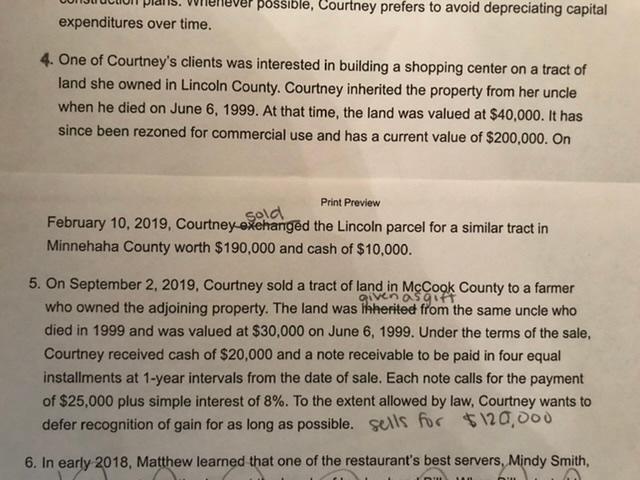

Print Preview given asgift. possible, Courtney prefers to avoid depreciating capital expenditures over time. 4. One of Courtney's clients was interested in building a shopping center on a tract of land she owned in Lincoln County. Courtney inherited the property from her uncle when he died on June 6, 1999. At that time, the land was valued at $40,000. It has since been rezoned for commercial use and has a current value of $200,000. On February 10, 2019, Courtney exchanged the Lincoln parcel for a similar tract in sold Minnehaha County worth $190,000 and cash of $10,000. 5. On September 2, 2019, Courtney sold a tract of land in County to a farmer who owned the adjoining property. The land was liaherited from the same uncle who died in 1999 and was valued at $30,000 on June 6, 1999. Under the terms of the sale, Courtney received cash of $20,000 and a note receivable to be paid in four equal installments at 1-year intervals from the date of sale. Each note calls for the payment of $25,000 plus simple interest of 8%. To the extent allowed by law, Courtney wants to defer recognition of gain for as long as possible. sells for $120,000 6. In early 2018, Matthew learned that one of the restaurant's best servers, Mindy Smith, Print Preview given asgift. possible, Courtney prefers to avoid depreciating capital expenditures over time. 4. One of Courtney's clients was interested in building a shopping center on a tract of land she owned in Lincoln County. Courtney inherited the property from her uncle when he died on June 6, 1999. At that time, the land was valued at $40,000. It has since been rezoned for commercial use and has a current value of $200,000. On February 10, 2019, Courtney exchanged the Lincoln parcel for a similar tract in sold Minnehaha County worth $190,000 and cash of $10,000. 5. On September 2, 2019, Courtney sold a tract of land in County to a farmer who owned the adjoining property. The land was liaherited from the same uncle who died in 1999 and was valued at $30,000 on June 6, 1999. Under the terms of the sale, Courtney received cash of $20,000 and a note receivable to be paid in four equal installments at 1-year intervals from the date of sale. Each note calls for the payment of $25,000 plus simple interest of 8%. To the extent allowed by law, Courtney wants to defer recognition of gain for as long as possible. sells for $120,000 6. In early 2018, Matthew learned that one of the restaurant's best servers, Mindy Smith

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts