Question: What would you suggest as a more appropriate allocation base than direct labor, and why would it be more appropriate? Wasley has three operating divisions.

What would you suggest as a more appropriate allocation base than direct labor, and why would it be more appropriate?

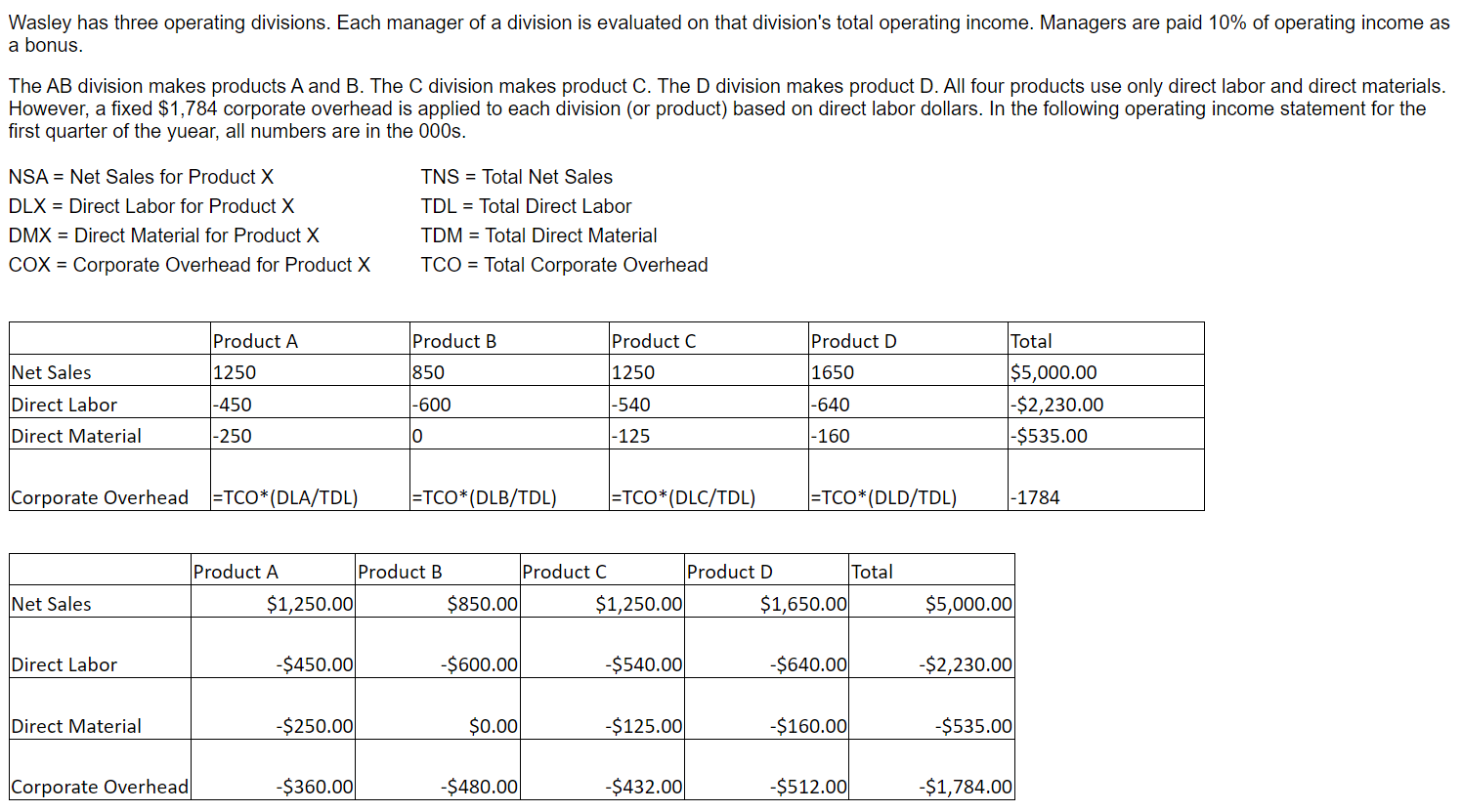

Wasley has three operating divisions. Each manager of a division is evaluated on that division's total operating income. Managers are paid 10% of operating income as a bonus The AB division makes products A and B. The C division makes product C. The D division makes product D. All four products use only direct labor and direct materials. However, a fixed $1,784 corporate overhead is applied to each division (or product) based on direct labor dollars. In the following operating income statement for the first quarter of the yuear, all numbers are in the 000s. NSA = Net Sales for Product X DLX = Direct Labor for Product X DMX = Direct Material for Product X COX = Corporate Overhead for Product X TNS = Total Net Sales TDL = Total Direct Labor TDM = Total Direct Material TCO = Total Corporate Overhead Product A Product B Product C Product D Total Net Sales 1250 1850 1250 1650 Direct Labor -450 -600 -540 -640 $5,000.00 -$2,230.00 -$535.00 Direct Material -250 0 -125 -160 Corporate Overhead =TCO*(DLA/TDL) =TCO*(DLB/TDL) =TCO*(DLC/TDL) =TCO*(DLD/TDL) -1784 Product A Product B Product C Product D Total Net Sales $1,250.00 $850.00 $1,250.00 $1,650.00 $5,000.00 Direct Labor -$450.00 -$600.00 -$540.00 $640.00 -$2,230.00 Direct Material -$250.00 $0.00 -$125.00 $160.00 -$535.00 Corporate Overhead -$360.00 -$480.00 -$432.00 $512.00 -$1,784.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts