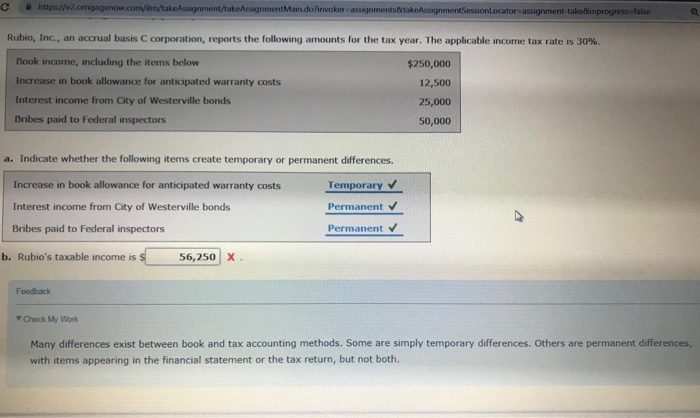

Question: Whats taxable income for Rubios? Explain https://v2.ceng /takeAssignmentMain.dofinvoker assignmer onLocator-assignment-takeBinprogress-false Rubio, Inc., an accrual basis C corporation, reports the following amounts for the tax year.

https://v2.ceng /takeAssignmentMain.dofinvoker assignmer onLocator-assignment-takeBinprogress-false Rubio, Inc., an accrual basis C corporation, reports the following amounts for the tax year. The applicable income tax rate is 30%, Book income, including the items below Increase in book allowance for anticipated warranty costs Interest income from City of Westerville bonds Bribes paid to Federal inspectons $250,000 12,500 25,000 50,000 a. Indicate whether the following items create temporary or permanent differences. Increase in book allowance for anticipated warranty costs Interest income from City of Westerville bonds Bribes paid to Federal inspectors Temporary Permanent v Permanent b. Rubio's taxable income is 56,250 X Feedback Check My Work Many differences exist between book and tax accounting methods. Some are simply temporary differences. Others are permanent differences with items appearing in the financial statement or the tax return, but not both

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts