On January 1, 2021, Sandy, Chris and Paul formed SCP Company with a total beginning capital...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

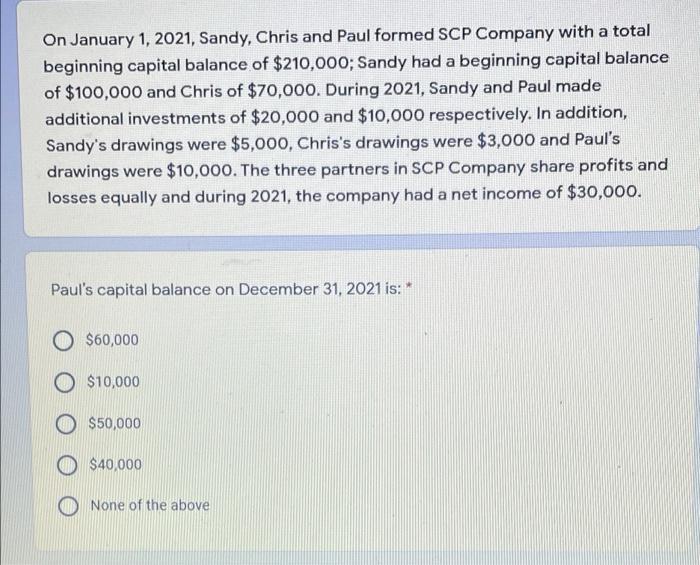

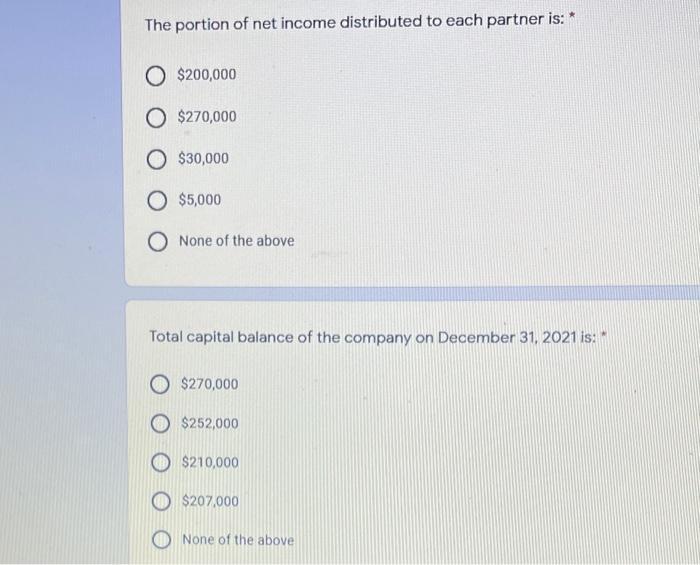

On January 1, 2021, Sandy, Chris and Paul formed SCP Company with a total beginning capital balance of $210,000; Sandy had a beginning capital balance of $100,000 and Chris of $70,000. During 2021, Sandy and Paul made additional investments of $20,000 and $10,000 respectively. In addition, Sandy's drawings were $5,000, Chris's drawings were $3,000 and Paul's drawings were $10,000. The three partners in SCP Company share profits and losses equally and during 2021, the company had a net income of $30,000. Paul's capital balance on December 31, 2021 is: * O $60,000 $10,000 $50,000 $40,000 None of the above The portion of net income distributed to each partner is: * O $200,000 O $270,000 O $30,000 $5,000 O None of the above Total capital balance of the company on December 31, 2021 is: " $270,000 $252,000 $210,000 $207,000 None of the above On January 1, 2021, Sandy, Chris and Paul formed SCP Company with a total beginning capital balance of $210,000; Sandy had a beginning capital balance of $100,000 and Chris of $70,000. During 2021, Sandy and Paul made additional investments of $20,000 and $10,000 respectively. In addition, Sandy's drawings were $5,000, Chris's drawings were $3,000 and Paul's drawings were $10,000. The three partners in SCP Company share profits and losses equally and during 2021, the company had a net income of $30,000. Paul's capital balance on December 31, 2021 is: * O $60,000 $10,000 $50,000 $40,000 None of the above The portion of net income distributed to each partner is: * O $200,000 O $270,000 O $30,000 $5,000 O None of the above Total capital balance of the company on December 31, 2021 is: " $270,000 $252,000 $210,000 $207,000 None of the above

Expert Answer:

Answer rating: 100% (QA)

Question Step 1 Partnership A formal agreement between two or more parties is made in this sort of commercial entity The coownership of the firm and r... View the full answer

Related Book For

Financial Accounting

ISBN: 978-1259914898

5th edition

Authors: David Spiceland, Wayne M. Thomas, Don Herrmann

Posted Date:

Students also viewed these management leadership questions

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

There are three main streams for Porters generic strategies that are used by multinational firms like Frito-Lay Inc Grandma s to achieve the growth objectives. Cost leadership: Cost leadership...

-

Founded by Jeff Bezos, online giant Amazon.com, Inc. (Amazon), was incorporated in the state of Washington in July, 1994, and sold its first book in July, 1995. In May 1997, Amazon (AMZN) completed...

-

We often speak of how price rations goods. What are other rationing measures in clinics in which free care is provided?

-

The two pulleys shown may be operated with the V belt in any of three positions. If the angular acceleration of shaft A is 6 rad/s2 and if the system is initially at rest, determine the time required...

-

Understanding Option Quote s Use the option quote information shown here to answer the questions that follow. The stock is currently selling for $83. Option and NY Close Expiration Strike Price Calls...

-

Guilt in decision making. The effect of guilt emotion on how a decision maker focuses on a problem was investigated in the Jan. 2007 issue of the Journal of Behavioral Decision Making (see Exercise...

-

UrLink Company is a newly formed company specializing in high-speed Internet service for home and business. The owner, Lenny Kirkland, had divided the company into two segments: Home Internet Service...

-

4. Your client, Albert Almora Leasing Company, is preparing a contract to lease a machine to Souvenirs Corporation for a period of 25 years. Almora has an investment cost of $365,755 in the machine,...

-

Use Venn diagrams to evaluate the immediate inferences in Part II of this exercise. Identify any that commit the existential fallacy. In part 1. No sculptures by Rodin are boring creations....

-

Your company is assembling product X. It is composed of two subassemblies: one B and two E. B is composed of one component C and two subassemblies D. In addition, E is composed of one of component C...

-

Is there a difference between a Leader and a Manager; if yes, what and what are the differences? What is the message of the video ? https://youtu.be/TQhns5AwAkA

-

Thomas Inc. purchased 90% of Tracy Co. for $990,000 when the book value of Tracy was $1,000,000. There was no premium paid by Thomas. Tracy currently has 100,000 shares outstanding and a book value...

-

Troy Engines, Ltd., manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors. An...

-

A Community Hospital has two (2) service departments: Maintenance and Food Services. The hospital has three (3) patient care units, namely: General Medicine, OB, and Surgery. Additional information...

-

The following link is for the United States International Trade Commission database on current tariffs that the United States has in place: https://dataweb.usitc.gov/tariff/database This link is for...

-

Please Answer the following parts to the question On January 1, 2021, Tropical Paradise borrows $43,000 by agreeing to a 6%, five-year note with the bank. The funds will be used to purchase a new BMW...

-

In your readings, there were many examples given for nurturing close family relationships in this ever-evolving technological society we live in Based upon your readings and research describe three...

-

Computer Wholesalers restores and resells notebook computers. It originally acquires the notebook computers from corporations upgrading their computer systems, and it backs each notebook it sells...

-

Assume that Little King Sandwiches uses straight-line depreciation and University Hero uses double-declining-balance depreciation. Explain the difficulties in comparing the income statements and...

-

Selected financial data for DC Menswear is provided as follows: ($ in millions) Sales ................................................................................... $ 14,549 Net income...

-

Whales entangled in fishing gear. Refer to the Marine Mammal Science (April 2010) investigation of whales entangled by fishing gear, Exercise 10.32 (p. 552). The mean body lengths (meters) of whales...

-

Consider a completely randomized design with five treatments: A, B, C, D, and E. The ANOVA F-test revealed LO4 significant differences among the means. A multiplecomparison procedure was used to...

-

Animal-assisted therapy for heart patients. Refer to the American Heart Association Conference (Nov. 2005) study to gauge whether animal-assisted therapy can improve the physiological responses of...

Study smarter with the SolutionInn App