Question: whats the answer to these three questions please ? Which of the following is a reason for a high-dividend-payout policy? Cash payments today are preferred

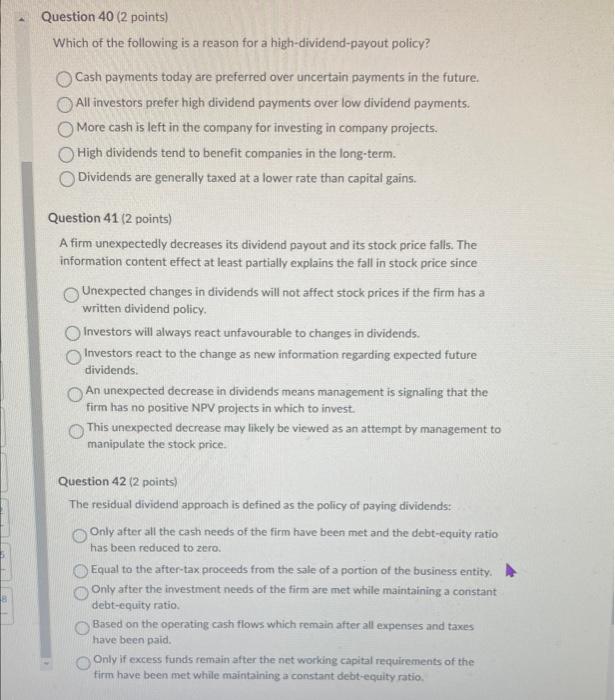

Which of the following is a reason for a high-dividend-payout policy? Cash payments today are preferred over uncertain payments in the future. All investors prefer high dividend payments over low dividend payments. More cash is left in the company for investing in company projects. High dividends tend to benefit companies in the long-term. Dividends are generally taxed at a lower rate than capital gains. Question 41 ( 2 points) A firm unexpectedly decreases its dividend payout and its stock price falls. The information content effect at least partially explains the fall in stock price since Unexpected changes in dividends will not affect stock prices if the firm has a written dividend policy. Investors will always react unfavourable to changes in dividends. Investors react to the change as new information regarding expected future dividends. An unexpected decrease in dividends means management is signaling that the firm has no positive NPV projects in which to invest. This unexpected decrease may likely be viewed as an attempt by management to manipulate the stock price. Question 42 ( 2 points) The residual dividend approach is defined as the policy of paying dividends: Only after all the cash needs of the firm have been met and the debt-equity ratio has been reduced to zero. Equal to the after-tax proceeds from the sale of a portion of the business entity. Only after the investment needs of the firm are met while maintaining a constant debt-equity ratio. Based on the operating cash flows which remain after all expenses and taxes have been paid. Only if excess funds remain after the net working capital requirements of the firm have been met while maintaining a constant debt-equity ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts