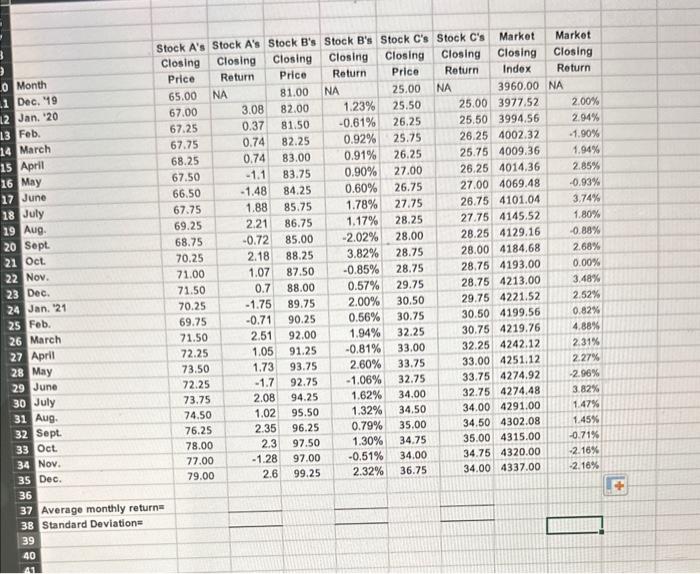

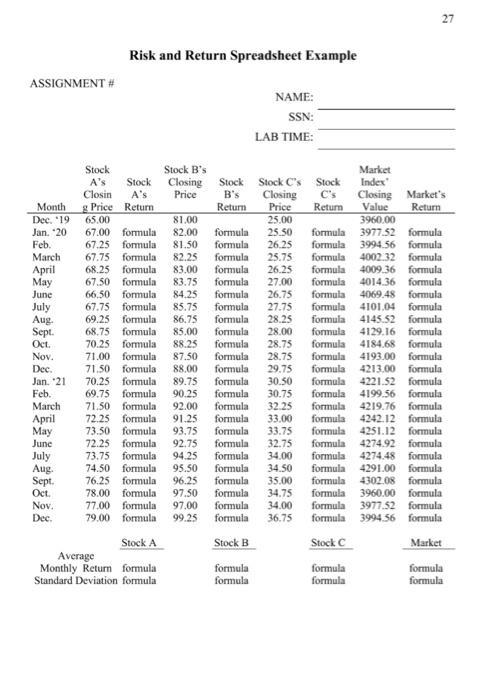

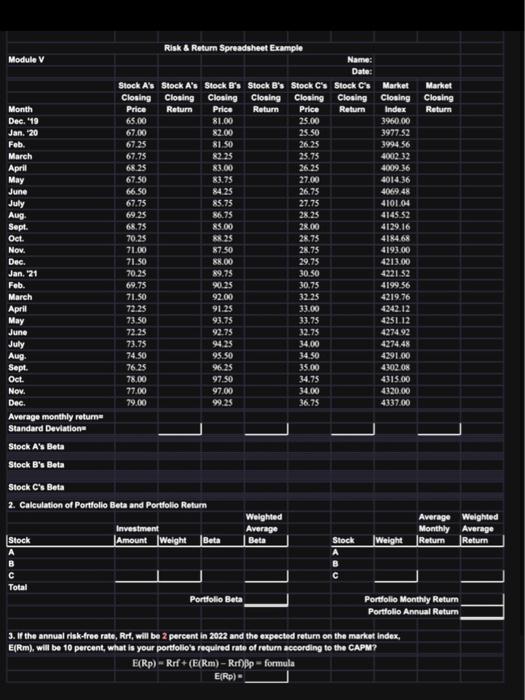

Question: whats the average monthly return and standard deviation? also what is Stock A, B and C's Beta? lastly what are the calculations for the portfolio

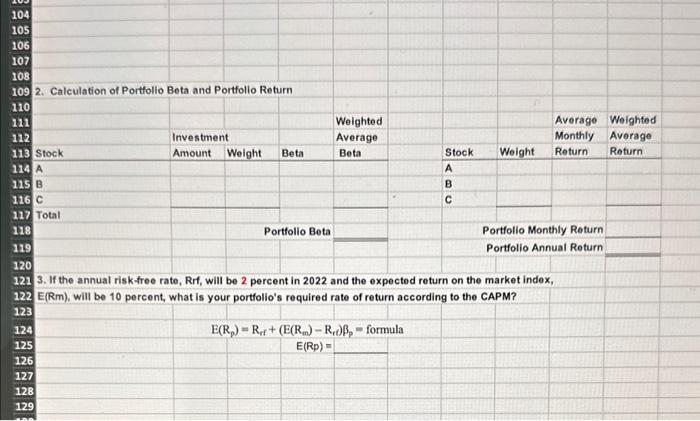

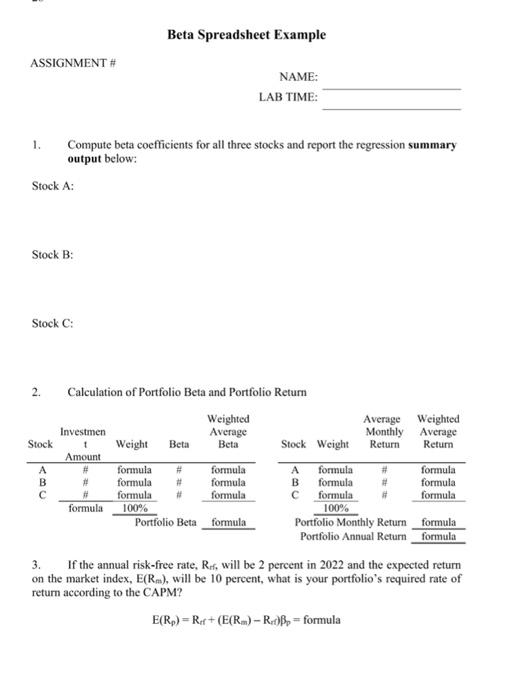

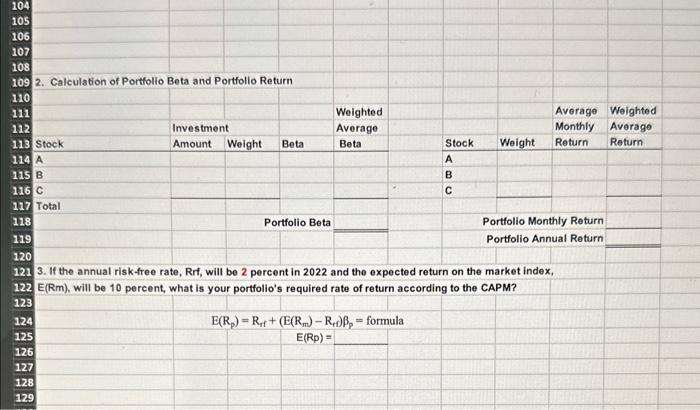

\begin{tabular}{|l|l|} \hline 40 & \\ \hline 41 & \\ \hline 42 & Stock A's Beta \\ \hline \end{tabular} 43 44 46 47 48 50 51 52 53 54 56 57 58 59 60 61 62 63 64 Stock B's Beta 65 66 67 68 69 70 71 72 73 74 75 2. Calculation of Portfolio Beta and Portfolio Return 3. If the annual risk free rate, Rrf, will be 2 percent in 2022 and the expected return on the market index, E(Rm), will be 10 percent, what is your portfolio's required rate of return according to the CAPM? E(Rp)=Rrf+(E(Rm)Rr)p=formula 1. Compute beta coefficients for all three stocks and report the regression summary output below: Stock A: Stock B: Stock C: 2. Calculation of Portfolio Beta and Portfolio Return on the market index, E(Rm), will be 10 percent, what is your portfolio's required rate of return according to the CAPM? E(Rp)=Rtf+(E(Rm)Rr)p=formula 27 Risk and Return Spreadsheet Example ASSIGNMENT \# NAME: SSN: LAB TIME: a Amelailadan at Dartallia Rata and Dartinlia Dathirn E(Rm), will be 10 percent, what is your portfolio's required rate of return according to the CAPM? E(Rp)=Rrf+(E(Rm)Rti)p=formula \begin{tabular}{|l|l|} \hline 40 & \\ \hline 41 & \\ \hline 42 & Stock A's Beta \\ \hline \end{tabular} 43 44 46 47 48 50 51 52 53 54 56 57 58 59 60 61 62 63 64 Stock B's Beta 65 66 67 68 69 70 71 72 73 74 75 2. Calculation of Portfolio Beta and Portfolio Return 3. If the annual risk free rate, Rrf, will be 2 percent in 2022 and the expected return on the market index, E(Rm), will be 10 percent, what is your portfolio's required rate of return according to the CAPM? E(Rp)=Rrf+(E(Rm)Rr)p=formula 1. Compute beta coefficients for all three stocks and report the regression summary output below: Stock A: Stock B: Stock C: 2. Calculation of Portfolio Beta and Portfolio Return on the market index, E(Rm), will be 10 percent, what is your portfolio's required rate of return according to the CAPM? E(Rp)=Rtf+(E(Rm)Rr)p=formula 27 Risk and Return Spreadsheet Example ASSIGNMENT \# NAME: SSN: LAB TIME: a Amelailadan at Dartallia Rata and Dartinlia Dathirn E(Rm), will be 10 percent, what is your portfolio's required rate of return according to the CAPM? E(Rp)=Rrf+(E(Rm)Rti)p=formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts