Question: What's the solution to this problem? Question 42 (4 marks) Huskie Industries, a U.S.-based MNC, considers purchasing a small manufacturing company in France that sells

What's the solution to this problem?

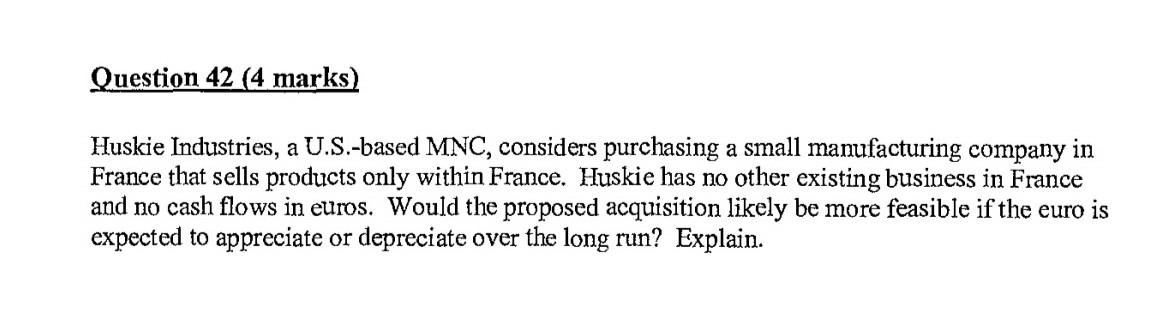

Question 42 (4 marks) Huskie Industries, a U.S.-based MNC, considers purchasing a small manufacturing company in France that sells products only within France. Huskie has no other existing business in France and no cash flows in euros. Would the proposed acquisition likely be more feasible if the euro is expected to appreciate or depreciate over the long run? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts