Question: What's your next question? Linear programming models are used by many Wall Street firms to select a desirable bond portfolio. The following is a simplified

What's your next question?

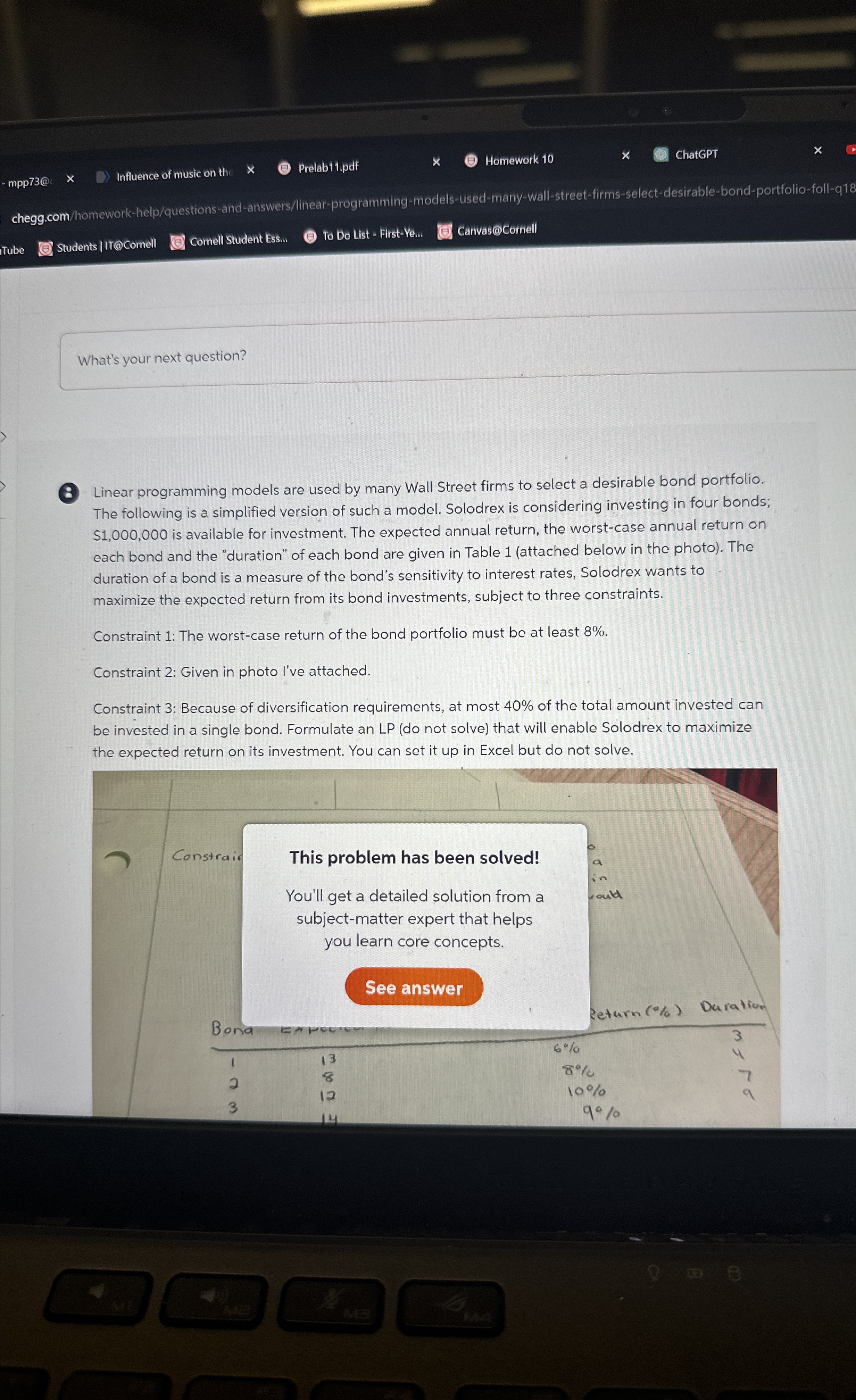

Linear programming models are used by many Wall Street firms to select a desirable bond portfolio. The following is a simplified version of such a model. Solodrex is considering investing in four bonds; $ is available for investment. The expected annual return, the worstcase annual return on each bond and the "duration" of each bond are given in Table attached below in the photo The duration of a bond is a measure of the bond's sensitivity to interest rates. Solodrex wants to maximize the expected return from its bond investments, subject to three constraints.

Constraint : The worstcase return of the bond portfolio must be at least

Constraint : Given in photo I've attached.

Constraint : Because of diversification requirements, at most of the total amount invested can be invested in a single bond. Formulate an LP do not solve that will enable Solodrex to maximize the expected return on its investment. You can set it up in Excel but do not solve.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock