Question: When a company is issuing bonds, it usually cannot issue them exactly at face (par) value because the coupon rate and the yield demanded by

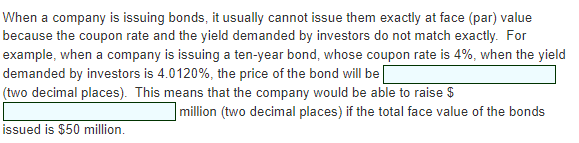

When a company is issuing bonds, it usually cannot issue them exactly at face (par) value because the coupon rate and the yield demanded by investors do not match exactly. For example, when a company is issuing a ten-year bond, whose coupon rate is 4%, when the yield demanded by investors is 4.0120%, the price of the bond will be (two decimal places). This means that the company would be able to raise $ |million (two decimal places) if the total face value of the bonds issued is $50 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts