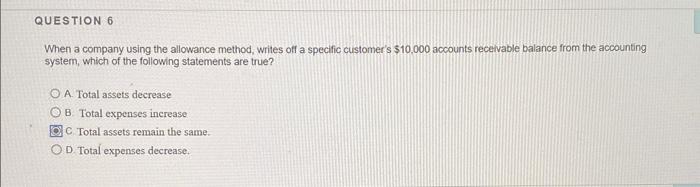

Question: When a company using the allowance method, writes off a specific customer's $10,000 accounts receivable balance from the accounting system, which of the following statements

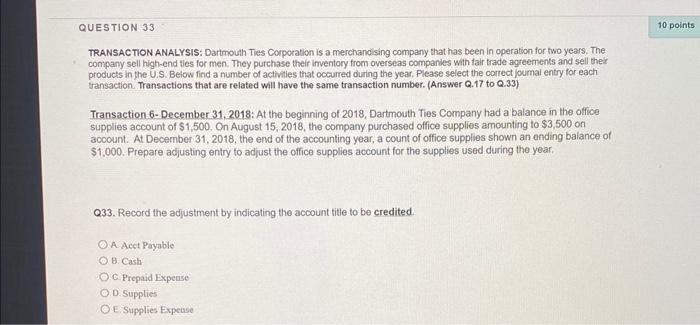

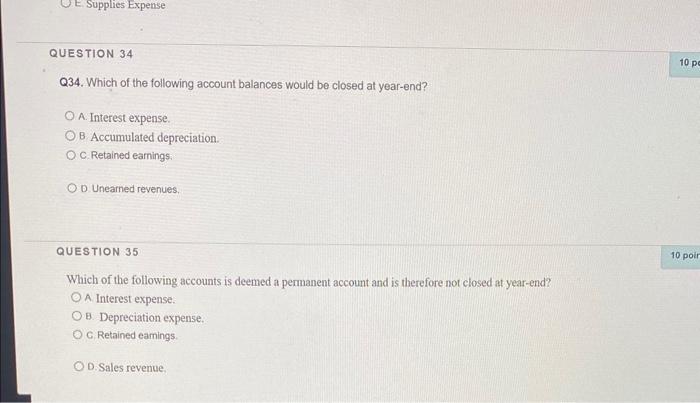

When a company using the allowance method, writes off a specific customer's $10,000 accounts receivable balance from the accounting system, which of the following statements are true? A. Total assets decrease B. Total expenses increase C. Total assets remain the same. D. Total expenses decrease. TRANSACTION ANALYSIS: Dartmouth Ties Corporation is a merchandising company that has been in operation for two years. The company sell high-end ties for men. They purchase their inventory from overseas companies with fair trade agreements and sell their products in the U.S. Below find a number of activities that occurred during the year, Please select the correct joumal entry for each tansaction. Transactions that are related will have the same transaction number. (Answer Q.17 to Q.33) Transaction 6- December 31, 2018: At the beginning of 2018, Dartmouth Ties Company had a balance in the office supplies account of $1,500. On August 15,2018 , the company purchased office supplies amounting to $3,500 on account. At December 31, 2018, the end of the accounting year, a count of office supplies shown an ending balance of $1.000. Prepare adjusting entry to adjust the office supplies account for the supplies used during the year. Q33. Record the adjustment by indicating the account title to be credited. A. Acet Payable B. Cash C. Frepaid Expense D. Supplies E. Supplies Expeuse Q34. Which of the following account balances would be closed at year-end? A. Interest expense. B Accumulated depreciation. C. Retained earnings: D. Unearned revenues. QUESTION 35 Which of the following accounts is deemed a permanent account and is therefore not closed at year-end? A. Interest expense: B. Depreciation expense. c. Retained eamings. D. Sales revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts