When a company's bookkeeper started to prepare the monthly bank reconciliation, the cash account showed a...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

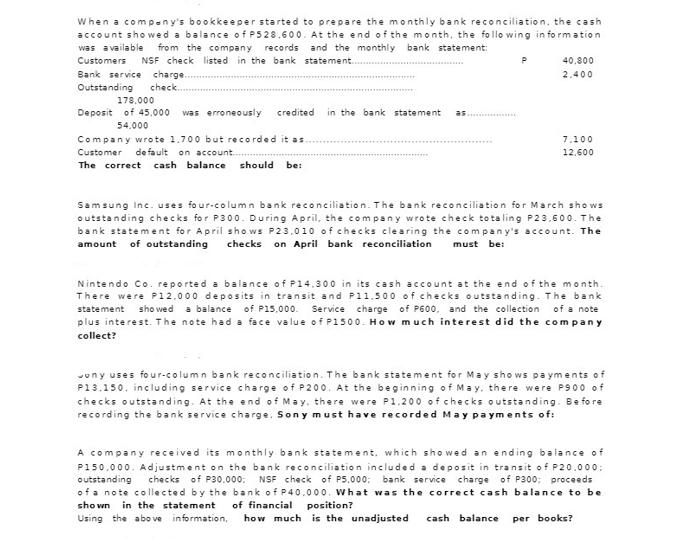

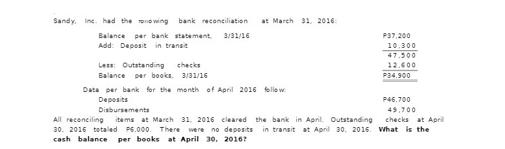

When a company's bookkeeper started to prepare the monthly bank reconciliation, the cash account showed a balance of P528.600. At the end of the month, the following information was available from the company records and the monthly bank statement: Customers NSF check listed in the bank statement... Bank service charge. Outstanding check... 178.000 Deposit of 45.000 was erroneously credited in the bank statement as 54.000 Company wrote 1.700 but recorded it as. Customer default on account. The correct cash balance should be: P 40.800 2.400 7.100 12,600 Samsung Inc. uses four-column bank reconciliation. The bank reconciliation for March shows outstanding checks for P300. During April, the company wrote check totaling P23,600. The bank statement for April shows P23.010 of checks clearing the company's account. The amount of outstanding checks on April bank reconciliation must be: Nintendo Co. reported a balance of P14.300 in its cash account at the end of the month. There were P12.000 deposits in transit and P11.500 of checks outstanding. The bank statement showed a balance of P15,000. Service charge of P600, and the collection of a note plus interest. The note had a face value of P1500. How much interest did the company collect? Jony uses four-column bank reconciliation. The bank statement for May shows payments of P13.150, including service charge of P200. At the beginning of May, there were P900 of checks outstanding. At the end of May, there were P1.200 of checks outstanding. Before recording the bank service charge. Sony must have recorded May payments of: A company received its monthly bank statement, which showed an ending balance of P150.000. Adjustment on the bank reconciliation included a deposit in transit of P20.000; outstanding checks of P30.000: NSF check of P5,000: bank service charge of P300; proceeds of a note collected by the bank of P40.000. What was the correct cash balance to be. shown in the statement of financial position? Using the above information, how much is the unadjusted cash balance per books? Sandy, Inc. had the owing bank reconciliation Balance per bank statement 3/31/16 Add: Deposit in transit Less: Outstanding checks Balance per books. 3/31/16 at March 31, 2016: Data per bank for the month of April 2016 follow Deposits Disbursements All reconciling items at March 31, 2016 cleared the bank in April. Outstanding 30. 2016 totaled P6.000. There were no deposits in transit at April 30, 2016. cash balance per books at April 30, 2016? P37,200 10.300 47.500 12.600 P34.900 P46.700 49.700 checks at Apri What is the When a company's bookkeeper started to prepare the monthly bank reconciliation, the cash account showed a balance of P528.600. At the end of the month, the following information was available from the company records and the monthly bank statement: Customers NSF check listed in the bank statement... Bank service charge. Outstanding check... 178.000 Deposit of 45.000 was erroneously credited in the bank statement as 54.000 Company wrote 1.700 but recorded it as. Customer default on account. The correct cash balance should be: P 40.800 2.400 7.100 12,600 Samsung Inc. uses four-column bank reconciliation. The bank reconciliation for March shows outstanding checks for P300. During April, the company wrote check totaling P23,600. The bank statement for April shows P23.010 of checks clearing the company's account. The amount of outstanding checks on April bank reconciliation must be: Nintendo Co. reported a balance of P14.300 in its cash account at the end of the month. There were P12.000 deposits in transit and P11.500 of checks outstanding. The bank statement showed a balance of P15,000. Service charge of P600, and the collection of a note plus interest. The note had a face value of P1500. How much interest did the company collect? Jony uses four-column bank reconciliation. The bank statement for May shows payments of P13.150, including service charge of P200. At the beginning of May, there were P900 of checks outstanding. At the end of May, there were P1.200 of checks outstanding. Before recording the bank service charge. Sony must have recorded May payments of: A company received its monthly bank statement, which showed an ending balance of P150.000. Adjustment on the bank reconciliation included a deposit in transit of P20.000; outstanding checks of P30.000: NSF check of P5,000: bank service charge of P300; proceeds of a note collected by the bank of P40.000. What was the correct cash balance to be. shown in the statement of financial position? Using the above information, how much is the unadjusted cash balance per books? Sandy, Inc. had the owing bank reconciliation Balance per bank statement 3/31/16 Add: Deposit in transit Less: Outstanding checks Balance per books. 3/31/16 at March 31, 2016: Data per bank for the month of April 2016 follow Deposits Disbursements All reconciling items at March 31, 2016 cleared the bank in April. Outstanding 30. 2016 totaled P6.000. There were no deposits in transit at April 30, 2016. cash balance per books at April 30, 2016? P37,200 10.300 47.500 12.600 P34.900 P46.700 49.700 checks at Apri What is the

Expert Answer:

Answer rating: 100% (QA)

Lets calculate the correct cash balance for each of the given scenarios Company with Errors in Bank Reconciliation Initial Cash Account Balance P52860... View the full answer

Related Book For

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley

Posted Date:

Students also viewed these accounting questions

-

a ) How is data analytics used in the accounting profession? b ) Can data analytics enhance financial reporting quality and, if so , how? c ) Identify the skills required of a data analyst in the...

-

The following information was available to reconcile Montrose Company's book balance of Cash with its bank statement balance as of October 31, 2014: a. After all posting was completed on October 31,...

-

The following information was available to reconcile Frog box Moving's book Cash balance with its bank statement balance as of December 31, 2014: a. The December 31 Cash balance according to the...

-

1. Green logistics advocates a type of SCM that minimizes the environmental impacts including climate change, air pollution, water pollution, soil degradation, solid waste, noise, vibration, and...

-

In the network in figure Io using super position 6 kn 6 kn 12 v(+ 12 V 6 mA 36kn 6 kn

-

(a) Write structural formulas and provide IUPAC names for all the isomeric aldehydes and ketones that have the molecular formula C5H10O. Include stereoisomers. (b) Which of the isomers in part (a)...

-

Is the collision in Example 10.7 elastic? Data from Example 10.7 Pucks 1 and 2 slide on ice and collide. The inertia of puck 2 is twice that of puck 1 . Puck 1 initially moves at \(1.8 \mathrm{~m} /...

-

A citys road maintenance department received donations of two types of assets: 1. From the county in which the city is located it received earthmoving equipment. The equipment had cost the county...

-

15. If y = 3x-4x+2 then slope at x = 1 is: (1) 1 (2) 2 (3) 4 (4) -2 16. sin240 = ? (1) - 2 (3) 3 1/2 17. Value of sin 2 is (4) (2) 12 (1) 23 (2) (3) 90 180 (4) 0 18. The rate of mass of the gas...

-

Examine the Apartment worksheet, and apply appropriate names to cells D17:D20. 2. Set up the structure of a one-variable data table on the Analysis worksheet that shows the apartment rental price,...

-

Complete the journal entries from 9/30/X2 to 6/30/X3 Fair value Fair value Cash Interest Interest Debt Swap out (in) paid Expense 6.41% 7/1/20X1 1,000,000 0 6.48% 9/30/20X1 998,851 (1,149) 0 16,025...

-

Instruction: This case study requires you to make a report on Virtual Machine Software. You may choose VMWare, Oracle VM VirtualBox or any other alternative. Tasks: List Australian government and...

-

The following table presents four variables that may be used to estimate Value of an Office Building. Floor space in square feet Number of offices Number of entrances Age of the office bu 215 2 2 20...

-

Prepare a multiple-step income statement. (Round answers to O decimal places, e.g. 15,222.) The Clorox Company Income Statement For the Year Ended June 30, 2025 (amounts in millions) Sales Sales...

-

In the seven circuits shown below there are two sets of three identical circuits and one "oddball". Identify the "oddball" and state which of the remaining circuits are electrically equivalent to...

-

Youve decided you want to get your MBA, which will cost you $15,000. If you have $10,000 now and can make 7.5% on your money, how soon can you attend classes? Youve just been hired on your first job!...

-

5. The ancient Egyptian numeration system represented numbers with hieroglyphic symbols. 1 is represented by I; 10 is represented by n; 100 is represented by, 1000 is represented by 10000 is...

-

In Exercises 1558, find each product. (9 - 5x) 2

-

The following information pertains to two competitors, Mostly Inc. and Hardly Ltd. Mostly Inc. reported sales revenues of $1,310,000 and Hardly Ltd. reported sales revenues of $2,890,000. Required a....

-

Ferguson Theatres Inc. operates specialty film format theatres that display images of greater size and higher quality resolution. Ferguson is considering expanding its theatres in China and needs to...

-

If your instructor has assigned the Appendix to this chapter, redo Problem AP7-6B assuming that the company uses a periodic inventory system. Round weighted-average per unit cost to two decimal...

-

Powerhouse Ltd purchased machinery on 2 January 2019, at a cost of $800 000. The machinery is depreciated using the straightline method over a useful life of 8 years with a residual value of $80 000....

-

The purchases and sales of Big Flower Pty Ltd of one brand of lawn fertiliser for the year ended 31 December 2019 are contained in the schedule below. The selling price up to 30 June was $12 per unit...

-

In groups of four or five, consider the following information. On 1 July 2019, Stevenson Pty Ltd, a proprietary company with three shareholders, acquired some property by issuing 100 000 shares to...

Study smarter with the SolutionInn App