Question: When a firm issues preferred stock to raise capital instead of common stock or debt, what is one key advantage and one key disadvantage of

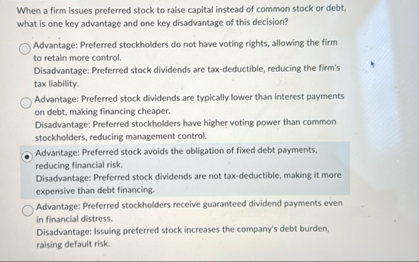

When a firm issues preferred stock to raise capital instead of common stock or debt, what is one key advantage and one key disadvantage of this decision?

Advantage: Preferred stockholders do not have voting rights, allowing the firm to retain more control.

Disadvantage: Preferred stock dividends are taxdeductible, reducing the firm's tax liability.

Advantage: Preferred stock dividends are typically lower than interest payments on debt, making financing cheaper.

Disadvantage: Preferred stockholders have higher voting power than common stockholders, reducing management control.

Advantage: Preferred stock avoids the obligation of fixed debt payments, reducing financial risk.

Disadvantage: Preferred stock dividends are not taxdeductible, making it more expensive than debt financing.

Advantage: Preferred stockholders receive guaranteed dividend payments even in financial distress.

Disadvantage: Issuing preferred stock increases the company's debt burden, raising default risk.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock