Question: When a swap is initially structured, the dealer uses a series of forward rates to predict future floating rates, and then calculates the fixed rate

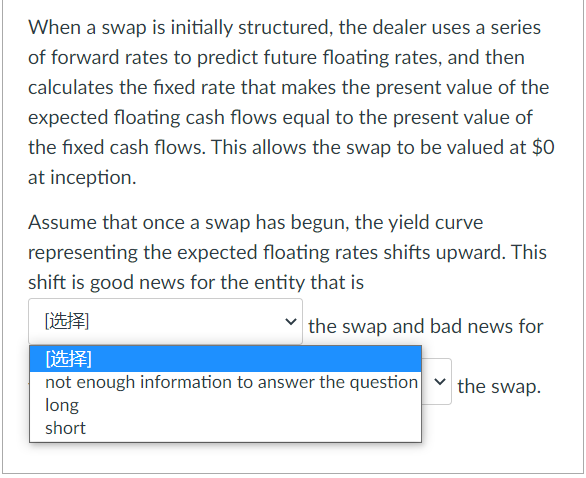

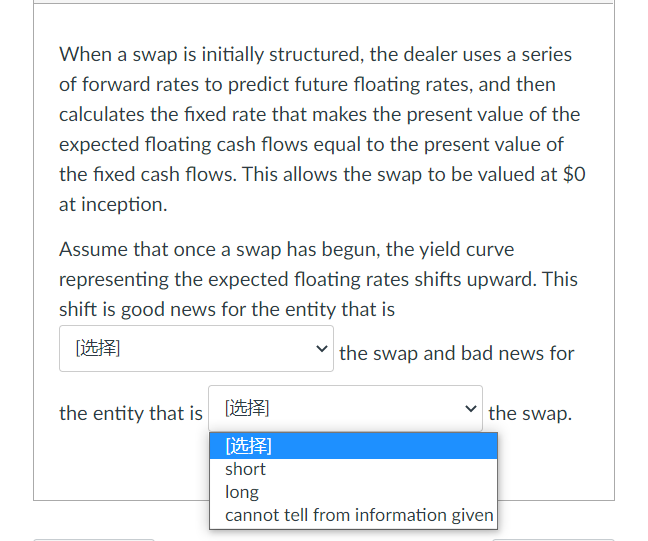

When a swap is initially structured, the dealer uses a series of forward rates to predict future floating rates, and then calculates the fixed rate that makes the present value of the expected floating cash flows equal to the present value of the fixed cash flows. This allows the swap to be valued at $0 at inception. Assume that once a swap has begun, the yield curve representing the expected floating rates shifts upward. This shift is good news for the entity that is [it] the swap and bad news for [ty] not enough information to answer the question the swap. long short When a swap is initially structured, the dealer uses a series of forward rates to predict future floating rates, and then calculates the fixed rate that makes the present value of the expected floating cash flows equal to the present value of the fixed cash flows. This allows the swap to be valued at $0 at inception. Assume that once a swap has begun, the yield curve representing the expected floating rates shifts upward. This shift is good news for the entity that is the swap and bad news for the entity that is list] the swap. [ short long cannot tell from information given

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts