Question: When a tax is levied on a good, there is a decrease in the quantity of the good bought and sold in the market.

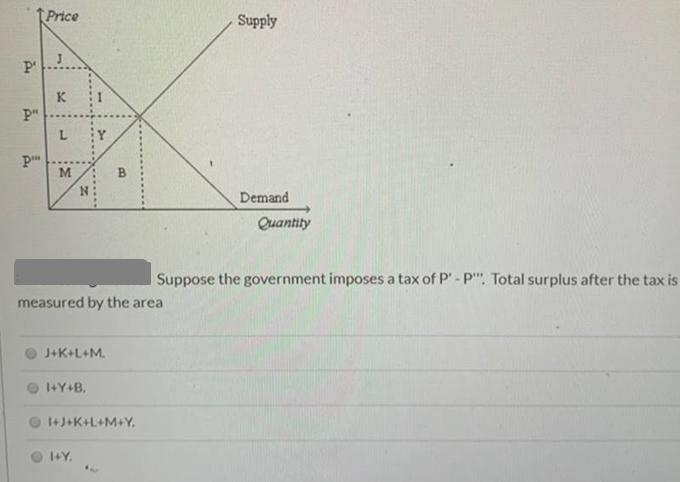

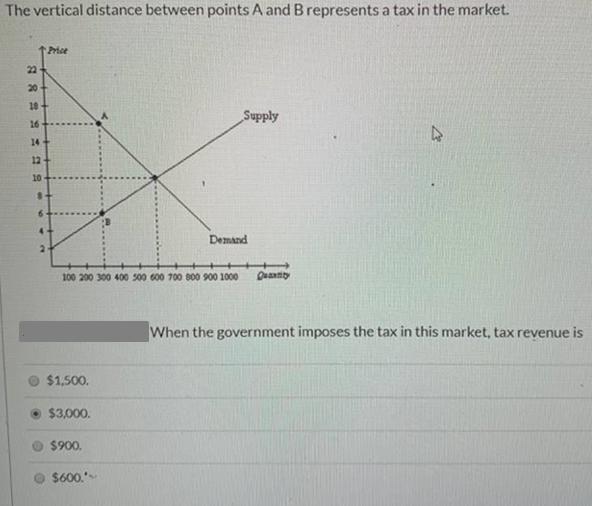

When a tax is levied on a good, there is a decrease in the quantity of the good bought and sold in the market. the price that sellers receive exceeds the price that buyers pay. All of the above are correct. government revenues exceed the loss in total welfare. 1Price Supply P' K. P" L. Y M B Demand Quantity Suppose the government imposes a tax of P' - P" Total surplus after the tax is measured by the area J+K+L+M. 1+Y+B. +J+K+L+M+Y, 1+Y. The vertical distance between points A and Brepresents a tax in the market. 22 20 Supply 16 14+ 12 10 Demand 100 200 300 400 500 600 700 800 900 1000 Duannity When the government imposes the tax in this market, tax revenue is $1,500. $3,000. $900. $600. When a tax is levied on a good, there is a decrease in the quantity of the good bought and sold in the market. the price that sellers receive exceeds the price that buyers pay. All of the above are correct. government revenues exceed the loss in total welfare. 1Price Supply P' K. P" L. Y M B Demand Quantity Suppose the government imposes a tax of P' - P" Total surplus after the tax is measured by the area J+K+L+M. 1+Y+B. +J+K+L+M+Y, 1+Y. The vertical distance between points A and Brepresents a tax in the market. 22 20 Supply 16 14+ 12 10 Demand 100 200 300 400 500 600 700 800 900 1000 Duannity When the government imposes the tax in this market, tax revenue is $1,500. $3,000. $900. $600. When a tax is levied on a good, there is a decrease in the quantity of the good bought and sold in the market. the price that sellers receive exceeds the price that buyers pay. All of the above are correct. government revenues exceed the loss in total welfare. 1Price Supply P' K. P" L. Y M B Demand Quantity Suppose the government imposes a tax of P' - P" Total surplus after the tax is measured by the area J+K+L+M. 1+Y+B. +J+K+L+M+Y, 1+Y. The vertical distance between points A and Brepresents a tax in the market. 22 20 Supply 16 14+ 12 10 Demand 100 200 300 400 500 600 700 800 900 1000 Duannity When the government imposes the tax in this market, tax revenue is $1,500. $3,000. $900. $600. When a tax is levied on a good, there is a decrease in the quantity of the good bought and sold in the market. the price that sellers receive exceeds the price that buyers pay. All of the above are correct. government revenues exceed the loss in total welfare. 1Price Supply P' K. P" L. Y M B Demand Quantity Suppose the government imposes a tax of P' - P" Total surplus after the tax is measured by the area J+K+L+M. 1+Y+B. +J+K+L+M+Y, 1+Y. The vertical distance between points A and Brepresents a tax in the market. 22 20 Supply 16 14+ 12 10 Demand 100 200 300 400 500 600 700 800 900 1000 Duannity When the government imposes the tax in this market, tax revenue is $1,500. $3,000. $900. $600. When a tax is levied on a good, there is a decrease in the quantity of the good bought and sold in the market. the price that sellers receive exceeds the price that buyers pay. All of the above are correct. government revenues exceed the loss in total welfare. 1Price Supply P' K. P" L. Y M B Demand Quantity Suppose the government imposes a tax of P' - P" Total surplus after the tax is measured by the area J+K+L+M. 1+Y+B. +J+K+L+M+Y, 1+Y. The vertical distance between points A and Brepresents a tax in the market. 22 20 Supply 16 14+ 12 10 Demand 100 200 300 400 500 600 700 800 900 1000 Duannity When the government imposes the tax in this market, tax revenue is $1,500. $3,000. $900. $600.

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

1 ANS As per the given situation that is the tax is being imposed on go... View full answer

Get step-by-step solutions from verified subject matter experts