Question: When an individual taxpayer sells a Section 1 2 5 0 asset at a gain, how much of the gain will be taxed as ordinary

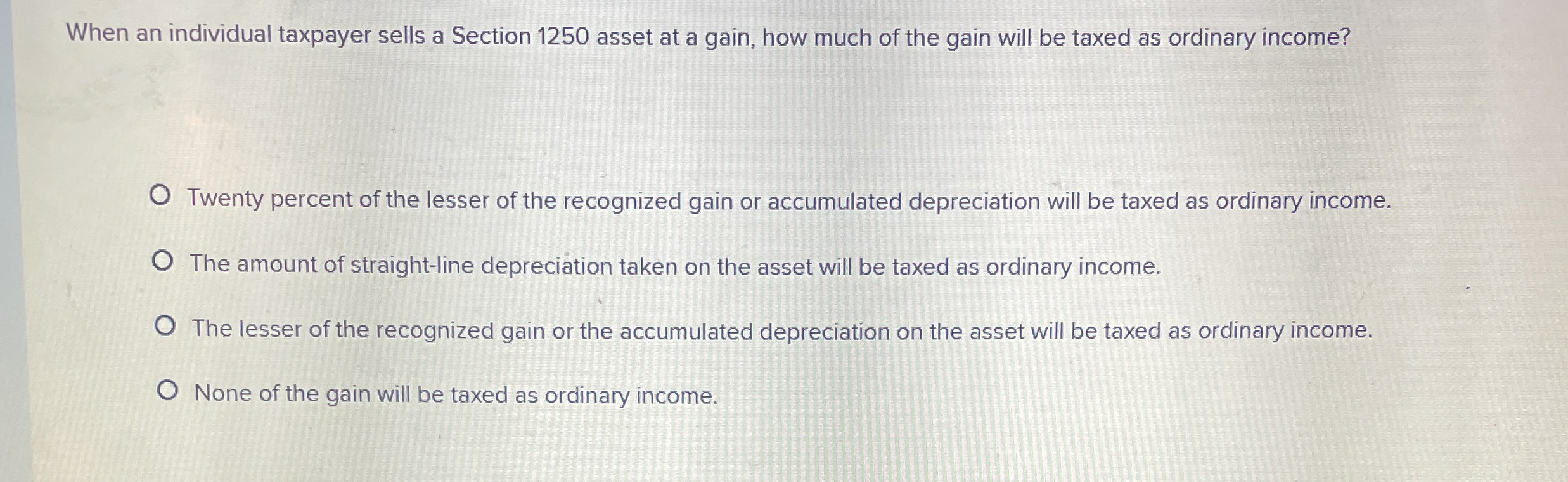

When an individual taxpayer sells a Section asset at a gain, how much of the gain will be taxed as ordinary income?

Twenty percent of the lesser of the recognized gain or accumulated depreciation will be taxed as ordinary income.

The amount of straightline depreciation taken on the asset will be taxed as ordinary income.

The lesser of the recognized gain or the accumulated depreciation on the asset will be taxed as ordinary income.

None of the gain will be taxed as ordinary income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock