Question: When answering the questions being asked, please be sure that you focus on interpreting the information, as that is the real assignment here. Don't just

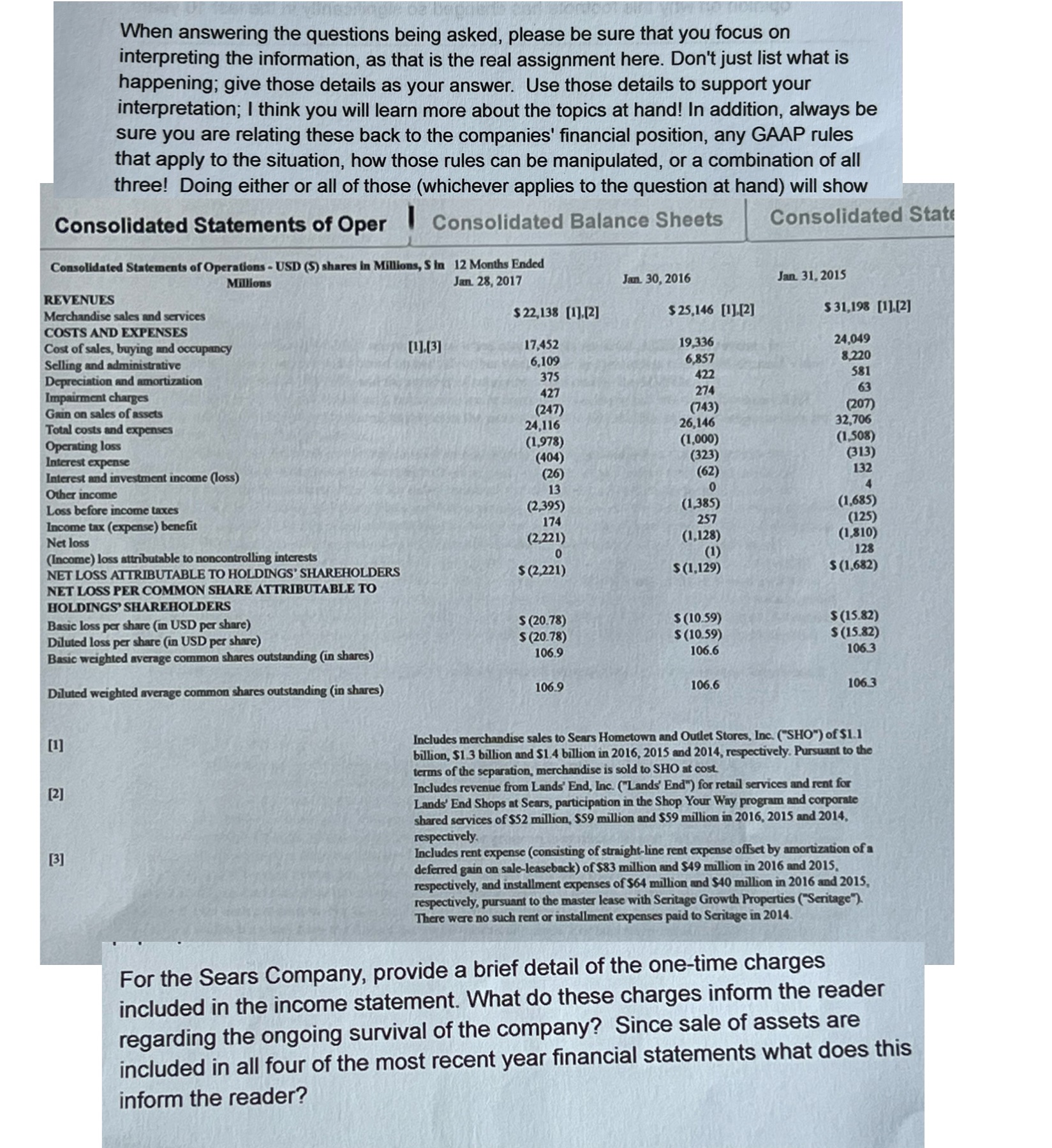

When answering the questions being asked, please be sure that you focus on interpreting the information, as that is the real assignment here. Don't just list what is happening; give those details as your answer. Use those details to support your interpretation; I think you will learn more about the topics at hand! In addition, always be sure you are relating these back to the companies' financial position, any GAAP rules that apply to the situation, how those rules can be manipulated, or a combination of all three! Doing either or all of those (whichever applies to the question at hand) will show Consolidated Statements of Oper | Consolidated Balance Sheets Consolidated State Consolidated Statements of Operations - USD (S) shares in Millions, S In 12 Months Ended Millions Jan. 28, 2017 Jan. 30, 2016 Jan. 31, 2015 REVENUES Merchandise sales and services $ 22,138 [1].[2] $ 25,146 [1].[2] $ 31,198 [1].[2] COSTS AND EXPENSES Cost of sales, buying and occupand [1],[3] 17,452 19,336 24,049 Selling and administrative 6,109 6,857 8,220 Depreciation and amortization 375 422 581 Impairment charges 427 274 63 Gain on sales of assets (247) (743) (207) Total costs and expenses 24,116 26,146 32,706 Operating loss (1,978) (1,000) (1,508) Interest expense (404) (323) (313) Interest and investment income (loss) (26) (62) 132 Other income 13 0 Loss before income taxes (2,395) (1,385) (1,685) Income tax (expense) benefit 174 257 (125) Net loss (2,221) (1,128) (1,810) (Income) loss attributable to noncontrolling interests 0 (1) 128 NET LOSS ATTRIBUTABLE TO HOLDINGS' SHAREHOLDERS $ (2,221) $ (1,129) $ (1,682) NET LOSS PER COMMON SHARE ATTRIBUTABLE TO HOLDINGS' SHAREHOLDERS Basic loss per share (in USD per share) $ (20.78) $ (10.59) $ (15.82) Diluted loss per share (in USD per share) $ (20.78) $ (10.59) $ (15.82) Basic weighted average common shares outstanding (in shares) 106.9 106.6 106.3 Diluted weighted average common shares outstanding (in shares) 106.9 106.6 106.3 [1] Includes merchandise sales to Sears Hometown and Outlet Stores, Inc. ("SHO") of $1.1 billion, $1.3 billion and $1.4 billion in 2016, 2015 and 2014, respectively. Pursuant to the terms of the separation, merchandise is sold to SHO at cost. [2] Includes revenue from Lands' End, Inc. ("Lands' End") for retail services and rent for Lands' End Shops at Sears, participation in the Shop Your Way program and corporate shared services of $52 million, $59 million and $59 million in 2016, 2015 and 2014, respectively. [3] Includes rent expense (consisting of straight-line rent expense offset by amortization of a deferred gain on sale-leaseback) of $83 million and $49 million in 2016 and 2015. respectively, and installment expenses of $64 million and $40 million in 2016 and 2015, espectively, pursuant to the master lease with Seritage Growth Properties ("Seritage"). There were no such rent or installment expenses paid to Seritage in 2014. For the Sears Company, provide a brief detail of the one-time charges included in the income statement. What do these charges inform the reader regarding the ongoing survival of the company? Since sale of assets are included in all four of the most recent year financial statements what does this inform the reader

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts