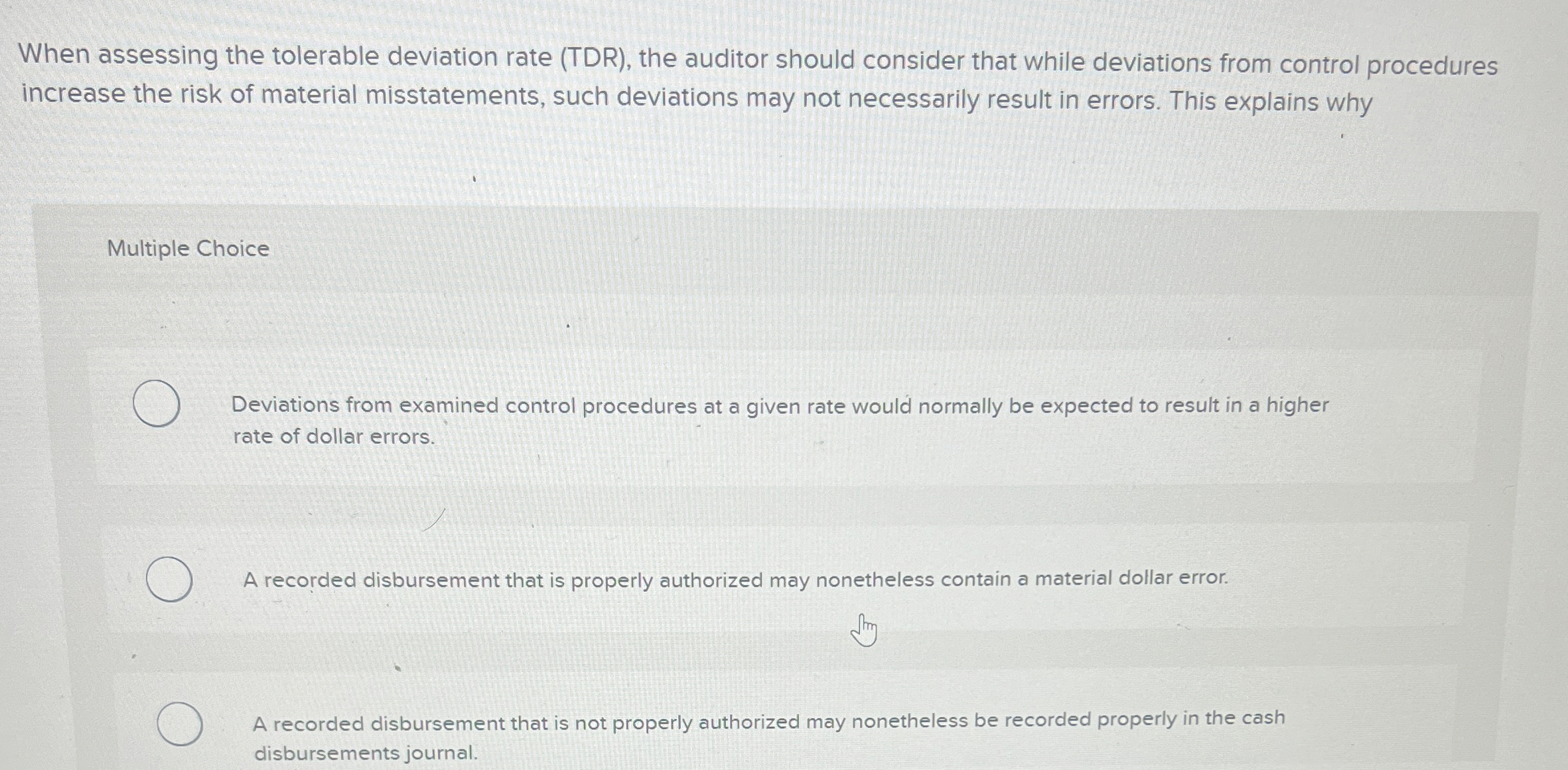

Question: When assessing the tolerable deviation rate ( TDR ) , the auditor should consider that while deviations from control procedures increase the risk of material

When assessing the tolerable deviation rate TDR the auditor should consider that while deviations from control procedures

increase the risk of material misstatements, such deviations may not necessarily result in errors. This explains why

Multiple Choice

Deviations from examined control procedures at a given rate would normally be expected to result in a higher

rate of dollar errors.

A recorded disbursement that is properly authorized may nonetheless contain a material dollar error.

A recorded disbursement that is not properly authorized may nonetheless be recorded properly in the cash

disbursements journal.

Deviations would reault in dollar errors in the accounting records only when they occurred in different transactions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock