Question: 1. what is the best division to invest? 2. Why are the Cost of Equity requested by investors by division different? In what case would

1. what is the best division to invest?

2. Why are the "Cost of Equity" requested by investors by division different? In what case would they be the same?

3. why banks ask for different credit rate?

when

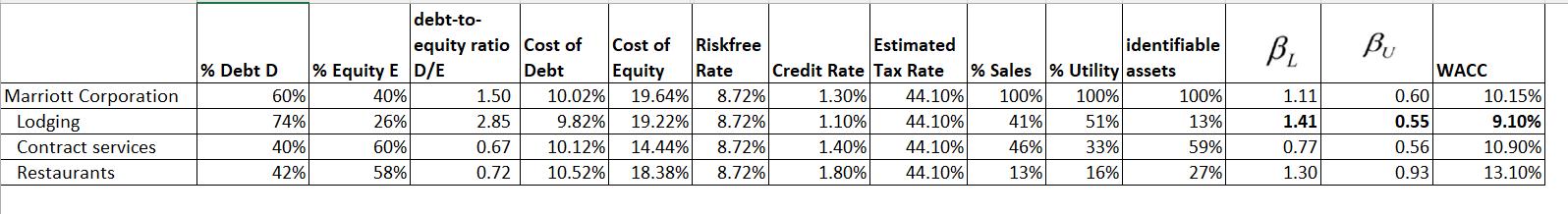

BL = Beta levered --> that is used for the calculation of the cost of equity

BU = Beta unlevered

Marriott Corporation Lodging Contract services Restaurants % Debt D 60% 74% 40% 42% % Equity E 40% 26% 60% 58% debt-to- equity ratio D/E 1.50 2.85 0.67 0.72 Cost of Debt Riskfree Estimated identifiable Rate Credit Rate Tax Rate % Sales % Utility assets 1.30% 44.10% 1.10% 44.10% 1.40% 44.10% 1.80% 44.10% 100% 100% 41% 51% 46% 33% 13% 16% Cost of 10.02% Equity 19.64% 8.72% 9.82% 19.22% 8.72% 10.12% 14.44% 8.72% 18.38% 10.52% 8.72% 100% 13% 59% 27% BL Bu 1.11 1.41 0.77 1.30 0.60 0.55 0.56 0.93 WACC 10.15% 9.10% 10.90% 13.10%

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

To determine the best division to invest in we need to consider factors such as the divisions cost of equity risk profile WACC Weighted Average Cost o... View full answer

Get step-by-step solutions from verified subject matter experts