Question: When calculating a project's NPV, cash flows are discounted at: O A) the opportunity cost of capital. OB) the risk-free rate of return. OC) a

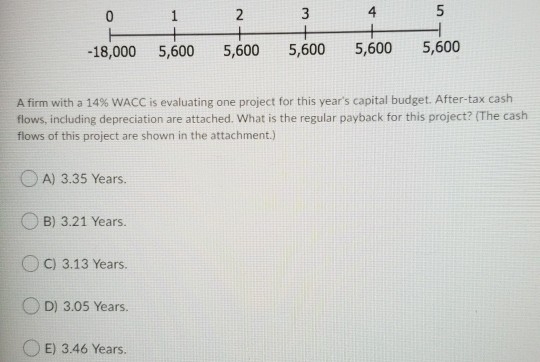

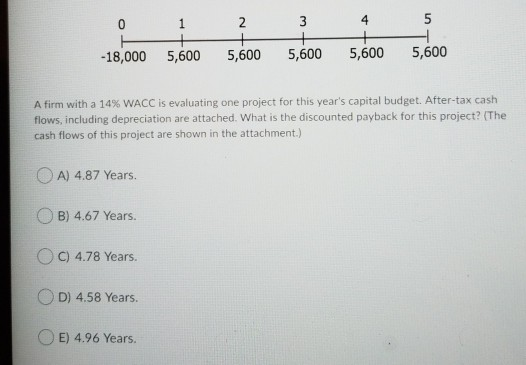

When calculating a project's NPV, cash flows are discounted at: O A) the opportunity cost of capital. OB) the risk-free rate of return. OC) a discount rate of zero. D) the internal rate of return. 0 1 4 5 2 + 5,600 3 + + -18,000 5,600 5,600 5,600 5,600 A firm with a 14% WACC is evaluating one project for this year's capital budget. After-tax cash flows, including depreciation are attached. What is the regular payback for this project? (The cash flows of this project are shown in the attachment.) A) 3.35 Years. B) 3.21 Years. OC) 3.13 Years. OD) 3.05 Years. E) 3.46 Years. 0 1 4 5 N + + + + -18,000 5,600 5,600 5,600 5,600 5,600 A firm with a 14% WACC is evaluating one project for this year's capital budget. After-tax cash flows, including depreciation are attached. What is the discounted payback for this project? (The cash flows of this project are shown in the attachment.) A) 4.87 Years B) 4.67 Years. OC) 4.78 Years. OD) 4.58 Years. E) 4.96 Years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts