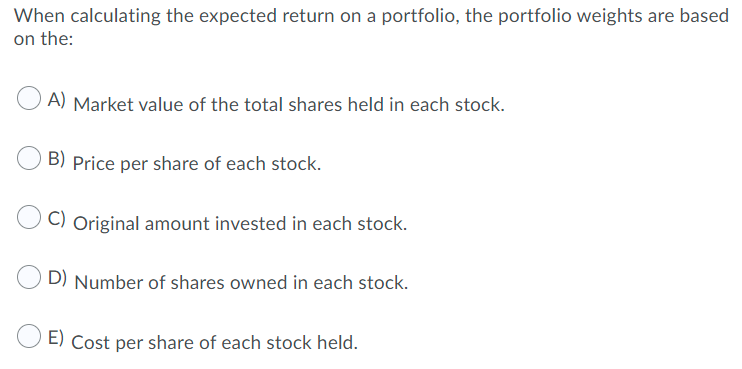

Question: When calculating the expected return on a portfolio, the portfolio weights are based on the: A) Market value of the total shares held in each

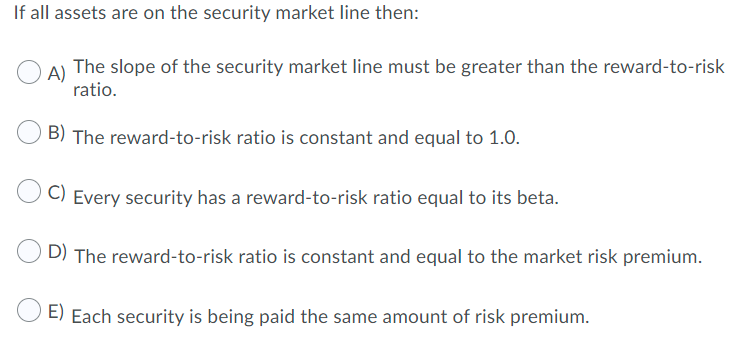

When calculating the expected return on a portfolio, the portfolio weights are based on the: A) Market value of the total shares held in each stock. B) Price per share of each stock. C) Original amount invested in each stock. D) Number of shares owned in each stock. E) Cost per share of each stock held. If all assets are on the security market line then: A) The slope of the security market line must be greater than the reward-to-risk ratio. B) The reward-to-risk ratio is constant and equal to 1.0. C) Every security has a reward-to-risk ratio equal to its beta. D) The reward-to-risk ratio is constant and equal to the market risk premium. E) Each security is being paid the same amount of risk premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts