Question: When commenting on each data set, provide evidence to support your rationale. Include an illustration, figure, or table. CHAPTER 9 For the Investor 391 CASE

When commenting on each data set, provide evidence to support your rationale. Include an illustration, figure, or table.

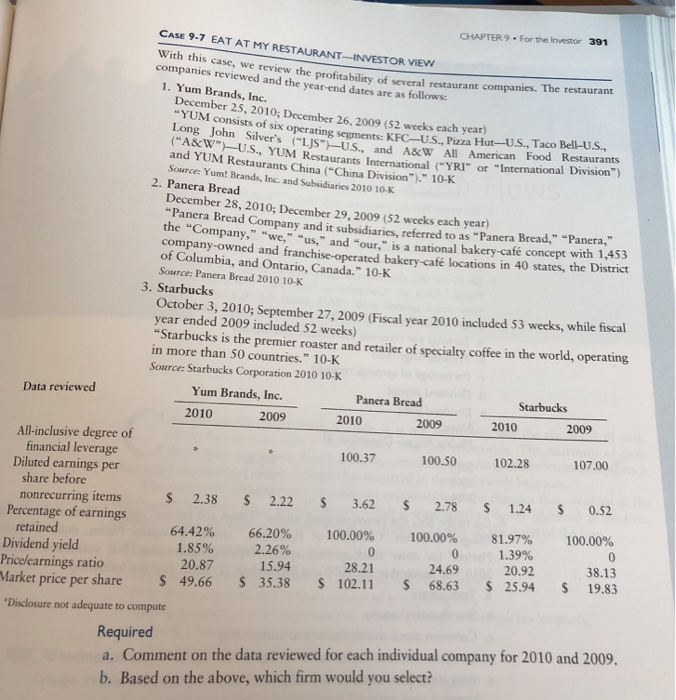

CHAPTER 9 For the Investor 391 CASE 9-7 EAT AT MY RESTAURANT-INVESTOR VIEw With this companies reviewed and the year-end dates are as follows: case, we review the profitability of several restaurant companies. The restaurant 1. Yum Brands, Inc. December 25, 2010; December 26, 2009 (52 weeks cach yearu-U.S, Taco YUM consists of six operating segments: KFC-US., Pizza laco Long John Silver's (LIS-US., and A&W All Americarn ("A&cW")-U.S, YUM Restaurants International ("YRI" or "Interna and YUM Restaurants China ("China Division"). 10-K Source: Yum! Brands, Inc. and Subsidiaries 2010 10-K Bell-U.S., n Food Restaurants 1 YR 2. Panera Bread December 28, 2010; December 29, 2009 (52 weeks each year) Company and it subsidiaries, referred to as "Panera Bread," "Panera, Company,"we," "us," and our," is a national bakery-caf concept with 1,453 company-owned and franchise-operated bakery-caf locations in 40 states, the District of Columbia, and Ontario, Canada." 10-K Source: Panera Bread 2010 10-K 3. Starbucks October 3, 2010; September 27, 2009 (Fiscal year 2010 included 53 weeks, while fiscal year ended 2009 included 52 weeks) "Starbucks is the premier roaster and retailer of specialty coffee in the world, operating in more than 50 countries." 10-K Source: Starbucks Corporation 2010 10-K Yum Brands, Inc. 2010 Data reviewed nera Bread Starbucks 2009 2010 2009 2009 All-inclusive degree of 100.50 102.28 107.00 financial leverage Diluted earnings per 100.37 share before 1.24 S 0.52 2.22 S 3.62 100.00% 28.21 2.78 100.00% 24.69 102.11 S 68.63 s 2.38 nonrecurring items Percentage of earnings 100.00% 38.13 81.97% retained Dividend yield Pricelearnings ratio Market price per share Disclosure not adequate to compute 64.42% 1.85% 20.87 49.66 66.20% 2.26% 15.94 1.39% 20.92 25.94 19.83 $ 35.38 Required a. Comment on the data reviewed for each individual company for 2010 and 2009. b. Based on the above, which firm would you select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts