Question: When companies offer new debt security issues, they publicize the offerings in the financial press and on Internet sites. Assume the following were among the

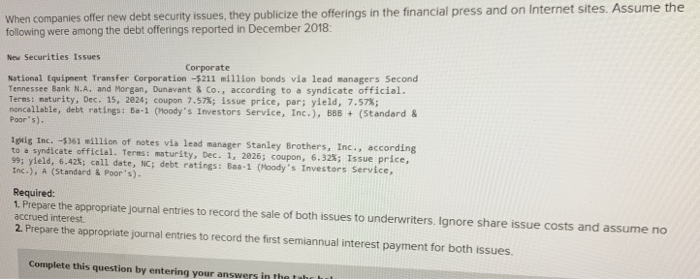

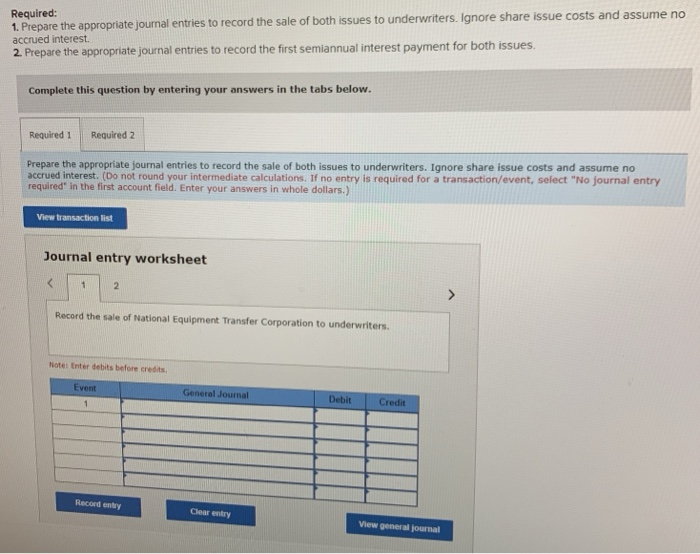

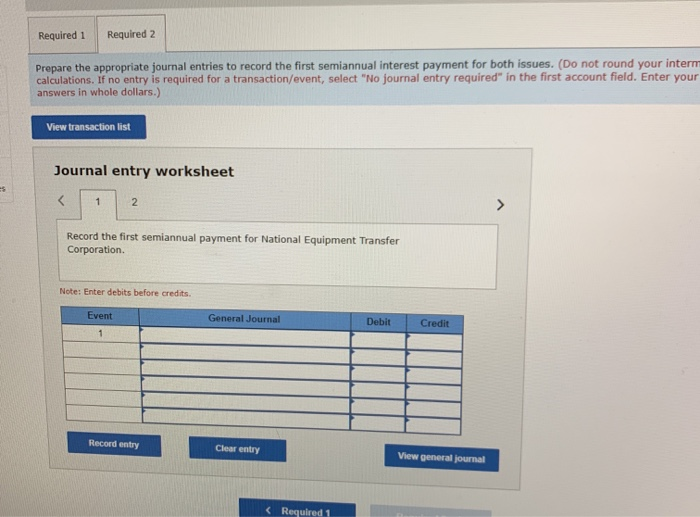

When companies offer new debt security issues, they publicize the offerings in the financial press and on Internet sites. Assume the following were among the debt offerings reported in December 2018: New Securities Issues Corporate National Equipnent Transfer Corporation -$211 million bonds via lead managers Second Tennessee Bank N.A. and Morgan, Dunavant & Co., according to a syndicate official. Terms: maturity, Dec. 15, 2024; coupon 7.57%; issue price, par; yield, 7.57%; noncallable, debt ratings: Ba-1 (Moody's Investors Service, Inc.), BBB + (Standard & Poor's). Igig Inc. -5361 million of notes via lead manager Stanley Brothers, Inc., according to a syndicate official. Terns: maturity, Dec. 1, 2026; coupon, 6.32%; Issue price, 99; yield, 6.42%; call date, NC; debt ratings: Baa-1 (Moody's Investors Service, Inc.), A (Standard & Poor's). Required: 1. Prepare the appropriate journal entries to record the sale of both issues to underwriters. Ignore share issue costs and assume no accrued interest 2. Prepare the appropriate journal entries to record the first semiannual interest payment for both issues. Complete this question by entering your answers in the t Required: 1. Prepare the appropriate journal entries to record the sale of both issues to underwriters. Ignore share issue costs and assume no accrued interest. 2. Prepare the appropriate journal entries to record the first semiannual interest payment for both issues. Complete this question by entering your answers in the tabs below. Required 2 Required 1 Prepare the appropriate journal entries to record the sale of both issues to underwriters. Ignore share issue costs and assume no accrued interest. (Do not round your intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet 2. Record the sale of National Equipment Transfer Corporation to underwriters. Note: Enter debits before credits. Event General Journal Debit Credit 1. Record entry Clear entry View general journal Required 2 Required 1. Prepare the appropriate journal entries to record the first semiannual interest payment for both issues. (Do not round your interm calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet Record the first semiannual payment for National Equipment Transfer Corporation. Note: Enter debits before credits. Event General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts