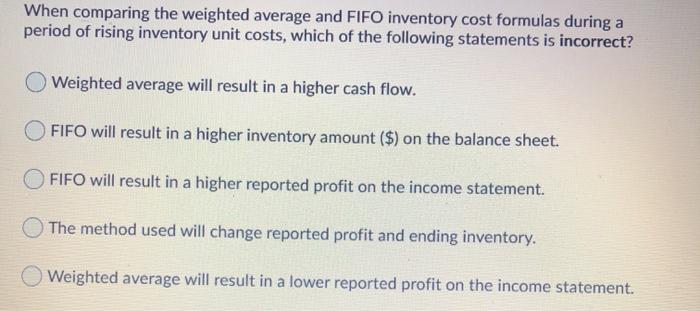

Question: When comparing the weighted average and FIFO inventory cost formulas during a period of rising inventory unit costs, which of the following statements is incorrect?

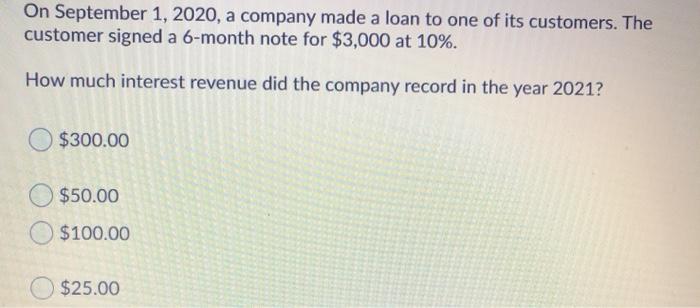

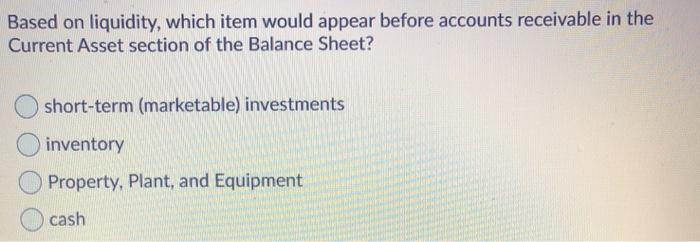

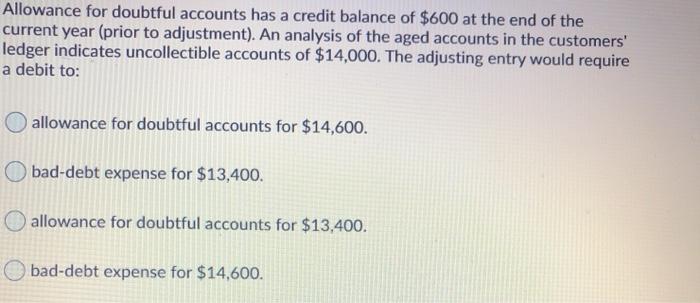

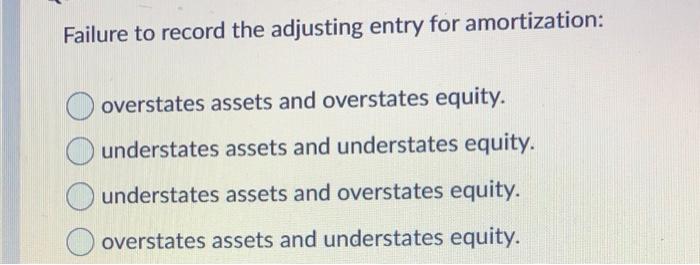

When comparing the weighted average and FIFO inventory cost formulas during a period of rising inventory unit costs, which of the following statements is incorrect? Weighted average will result in a higher cash flow. FIFO will result in a higher inventory amount ($) on the balance sheet. FIFO will result in a higher reported profit on the income statement The method used will change reported profit and ending inventory. Weighted average will result in a lower reported profit on the income statement. On September 1, 2020, a company made a loan to one of its customers. The customer signed a 6-month note for $3,000 at 10%. How much interest revenue did the company record in the year 2021? $300.00 $50.00 $100.00 $25.00 Based on liquidity, which item would appear before accounts receivable in the Current Asset section of the Balance Sheet? short-term (marketable) investments inventory Property, Plant, and Equipment cash Allowance for doubtful accounts has a credit balance of $600 at the end of the current year (prior to adjustment). An analysis of the aged accounts in the customers' ledger indicates uncollectible accounts of $14,000. The adjusting entry would require a debit to: allowance for doubtful accounts for $14,600. bad-debt expense for $13,400. allowance for doubtful accounts for $13,400. bad-debt expense for $14,600. Failure to record the adjusting entry for amortization: overstates assets and overstates equity. understates assets and understates equity. understates assets and overstates equity. overstates assets and understates equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts