Question: When computing the adjusted cash flow from assets, the tax amount is calculated as: O EBT(TC). O (EBT - Depreciation) (TC). O (EBIT + Depreciation

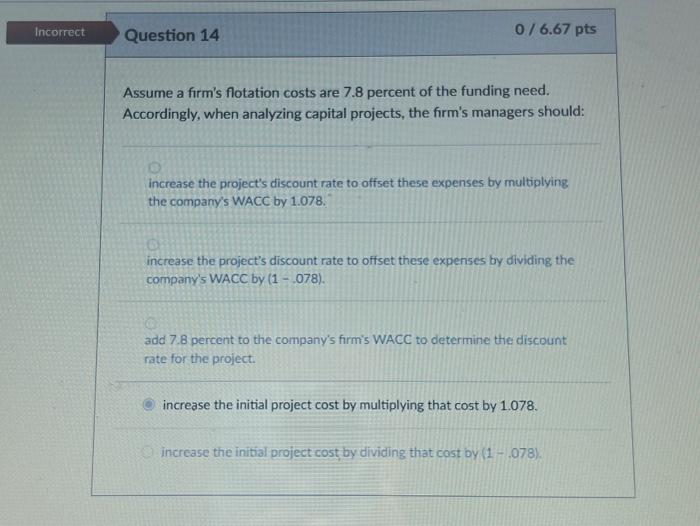

Incorrect Question 14 0/6.67 pts Assume a firm's flotation costs are 7.8 percent of the funding need. Accordingly, when analyzing capital projects, the firm's managers should: increase the project's discount rate to offset these expenses by multiplying the company's WACC by 1.078 . increase the project's discount rate to offset these expenses by dividing the company's WACC by (1078). add 7.8 percent to the company's firm's WACC to determine the discount rate for the project. increase the initial project cost by multiplying that cost by 1.078 . increase the initial project cost by dividing that cost by (1.078)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts