Question: - When consolidating a subsidiary under the equity method, which of the following statements is true? A. The value of any goodwill should be tested

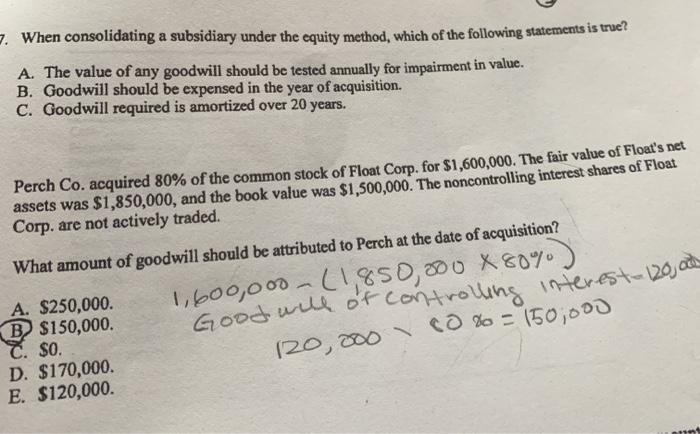

- When consolidating a subsidiary under the equity method, which of the following statements is true? A. The value of any goodwill should be tested annually for impairment in value. B. Goodwill should be expensed in the year of acquisition. C. Goodwill required is amortized over 20 years. Perch Co. acquired 80% of the common stock of Float Corp. for $1,600,000. The fair value of Float's net assets was $1,850,000, and the book value was $1,500,000. The noncontrolling interest shares of Float Corp. are not actively traded. What amount of goodwill should be attributed to Perch at the date of acquisition? A. $250,000. 1,600,000 (1,850,000 X 80% B $150,000. Good will of controlling interest - 120, at C. $0. D. $170,000. 120,000 CO% = 150,000 E. $120,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts