Question: When D died in 2 0 2 2 , D had only $ 5 0 , 0 0 0 . 0 0 in a bank

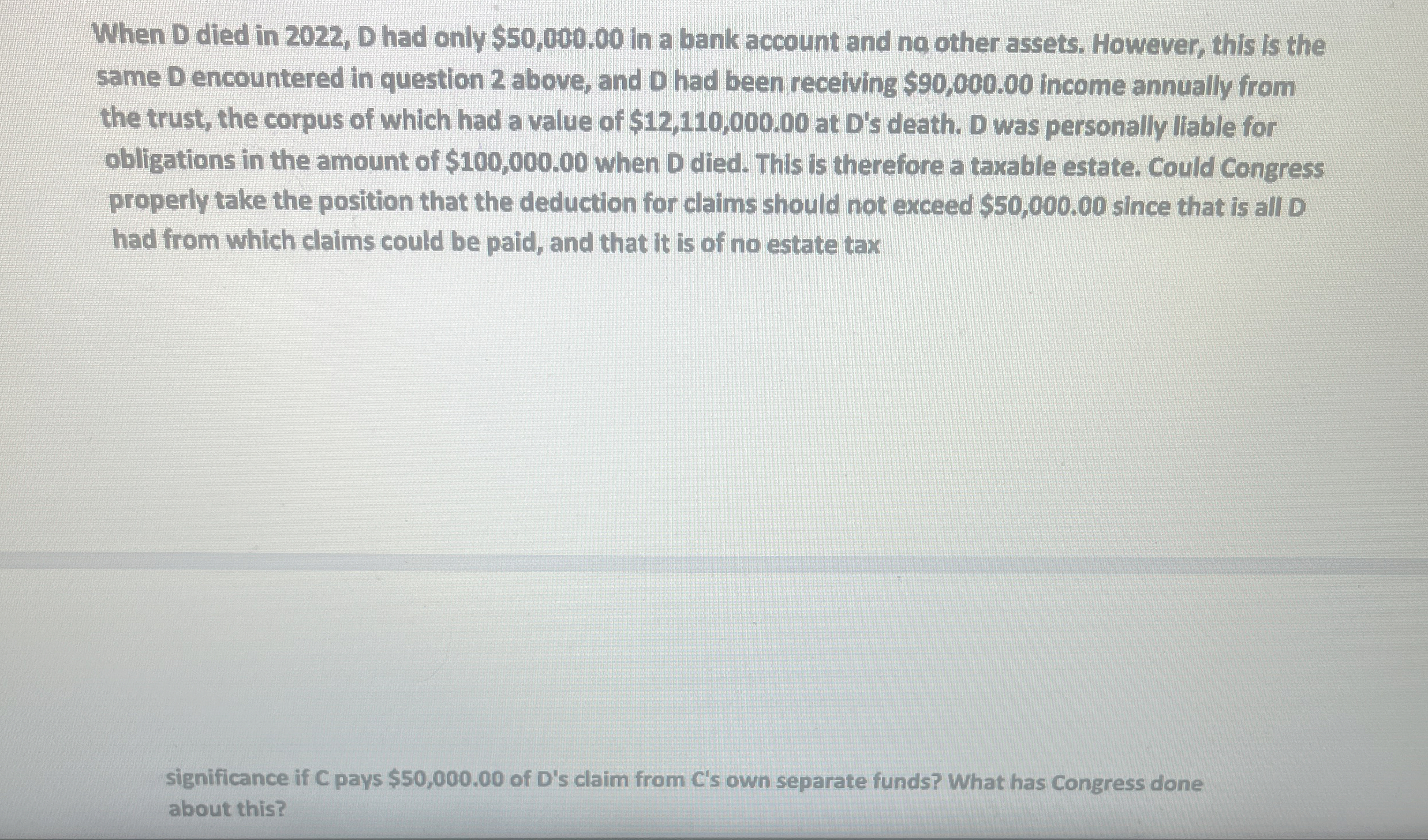

When D died in D had only $ in a bank account and na other assets. However, this is the same D encountered in question above, and had been recelving $ income annually from the trust, the corpus of which had a value of $ at death. D was personally liable for obligations in the amount of $ when died. This is therefore a taxable estate. Could Congress properly take the position that the deduction for claims should not exceed $ since that is all D had from which claims could be paid, and that it is of no estate tax

significance if C pays $ of Ds claim from Cs own separate funds? What has Congress done about this?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock