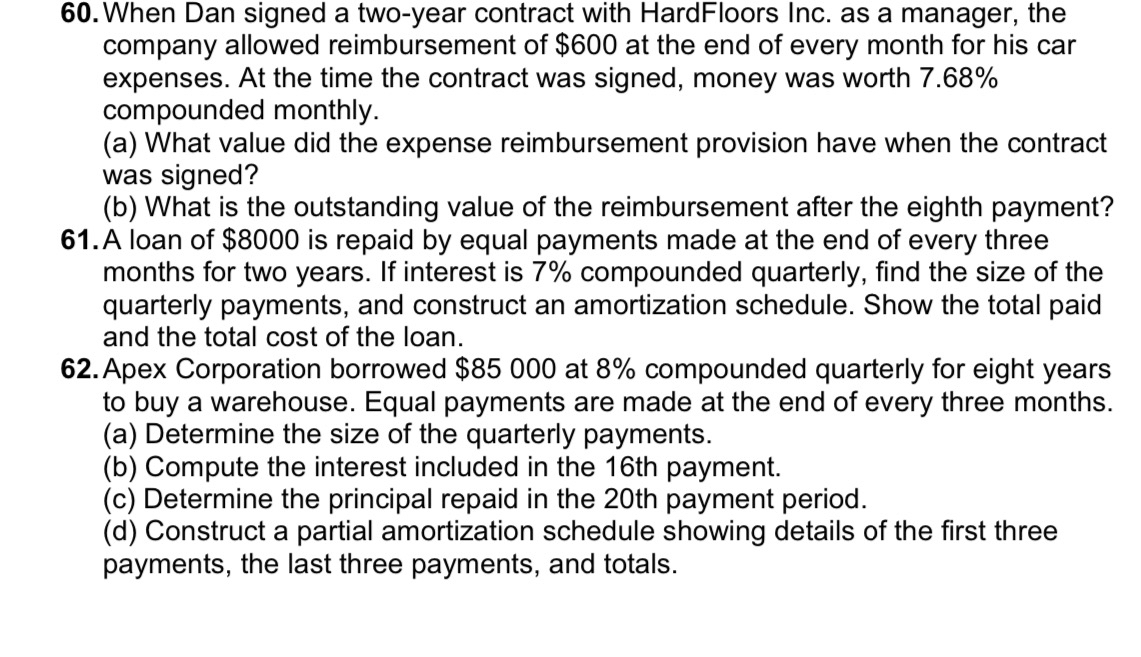

Question: When Dan signed a two - year contract with HardFloors Inc. as a manager, the company allowed reimbursement of $ 6 0 0 at the

When Dan signed a twoyear contract with HardFloors Inc. as a manager, the company allowed reimbursement of $ at the end of every month for his car expenses. At the time the contract was signed, money was worth compounded monthly.

a What value did the expense reimbursement provision have when the contract was signed?

b What is the outstanding value of the reimbursement after the eighth payment?

A loan of $ is repaid by equal payments made at the end of every three months for two years. If interest is compounded quarterly, find the size of the quarterly payments, and construct an amortization schedule. Show the total paid and the total cost of the loan.

Apex Corporation borrowed $ at compounded quarterly for eight years to buy a warehouse. Equal payments are made at the end of every three months.

a Determine the size of the quarterly payments.

b Compute the interest included in the th payment.

c Determine the principal repaid in the th payment period.

d Construct a partial amortization schedule showing details of the first three payments, the last three payments, and totals.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock