Question: When David Ltd. Received its Bank Statement for the period ended 30th June, 1998, this did not agree with the balance shown in the

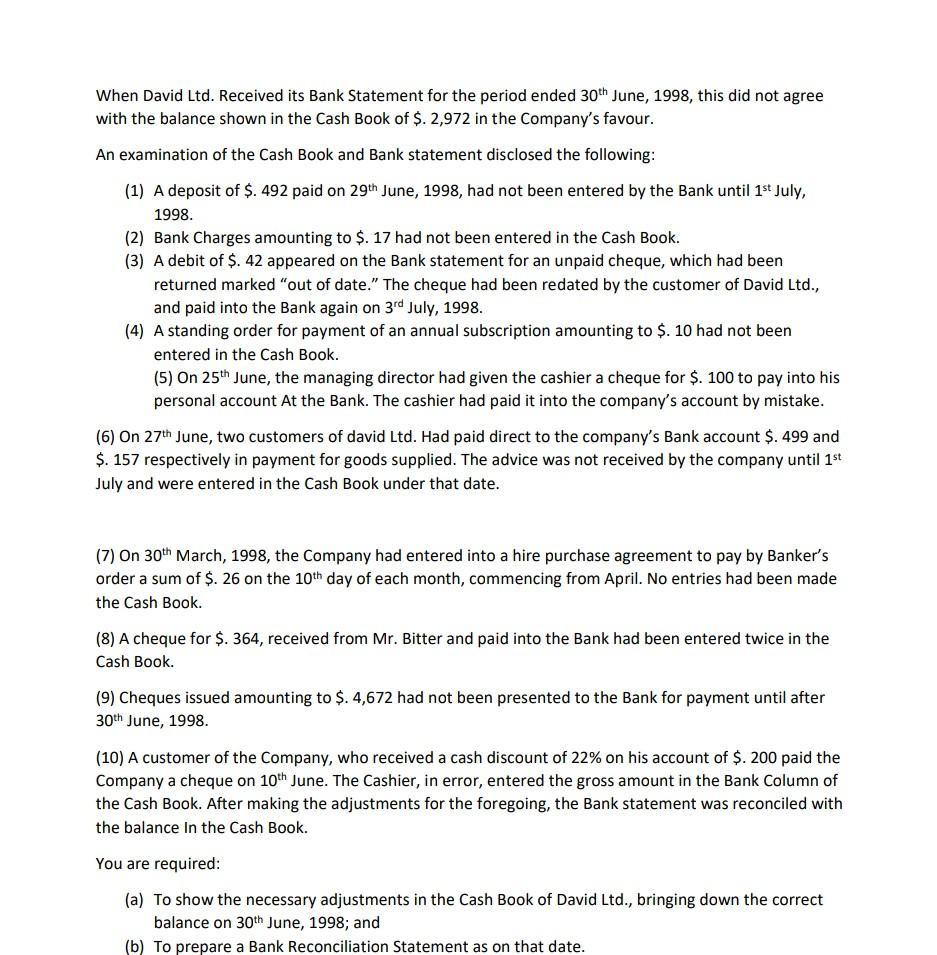

When David Ltd. Received its Bank Statement for the period ended 30th June, 1998, this did not agree with the balance shown in the Cash Book of $. 2,972 in the Company's favour. An examination of the Cash Book and Bank statement disclosed the following: (1) A deposit of $. 492 paid on 29th June, 1998, had not been entered by the Bank until 1st July, 1998. (2) Bank Charges amounting to $. 17 had not been entered in the Cash Book. (3) A debit of $. 42 appeared on the Bank statement for an unpaid cheque, which had been returned marked "out of date." The cheque had been redated by the customer of David Ltd., and paid into the Bank again on 3rd July, 1998. (4) A standing order for payment of an annual subscription amounting to $. 10 had not been entered in the Cash Book. (5) On 25th June, the managing director had given the cashier a cheque for $. 100 to pay into his personal account At the Bank. The cashier had paid it into the company's account by mistake. (6) On 27th June, two customers of david Ltd. Had paid direct to the company's Bank account $. 499 and $. 157 respectively in payment for goods supplied. The advice was not received by the company until 1st July and were entered in the Cash Book under that date. (7) On 30th March, 1998, the Company had entered into a hire purchase agreement to pay by Banker's order a sum of $. 26 on the 10th day of each month, commencing from April. No entries had been made the Cash Book. (8) A cheque for $. 364, received from Mr. Bitter and paid into the Bank had been entered twice in the Cash Book. (9) Cheques issued amounting to $. 4,672 had not been presented to the Bank for payment until after 30th June, 1998. (10) A customer of the Company, who received a cash discount of 22% on his account of $. 200 paid the Company a cheque on 10th June. The Cashier, in error, entered the gross amount in the Bank Column of the Cash Book. After making the adjustments for the foregoing, the Bank statement was reconciled with the balance in the Cash Book. You are required: (a) To show the necessary adjustments in the Cash Book of David Ltd., bringing down the correct balance on 30th June, 1998; and (b) To prepare a Bank Reconciliation Statement as on that date.

Step by Step Solution

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Step 1 1Adjustment in Cash Books of David Ltd Particulars Debit Particul... View full answer

Get step-by-step solutions from verified subject matter experts