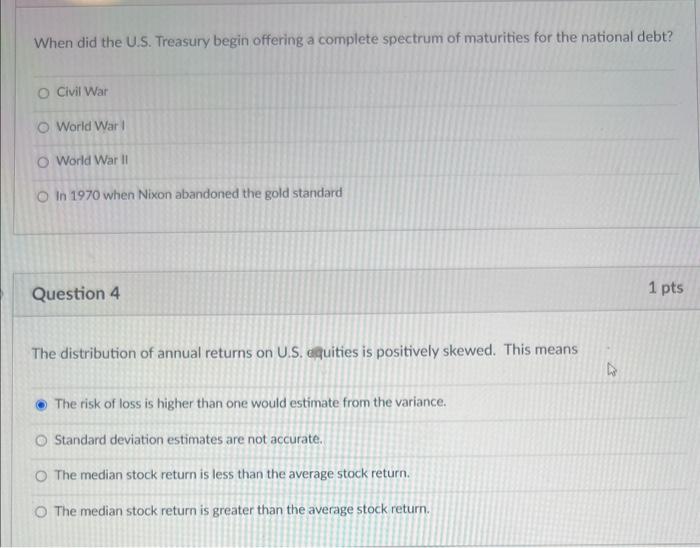

Question: When did the U.S. Treasury begin offering a complete spectrum of maturities for the national debt? Civil War World War I World War II In

When did the U.S. Treasury begin offering a complete spectrum of maturities for the national debt? Civil War World War I World War II In 1970 when Nixon abandoned the gold standard Question 4 The distribution of annual returns on U.S. equities is positively skewed. This means The risk of loss is higher than one would estimate from the variance. Standard deviation estimates are not accurate. The median stock return is less than the average stock return. The median stock return is greater than the average stock return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts