Question: When do we recognize (record) a contingent liability in our financial statements? Select one: a. When the likelihood is probable, and the amount is not

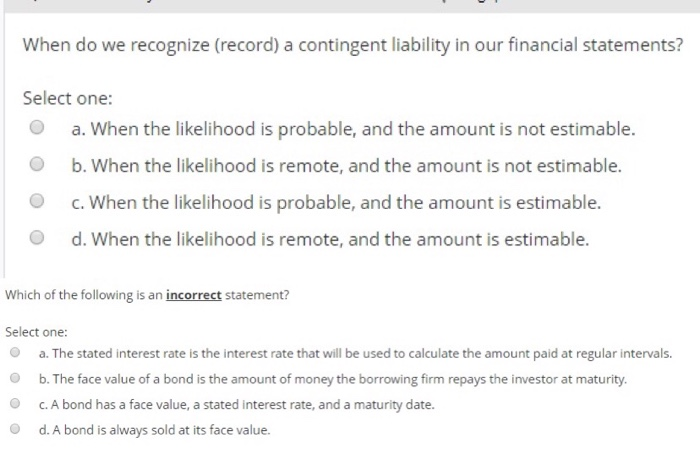

When do we recognize (record) a contingent liability in our financial statements? Select one: a. When the likelihood is probable, and the amount is not estimable. b. When the likelihood is remote, and the amount is not estimable. c. When the likelihood is probable, and the amount is estimable. d. When the likelihood is remote, and the amount is estimable. Which of the following is an incorrect statement? Select one: a. The stated interest rate is the interest rate that will be used to calculate the amount paid at regular intervals. b. The face value of a bond is the amount of money the borrowing firm repays the investor at maturity. c. A bond has a face value, a stated interest rate, and a maturity date. d. A bond is always sold at its face value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts