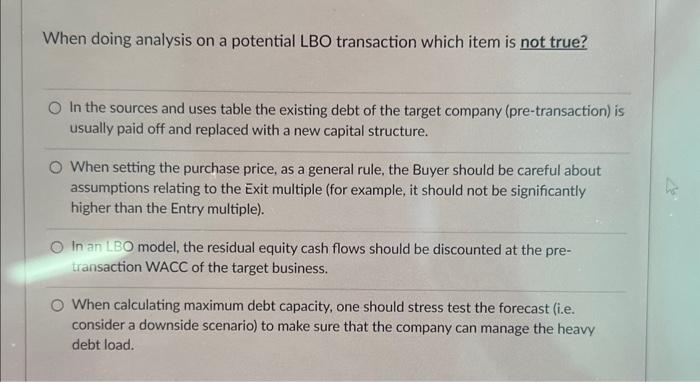

Question: When doing analysis on a potential LBO transaction which item is not true? In the sources and uses table the existing debt of the target

When doing analysis on a potential LBO transaction which item is not true? In the sources and uses table the existing debt of the target company (pre-transaction) is usually paid off and replaced with a new capital structure. When setting the purchase price, as a general rule, the Buyer should be careful about assumptions relating to the Exit multiple (for example, it should not be significantly higher than the Entry multiple). In an LBO model, the residual equity cash flows should be discounted at the pretransaction WACC of the target business. When calculating maximum debt capacity, one should stress test the forecast (i.e. consider a downside scenario) to make sure that the company can manage the heavy debt load

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts