Question: When evaluating a project, the portion of the variable expenses that would be allocated to the project should be: included as a cash outflow on

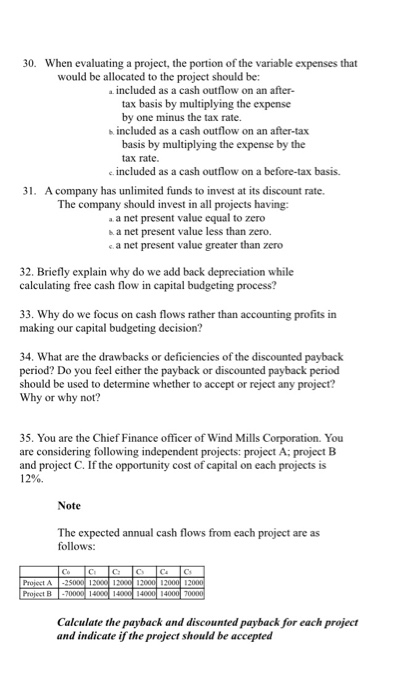

When evaluating a project, the portion of the variable expenses that would be allocated to the project should be: included as a cash outflow on an after tax basis by multiplying the expense by one minus the tax rate. included as a cash outflow on an after-tax basis by multiplying the expense by the tax rate. included as a cash outflow on a before-tax basis. A company has unlimited funds to invest at its discount rate. The company should invest in all projects having: a net present value equal to zero a net present value less than zero. a net present value greater than zero Briefly explain why do we add back depreciation while calculating free cash flow in capital budgeting process? Why do we focus on cash flows rather than accounting profits in making our capital budgeting decision? What are the drawbacks or deficiencies of the discounted payback period? Do you feel either the payback or discounted payback period should be used to determine whether to accept or reject any project? Why or why not? You are the Chief Finance officer of Wind Mills Corporation. You are considering following independent projects: project A; project B and project C. If the opportunity cost of capital on each projects is 12%. The expected annual cash flows from each project are as follows: Calculate the payback and discounted payback for each project and indicate if the project should be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts