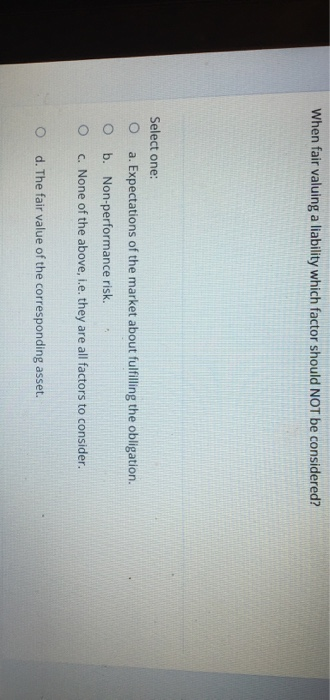

Question: When fair valuing a liability which factor should NOT be considered? Select one: a. Expectations of the market about fulfilling the obligation. O b. Non-performance

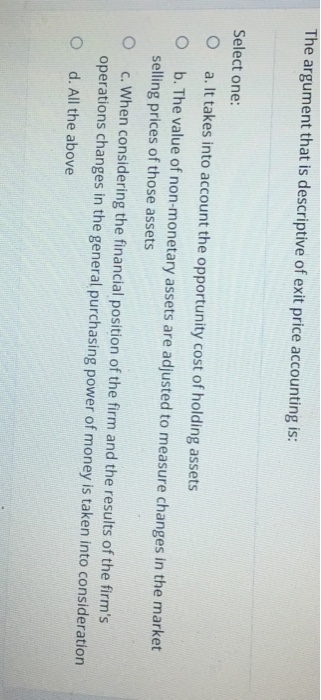

When fair valuing a liability which factor should NOT be considered? Select one: a. Expectations of the market about fulfilling the obligation. O b. Non-performance risk. O c. None of the above, i.e. they are all factors to consider. O d. The fair value of the corresponding asset. The argument that is descriptive of exit price accounting is: Select one: a. It takes into account the opportunity cost of holding assets o b. The value of non-monetary assets are adjusted to measure changes in the market selling prices of those assets O c. When considering the financial position of the firm and the results of the firm's operations changes in the general purchasing power of money is taken into consideration O d. All the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts