Question: When hedging interest rate risk, derivative instruments like interest rate caps and interest rate floors can be utilised. An interest rate cap provides a bank,

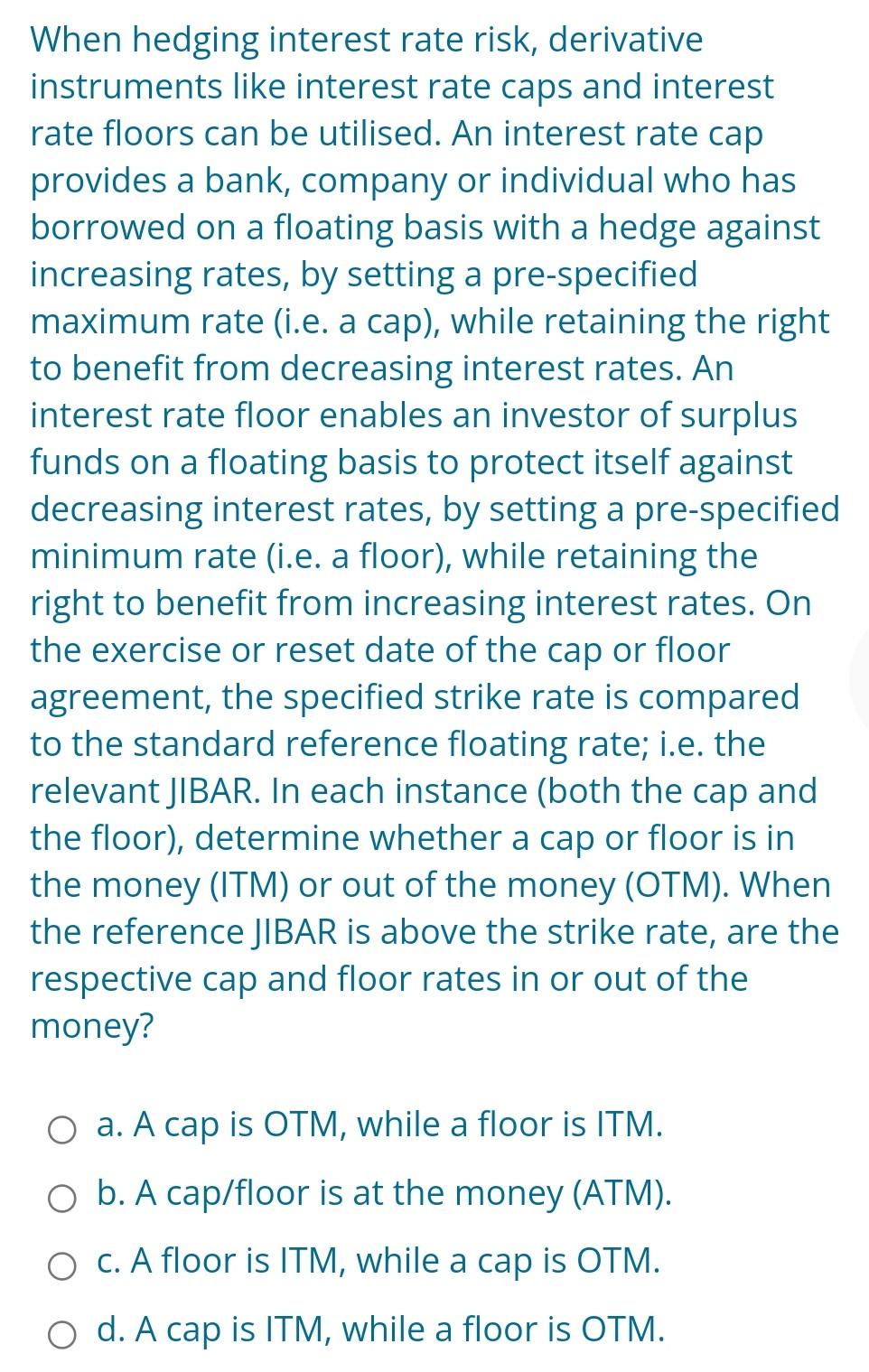

When hedging interest rate risk, derivative instruments like interest rate caps and interest rate floors can be utilised. An interest rate cap provides a bank, company or individual who has borrowed on a floating basis with a hedge against increasing rates, by setting a pre-specified maximum rate (i.e. a cap), while retaining the right to benefit from decreasing interest rates. An interest rate floor enables an investor of surplus funds on a floating basis to protect itself against decreasing interest rates, by setting a pre-specified minimum rate (i.e. a floor), while retaining the right to benefit from increasing interest rates. On the exercise or reset date of the cap or floor agreement, the specified strike rate is compared to the standard reference floating rate; i.e. the relevant JIBAR. In each instance (both the cap and the floor), determine whether a cap or floor is in the money (ITM) or out of the money (OTM). When the reference JIBAR is above the strike rate, are the respective cap and floor rates in or out of the money? O a. A cap is OTM, while a floor is ITM. ob. A cap/floor is at the money (ATM). O C. A floor is ITM, while a cap is OTM. O d. A cap is ITM, while a floor is OTM. When hedging interest rate risk, derivative instruments like interest rate caps and interest rate floors can be utilised. An interest rate cap provides a bank, company or individual who has borrowed on a floating basis with a hedge against increasing rates, by setting a pre-specified maximum rate (i.e. a cap), while retaining the right to benefit from decreasing interest rates. An interest rate floor enables an investor of surplus funds on a floating basis to protect itself against decreasing interest rates, by setting a pre-specified minimum rate (i.e. a floor), while retaining the right to benefit from increasing interest rates. On the exercise or reset date of the cap or floor agreement, the specified strike rate is compared to the standard reference floating rate; i.e. the relevant JIBAR. In each instance (both the cap and the floor), determine whether a cap or floor is in the money (ITM) or out of the money (OTM). When the reference JIBAR is above the strike rate, are the respective cap and floor rates in or out of the money? O a. A cap is OTM, while a floor is ITM. ob. A cap/floor is at the money (ATM). O C. A floor is ITM, while a cap is OTM. O d. A cap is ITM, while a floor is OTM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts