Question: when i do the general ledger, i have a few wrong please help me to correct these. thank you Problem 5-1A Preparing journal entries for

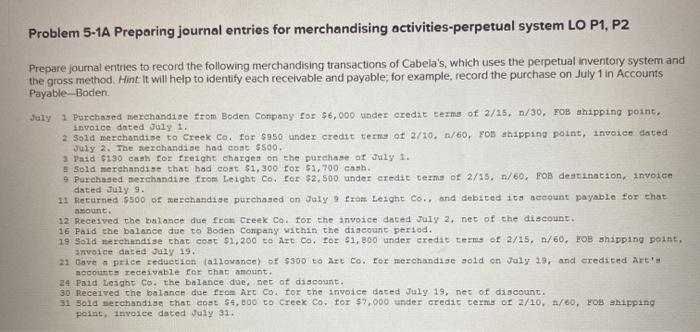

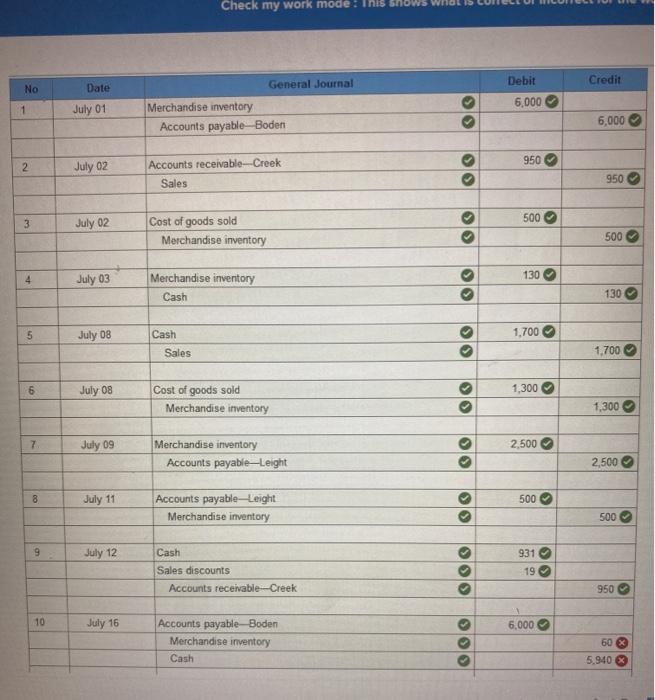

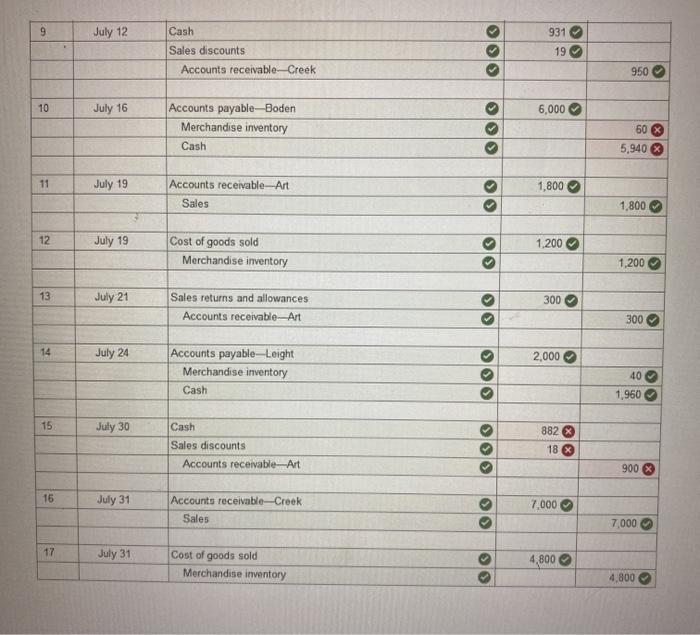

Problem 5-1A Preparing journal entries for merchandising activities-perpetual system LO P1, P2 Prepare journal entries to record the following merchandising transactions of Cabela's, which uses the perpetual inventory system and the gross method Hint it will help to identify each receivable and payable, for example, record the purchase on July 1 in Accounts Payable-Boden July 1 Purchased merchandise from Boden Company for $6,000 under credat terms of 2/15, 1/30, FOB shipping point. Invoice dated July 1. 2 Sold merchandise to Creek Co. for $950 under credit term of 2/10. n/60, YOB shipping point, invoice dated July 2. The merchandise had cost $500. 3 Paid $130 cash for Freight charges on the purchase of July 1. Sold merchandise that had cost $1,300 for $1.700 cash. Purchased merchandise from Leight Co, for $2.500 under credit term of 2/15, n/60, FOB destination, invoice dated July 9. 11 Returned $500 of merchandise purchased on July 9 from Leight Co., and debited ita account payable for that amount. 12 Received the balance due from Creek Co. for the invoice dated July 2. net of the discount. 16 Paid the bal due to Boden any within the discount period. 19 Sold herehandise that cost $2.200 to Art Co. for $1,800 under credit term of 2/15. 1/60, FOB shipping point, invoice dated July 19. 21 Gave price reduction allowance) of $300 to Art Co. for merchandise sold on July 19, and credited Art's mccounts receivable for that amount. 24 Paid Lenght Co. the balance due, net of discount. 30 Received the balance due from Art Co. for the invoice dated July 19, net of discount. 31 Sold merchandise that cost $4,000 to Creek Co. tor $7,000 under credit terms or 2/10, 1/60. FOB shipping point, invoice dated July 31. Check my work mode: This Debit No Credit General Journal Date 6,000 1 July 01 Merchandise inventory Accounts payable Boden 6,000 950 2 July 02 Accounts receivable--Creek Sales 950 500 3 July 02 Cost of goods sold Merchandise inventory 500 > >> 4 130 July 03 Merchandise inventory Cash 130 5 July 08 1,700 Cash Sales O 1.700 6 July 08 1,300 > Cost of goods sold Merchandise inventory 1,300 7 July 09 2,500 Merchandise inventory Accounts payable-Leight 2,500 8 July 11 500 Accounts payable-Leight Merchandise inventory 9 500 9 July 12 931 Cash Sales discounts Accounts receivable Creek IS 19 950 10 July 16 6,000 Accounts payable-Boden Merchandise inventory Cash 30 60 X 5.940 9 July 12 Cash 931 19 Sales discounts Accounts receivable Creek 950 10 July 16 6,000 Accounts payable-Boden Merchandise inventory Cash 60 X 5,940 11 July 19 > 1,800 Accounts receivable-Art Sales 1.800 12 July 19 Cost of goods sold Merchandise inventory 1,200 1,200 13 July 21 > 300 Sales returns and allowances Accounts receivable_Art 300 14 July 24 > 2,000 Accounts payable-Leight Merchandise inventory Cash 40 1.960 15 July 30 Cash Sales discounts Accounts receivable-Art 882 18 900 15 July 31 Accounts receivable Creek Sales >> 7.000 7 000 17 July 31 Cost of goods sold Merchandise inventory 4,800 O 4.800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts